With so much emphasis on making digital transformation strategies in banking, you would think that the industry would be in a veritable arms race to automate all the underlying processes.

And you would be wrong.

A survey by Cognizant of executives from across the financial industry — retail banking, credit cards, wealth management and mortgage lending — revealed that the automation efforts at nearly two-thirds (65%) of institutions remain at the early or proof-of-concept stages… if they’ve done anything at all. And yet nine in ten respondents professed that process automation is critical to their business plans, both now and in the future.

One of the primary reasons for this sluggish pace was that key internal constituencies weren’t on board. Automation — specifically robotic process automation (RPA) — is typically associated as the sole responsibility of IT. Only 12% of bankers think other business units share this responsibility to implement, according to the findings in Cognizant’s report.

Banking providers seem to view automation as a technological endeavor, even though automation, as the report notes, “isn’t about remaking IT.”

In fact, Cognizant points out that “one of the most appealing aspects of automation is that it requires minimal engineering and coding, and can be implemented via simple, business-friendly interfaces.”

RPA is about automating business processes and thus the decision regarding what needs to change must be made at the business or operations end, insists Sriniketh Chakravarthi, Cognizant’s Head of North American Banking and Financial Services.

“IT can and should own such things as architecture, tools, and security, but the business should make the choice of where to use RPA,” Chakravarthi explains.

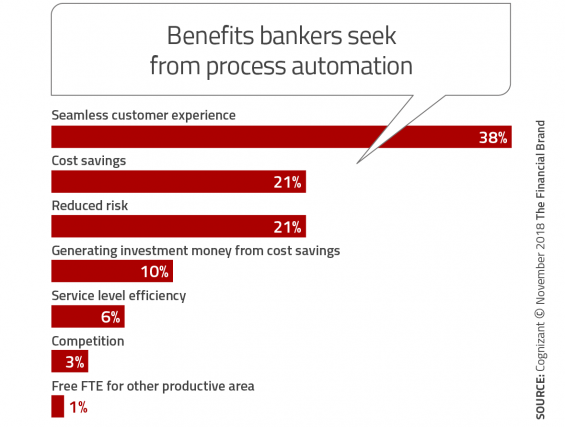

That would make sense, considering that the top benefit bankers say they look for from process automation is a seamless customer experience.

As an example of seamless experience, Chakravarthi cites the application process for a personal loan or a mortgage. Once the application form is completed digitally, he explains, data must be moved to other systems (e.g. credit checks, underwriting, pricing, etc.). That’s where most banks and credit unions encounter “speed bumps,” he says. That’s because data may need to be transferred manually, with each step possibly involving separate systems. RPA can help accelerate this by moving the required data from one system to another, thus eliminating wait times and errors stemming from transfers and/or transcription.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

RPA, Cognitive Automation, and The Impact on Digital Transformation

In the context of its survey, Cognizant used “automation” as a collective term, including both robotic process automation (RPA) and cognitive computing. RPA is software (bots) mimicking routine ways in which humans interact with data and IT systems. Cognitive automation is a technology powered by artificial intelligence using algorithms to handle more complex tasks, such as analyzing vast amounts of data and recognizing patterns for risk analysis that require judgment and inference.

For example, Cognizant says RPA could be used to extract information from a credit card application, validate it and submit it for approval. “From logging in to entering data and even scanning and sending email messages, RPA is aimed at speeding up processing times and, not incidentally, relieving people of some of the more mundane aspects of their work,” the report notes.

These functions fit tightly within the overall theme of retail banking’s digital transformation. Chakravarthi explains that true transformation entails the ability to drive a unified customer experience across channels, to dynamically deliver products and services, to tap into a wider ecosystem of fintechs and other partners and to drive a differentiated customer engagement leveraging data insights.

All this requires the customer-engagement process “to be stitched seamlessly from the front office to the back office,” says Chakravarthi. That requires a significant overhaul of the bank’s IT systems and applications. But RPA and cognitive automation can help, at both a tactical level and at a strategic level. On a tactical level, Chakravarthi explains, automation provides some wins to banks by “stitching processes together.” At a strategic level, automation yields insights from data while helping orchestrate a more unified, differentiated experience.

Read More: Robotics & Cognitive Automation Will Keep Banks From Drowning in Data

What’s Holding Up Progress With Automation?

Cognizant’s study uncovered five broad reasons that account for the lack of progress among banks and credit unions with respect to automating various operations.

1. The misconception that automation is all about a tech overhaul. This hinders many non-IT banking leaders from moving forward. Many opportunities don’t actually require extensive coding or interaction with legacy systems. They just need attention, often from senior executives outside the IT team.

