Could the banking industry revisit the financial crisis of 2008?

According to a 52-page analysis from McKinsey, “The Phoenix Rises: Remaking the Bank for an Ecosystem World,” that is precisely what banks and credit unions must be prepared for if there isn’t an increased focus on digitalization. Bottom line? The threat from digital technology players like Amazon, Tencent, Alibaba and Google is accelerating, and banking providers might find themselves relegated to commodities in less than a decade if the industry doesn’t rethink how its model.

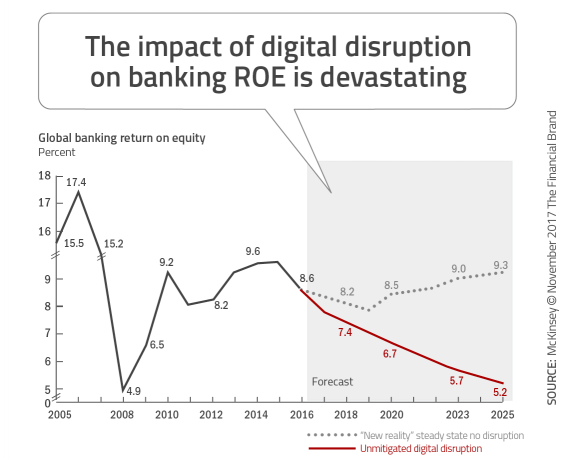

McKinsey estimates that fully digitizing, along with significantly improving skills in digital marketing and analytics, could add $350 billion to the banking industry’s bottom line over the next three to five years. In addition, if the banking industry could find ways to compete effectively with big tech companies like Amazon, Alibaba and Tencent, an ROE between 9% and 14% is possible by 2025.

Alternatively, if the financial services industry does not rethink distribution, and if retail and corporate customers switch their banking to digital companies at the same rate that people have adopted new technologies in the past, the industry’s ROE (absent any mitigating actions) could fall by roughly 4.0 points, to 5.2% by 2025. This is close to the levels experienced in 2008, during the worst of the 2008 financial crisis.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Digital Ecosystem Threat

The report mentions that over the past few years, the perceived threat of small start-up fintech firms have become collaboration opportunities. At the same time, large platform companies have exploited exceptional data and advanced data analytics to create customer-centric, unified value propositions that extends beyond what users could previously obtain. These firms are creating ‘ecosystems’ that reduce customers’ costs, increase convenience, and provide new experiences … extending to financial services.

One example cited in the report is Japan’s largest online retail marketplace, Rakuten. By using an ecosystem strategy to prioritize the customer relationship Rakuten:

- Is Japan’s single largest online retail marketplace with 1.1 billion members globally.

- Provides loyalty points and e-money usable at hundreds of thousands of virtual and real stores.

- Issues credit cards to tens of millions of members.

- Offers financial products and services including mortgages, securities and insurance.

- Runs one of Japan’s largest online travel portals, while also having energy, health & beauty and even professional sports businesses.

- Runs instant-messaging app, Viber, which has some 800 million users worldwide.

As a backgrounder, Rakuten was the first to launch a successful online marketplace in 1997 and the first to launch a fintech business closely linked to a strong e-commerce membership base in 2005. According to McKinsey, the Rakuten Card not only has tens of millions of members, but an annual transaction volume that will soon allow Rakuten to become the largest credit card company in Japan by transaction volume.

Read More: New Digital Technologies Will Disrupt Banking Forever

The Four Horsemen of the e-Pocalypse

Virtually every sector of the economy is facing what McKinsey refers to as the “four horsemen of the e-pocalypse” (or threats from digital players). First, and foremost, banks face disintermediation

from their customers as consumers switch to non-traditional banking channels and sources. This includes the ability to borrow money online, send money directly to a friend or buy a coffee without cash or a credit/debit card.

Second, banks and credit unions have traditionally offered integrated services, providing some products, such as checking and savings accounts, below cost to subsidize more lucrative services, such as lending. Today, banking products and services are impacted by unbundling, with consumers picking and choosing selected providers (like PayPal) to handle parts of their banking relationship.

