Despite the unparalleled growth of fintech start-ups, and the perception of accelerated innovation in the banking marketplace, there is evidence that smaller start-ups are growing much more slowly than comparable firms did in the past and that innovation in financial services has actually slowed.

This is because the largest banks are leveraging proprietary information technology to achieve major gains in efficiencies and to respond to highly heterogeneous demands of consumers and businesses. The result is a widening gap in revenue per employee and a solidification of the dominance of the market leaders … or ‘superstar capitalism’.

The question becomes, should dominant financial institutions be broken up, or should the banking giants be compelled to share technology, data and knowledge as part of open platforms similar to how Amazon has created a separate business with their cloud technology?

In a Banking Transformed podcast interview with James Bessen, lecturer at the Boston University School of Law and author of the book, “The New Goliaths: How Corporations Use Software to Dominate Industries, Kill Innovation, and Undermine Regulation,” Bessen shares his perspective on the impact of reduced competition, and how democratization of technology and insight can create a revived economy.

Listen Here: Are Big Banks Hurting Competition, Innovation and Equality?

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Dominance of Market Leaders

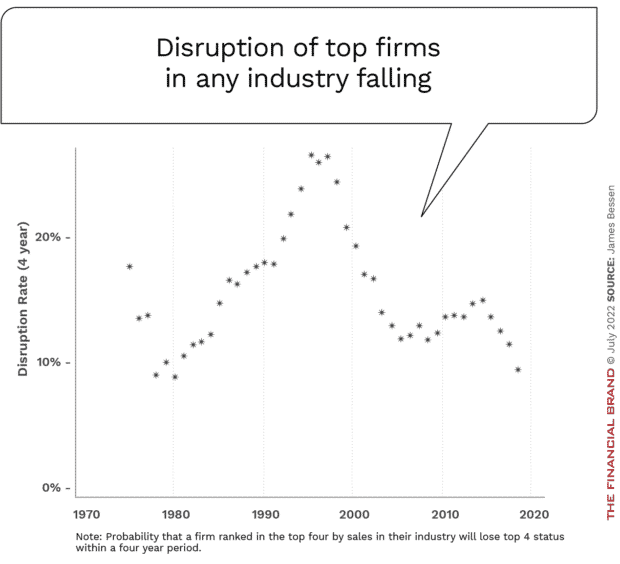

In banking, and across virtually all industries, the largest firms have been able to invest in proprietary information systems to take advantage of market opportunities and increase domination of both existing competition and new start-ups. This increase in dominance has created a decline in the risk that the biggest banks will be disrupted. According to Bessen, “In a given industry, the chance that a high-ranking firm (as measured by sales) will drop out of one of the top four spots within four years has fallen from over 20% to around 10%.”

The increased investment in software allows the largest banks to achieve efficiencies and to use data and systems to create customized products and services at scale. This allows these financial institutions to respond to customer needs faster than competitors. This makes it increasingly hard for established banking competitors to keep pace and for new start-ups to gain the scale of customers needed to disrupt the marketplace. In those instances where fintech firms can combine innovation and scale, the largest firms are in a financial position to acquire these firms.

According to Bessen, “These proprietary systems enable big firms to manage complexity, to handle greater variety, to handle more product features, to more finely target products to customers, and to advertise and reach those customers more efficiently.”

Finally, proprietary systems by the largest banks creates higher total revenues for these firms and higher labor productivity compared to competition. There is evidence that this efficiency creates an opportunity to pay more for talent at a time when demand is highest.

“There’s a talent war where the large firms not only hire more talented people, but they pay them more. They’ll pay 15%, 20%, or 30% more for a job with the same characteristics.”

— James Bessen

Market Concentration Impact on Innovation

Like all industries, the banking industry benefits from product and service innovation. There are arguments that smaller start-ups are more innovative than larger existing organizations. If this is true, then banking innovation – in total – is negatively impacted when the largest firms dominate the ecosystem. Research into innovations over the years supports the reality that both small and large firms are important to the innovation process, but that larger firms often focus more on process and incremental innovation, while smaller firms tend to focus on product innovation.

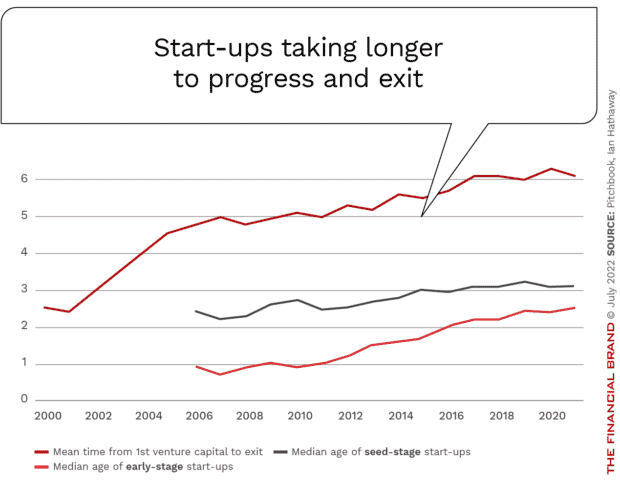

The challenge, as mentioned earlier, is that the technology gap between the largest players and smaller new and existing firms limits the ability for the smaller players to grow and deploy their innovations at scale. In fact, research shows that it has become more difficult for smaller firms to get the level of scale needed to exit. The technology gap also often limits the ability for smaller firms to provide the learning opportunities for workers interested in improving their skills using the most advanced technologies.

“Big firms are bringing great benefits to consumers, but at the same time, one of the critical things is they make it much harder for an innovative startup firm to grow.”

— James Bessen

Read More: The Future of Banking: More Competition Means More Disruption

Compliance Favors Largest Players

The complexity of banking has increased significantly over the years. This complexity has required increased regulations and a growing cost of regulations for banking organizations of all sizes.

A consequence of regulatory complexity and the increasing costs of compliance is that a large component of these costs are fixed, with the burden becoming much more significant as a percent of expenses for smaller financial firms.

Open Platforms Benefit Large and Small Banking Providers

Proprietary systems have made the biggest financial institutions more dominant than ever. That said, there are still consumer and business needs that are unmet (as evidenced by the number of fintech firms that have entered the marketplace). The policy challenge is to find ways to stimulate competition and try to level the playing field to benefit society.

“If customers can get their own data and make it easily portable to another platform, they could do many more things that they can’t get from the large banks. And I think that may be the frontier of where things need to open up in banking.”

— James Bessen

One option is to promote the unbundling of technology, data, hardware or knowledge in a marketplace. This has been done by firms as diverse as IBM (for software and hardware businesses) and Amazon (AWS cloud services and distribution logistics). Bessen states, “Where proprietary software systems have slowed the diffusion of new technology, unbundling may accelerate diffusion, improving innovation, productivity, and competition.”

That is not to say that the largest financial firms will be interested in unbundling their technology, data or proprietary knowledge without a governmental ‘nudge’. While detailed knowledge of customers offers a significant competitive advantage, most large banking organizations in the U.S. have been hesitant to embrace open banking, where access to data is made possible with standardized APIs.

To level the playing field in banking there may need to be incentives (positive or negative) provided to diffuse innovations and software technology.