2. Automation efforts lack sufficient resources. Although a significant majority of respondents in Cognizant’s research say they believe they have the pieces in place to implement process automation, the report’s authors are skeptical. For one thing, three quarters of the bankers describe their annual automation budget as “modest.” And only about half the respondents believe they have enough expertise to proceed.

3. Addressing security, risk and compliance issues. Not a surprising finding in the complex world of retail banking. Banks and credit unions have expertise in these areas, of course, but need help applying it specifically to automation’s challenges (for example, dealing with bot security, covered in the next point).

4. Uncharted territory in a post-automation environment. This is partly a function of dealing with the human impact of automation. Half expect an impact on jobs — at least a 5% reduction — but three quarters say they have plans to reassign displaced workers.

But there are also more tangible, concrete concerns. For instance, what if a software bot fails, or encounters a security issue? How quickly would managers be alert ed, and how quickly a human would be available to respond? As the report notes, the devil is in such details, and it’s precisely these type of contingencies that worry bankers (42% of respondents in the survey admitted they would be caught unprepared in such situations). Fortunately, Chakravarthi says software is available for just that purpose — to detect when a bot fails and then redirect consumer traffic to live agents.

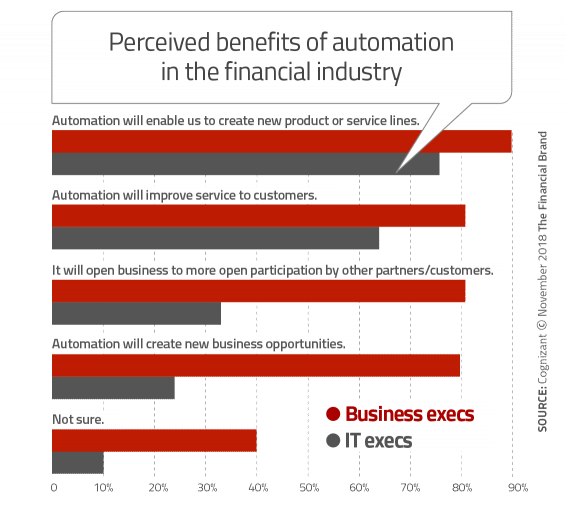

5. Disconnects between what IT and other teams expect from automation. This situation complicates any cost/benefit analysis, thwarting internal buy-in and confounding the evaluation of results, the report notes.

Automation is unlikely to bring about improvements in customer service on its own, says the report. “A more realistic perspective — which IT professionals may be more likely to have — is to look at automation as a key part of end-to-end process optimization,” Cognizant notes. “While automation can’t fix broken process, it can certainly optimize one that works, and in fairly short order.”

Automation is unlikely to bring about improvements in customer service on its own, says the report. “A more realistic perspective — which IT professionals may be more likely to have — is to look at automation as a key part of end-to-end process optimization,” Cognizant notes. “While automation can’t fix broken process, it can certainly optimize one that works, and in fairly short order.”

Chakravarthi says few quick wins will help advance the ball. He points to several possibilities:

- Application processing for loans/credit cards/accounts

- Generating reports that combine data from multiple sources

- Compliance processes such as Know Your Customer

- Bots that help a customer service agent to view all customer information in one place

Read More: How Banks Can Accelerate Innovation Through Digitization & Automation

Three Routes Around the Roadblocks to Automating Banking

Some of the biggest financial institutions are far down the automation road, but many regionals and large community banks and credit unions are either just starting out or not far beyond the proof-of-concept stage. Cognizant’s report outlined three distinct approaches:

1. Target one line of business at a time. Some institutions select one business area with high operational costs but simple processes and start with that. Doing so can help show benefits quickly.

2. Move from simple to complex processes. Other banks and credit unions have identified a set of simple, rules-based processes common to several lines of business that can be automated as a starting point. This approach needs enterprise support and takes longer to plan.

3. Tackle biggest impact areas first. A few financial institutions have focused on a single, but large, process to generate maximum impact when automated, particularly relating to cost savings. This is a way to create a funding model for subsequent automation.

“Keep in mind that when a bot goes into production, the surrounding systems will feel it,” the report notes. “What a human can do in an hour, a bot does in a fraction of the time, dramatically increasing data volumes.” It’s a good opportunity for IT and other retail teams to work together to avoid any disasters on Day One.

And one of the big problems you want to avoid, says Cognizant, is automating a process that is already broken or inefficient. Doing so can jeopardize the entire automation initiative. All it takes is one boneheaded move like that to undermine everyone’s confidence.

Although many of the points above relate to automating simple tasks, the report also urges financial institutions to look beyond simple rule-based automation and start identifying larger goals that will require cognitive solutions.