The third effect of digitalization of services is commoditization, where financial services organizations have difficulty differentiating themselves as consumers compare increasingly transparent offerings online. There are even services that do the shopping for consumers, providing recommendations based on the consumer’s need.

Finally, financial institutions are losing brand awareness and struggling with invisibility as customers can increasingly access financial services without knowing the actual brand of the institution. Some of these unbranded offerings are on social channels without any recognition of the actual bank offering the service.

The impact of these of these trends is manifested in the loss of the customer relationship and margin compression, primarily in retail banking, leading to sluggish growth and diminished profitability. According to McKinsey, revenue margin declined by approximately 4% from 2014 through 2016, which lowered ROE by 1.5 percentage points.

Improving Digital Effectiveness

Increasingly accessible technology is providing financial organizations the ability to improve their core offerings and financial results for the digital age. According to McKinsey, the opportunities are vast and spread across the entire enterprise. There are seven major initiatives that offer the most potential for banks and credit unions. The average financial institution is capable of improving productivity by 40-60% in each of these areas, states McKinsey:

- Building better digital marketing skills: Digital marketing is now a core foundational capability, with the need to improve the shopping, buying and engagement experience, with improved personalization along the customer journey. A customer-journey approach leads to 160% higher cross-sell, 200% greater online conversion through better search-engine marketing, up to 10 point increases in customer satisfaction scores, a two-third reduction in acquisition costs, and many other benefits.

- Reshaping the distribution architecture: As customer preferences shift to digital and remote advisory, banks need to optimize their branch formats and distribution networks to reflect the need for multichannel experiences.

- Enhancing sales productivity: Portfolio overviews, event alerts, risk-monitoring tools, prospect trackers, client action planners, pitch libraries, financial simulators, and dozens of other digital tools can be installed on a tablet, putting everything RMs need at their fingertips.

- Industrialising operations through automation and artificial intelligence: Robotic process automation (RPA) is already demonstrating great potential in the automation of repeatable tasks. In addition, artificial intelligence (AI) and cognitive technologies will help organizations. Specifically, machine learning, natural language processing and cognitive agents are either ready to roll out or are already in pilots.

- Underwriting, using data and analytics: Digital tools can reduce risk-weighted assets, shorten process times by making them up to 15 times more efficient, and avoid up to 30% of operational and credit losses.

- Cloud computing, open APIs, and other technologies: McKinsey research finds that cloud and related technologies together can drive down run-the-bank IT costs by more than 30%. Through APIs, banks can work around current legacy systems and build the type of banking ecosystem consumers will expect.

- Creating an agile organization: Agile organizations are both more stable (resilient, reliable

and efficient) and dynamic (fast, nimble and adaptive). This capability is required in today’s fast-paced banking environment.

Responding to an Ecosystem World

Banks and credit unions around the world have started to capitalize on their customers’ trust and data to build distinctive, end-to-end customer experiences in which they offer both banking and other services.

According to McKinsey, an ecosystem strategy can improve profit in their core business in two ways. First, a powerful platform will help retain customers and improve cross-selling and could add 1.9 percentage points to ROE. Second, with a network of partners and a sophisticated platform, banks can acquire customers for a fraction of the cost they do today.

Partners with big customer bases present extraordinary opportunities. With good data, banks can develop insightful underwriting strategies. Lower acquisition costs will lift ROE by 0.5 to 1.0 percentage points, according to McKinsey.

For banks that choose not to pursue an ecosystem strategy, McKinsey sees two options: Become a white-label balance sheet operator, or be a highly focused or specialized bank.

White-label balance sheet operators would greatly expand their balance sheets, as they lend to companies with stronger customer relationships. In this scenario, a bank would partner with platform companies, and be a manufacturer of financial products that are distributed by others.

A focused or specialized bank would concentrate on either a business line (e.g. private banking or investment banking), a specific segment of the value chain, a product category, a geography, a customer segment, or a service model (e.g. a stand-alone digital bank).

The rapid pace of digitization means that banks and credit unions must rethink their business models for the ecosystem era, where digitalization of the entire organization is not an option. The timeline for making decisions regarding the path to choose going forward is shorter than most imagine. And the stakes are higher.