Famed futurist and author Arthur C. Clarke once said that advanced technologies are virtually indistinguishable from magic. Just ten years ago, the idea that you could walk up to an ATM, wave your phone at it, and walk away with cash in your pocket would have sounded almost magical.

Think about it. In 2007, the iPhone was just rolling out and ATMs seemed unimaginable. But it’s not magic or science fiction. It’s just the inevitability of technology, and it’s right around the corner. The high saturation of mobile technologies in our society today have enabled this step forward.

People Still Need Access to Cash

Despite the introduction of Apple Pay and Google Wallet, we’re a long way from going cashless. The fact is cash still provides financial security and peace of mind, and there will always be those who don’t want to use cards — a phenomenon that becomes more common further from large, urban centers.

In fact, access to cash without the need of a debit card actually appeals to both audiences — the digitally sophisticated mobile-user, as well as the more conservative consumer who eschews plastic. It may seem counterintuitive, but someone who doesn’t want a debit card from their banking provider still needs access to cash… and they almost certainly have a mobile device that they are willing (and able) to use at an ATM.

And for everyone, one of the main benefits of cardless ATM access is that you don’t have to worry about losing your card or forgetting your PIN. Cardless ATMs also offer protection against stolen wallets.

Cardless ATMs are more secure than a traditional ATMs. With the growing prevalence of “skimmers” — devices that can intercept personal details while running your card through an ATM — a cardless system defeats such scams.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

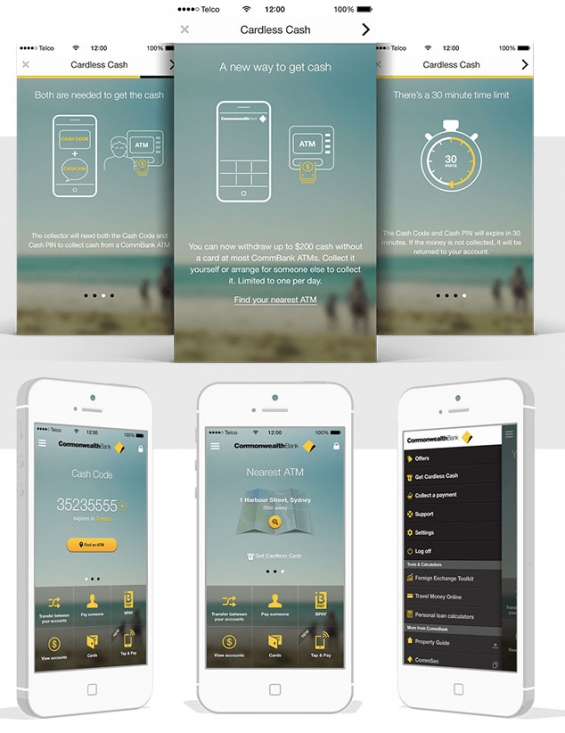

How Commonwealth Bank in Australia (CBA) has implemented cardless ATMs.

The Revolution Has Already Begun

There’s no question that cardless ATMs are an improvement over current cash delivery systems, and they’re naturally more secure and convenient. But, when will we see cardless ATMs appear in large numbers? Soon.

Major US-based banking provider Wells Fargo announced its intentions to roll out cardless functionality in its network of 13,000 ATMs in March of 2017. Wells Fargo isn’t alone. In the US, other major banking providers, such as JPMorgan Chase, Citigroup, and Bank of America, have all announced their own cardless pilot programs. This trend isn’t limited to just North America either. Banks headquartered in the UK, Turkey, Spain, Poland, India, and Australia have all pushed their own cardless ATM networks with high levels of success.

Keep in mind that these systems don’t make cardless banking a reality yet. At present, they simply permit consumers to enter a code received via SMS in order to withdraw a predefined amount of cash. But they are an important first step towards a future that eliminates all physical instruments from the banking world — no cash, no checks, no cards.