The pandemic caused the entire banking industry to reassess their positioning as digital banking providers in 2020. While the majority of banks and credit unions responded quickly to the need to deliver basic digital solutions as physical banking capabilities shut down, the delivery of strong digital experiences often were lacking from a simplicity and integration perspective.

In 2021 financial institutions will need to determine their commitment to improving digital banking experiences and prioritize technology investments to support a multichannel future. In other words, organizations of all sizes will need to evaluate their digital transformation journey in light of what has occurred in 2020 … and what will be required in the months and years to come.

Adding to the challenge of “catching up” in an increasingly digital world, banks and credit unions will need to prioritize their investment in technology during a time of economic uncertainty. It is expected that there will be a continued slowdown in GDP growth, continuing low interest rates, modest payment transaction volumes and a concern around loan losses.

Given this backdrop, financial institutions of all sizes will need to determine their individual path to digital transformation. According to Deloitte, “The crisis has served as a litmus test for banks’ digital infrastructure. While institutions that made strategic investments in technology came out stronger, laggards may still be able to leapfrog competitors if they take swift action to accelerate tech modernization.”

Read More:

- 7 Essentials of Digital Banking Transformation Success

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Banking Redefined

Clearly the pandemic acted as a catalyst for digitization in all industries, especially banking. As a result, banks and credit unions needed to review their entire business model, from products offered to back-office processes that had been in place for decades.

With an industry and economy still in a state of flux, organizations need to find ways to serve consumers faster, with less friction, and at a lower cost. More than ever, there will be a focus on data and analytics, modern technology and the ability to deliver an improved customer experience.

For some institutions, the cost and commitment to digital transformation may be too great. In fact, many organizations may continue to delay long-term technology initiatives as opposed to focusing on innovation and future growth. It also appears that the redefinition of banking will need to occur from a continued remote working structure … at least for the time being. This will convert even more traditional paradigms around decision making and the legacy culture of banking.

In the world of banking redefined, the ability to be agile, flexible and resilient will help define winners.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Rethinking Financial Services with Artificial Intelligence Tools

Using Technology to Accelerate Digital Transformation

The pandemic exposed weaknesses in the ability for many banking organizations to deliver positive digital experiences and to leverage existing technologies to support current and future needs. According to Deloitte, almost 80% of respondents to their survey of top financial institutions stated that COVID-19 uncovered shortcomings in their institution’s digital capabilities. In most cases, these challenges were attributed to legacy infrastructure and data fragmentation.

About two-thirds of Deloitte’s survey respondents picked one of three paths for technology investment: Investing in technology for greater efficiency, investing for innovation, or simply cancelling or delaying long-term tech projects. The first option is understood given the economic environment, but creates concern given the need to improve customer experiences for growth. Organizations investing in technology with an eye on innovation are obviously better prepared for future opportunities.

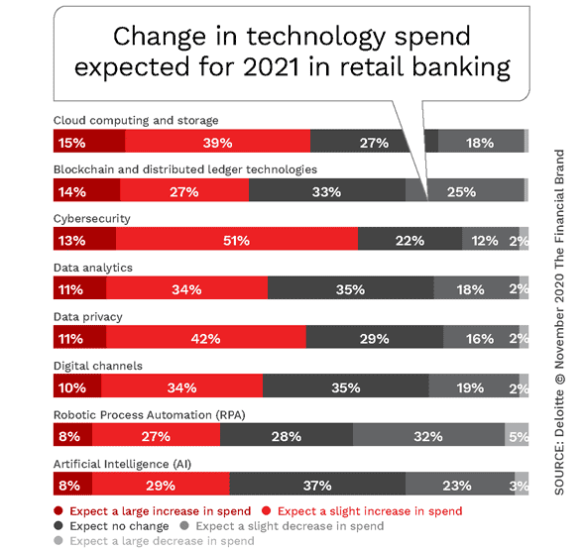

In the near term, organizations should invest in technology to shore up areas of weakness exposed by the pandemic. This includes investing in cloud computing, cybersecurity, privacy, data analytics and digital channels.

In addition, financial institutions should invest in core systems modernization. According to CenterState and Financial Post, 60%–65% of the industry’s tech and IT budgets already go toward ongoing infrastructure maintenance, representing an increasing liability.

It is no longer advisable to simply make modest adjustments to systems that are decades old and present both structural and security risks. “Technology leaders should factor in how the current technology stack can interface with not just next-gen but next-next-gen innovations, such as advanced machine learning techniques, blockchain applications, or quantum computing,” the Deloitte report states.

Cloud computing can assist with many of these initiatives, assisting with agility, scale, product innovation and analytic projects. With many third-party providers offering solutions designed for financial institutions, the cost and risk associated with these partnerships should be appealing for firms of almost any size.

Technology to Improve Consumer Experiences

As the use of digital channels continues to increase, consumer expectations will increase as well. To support these higher expectations, financial institutions will need to move beyond investing in technology modifications, to rethinking technology strategies that will support improved product development and user experiences. The result will be a dual impact of improved satisfaction along with reduced costs.

During this phase of technology investment, banks will focus on simplifying products and processes where consumers currently experience “digital pain.” This includes, but is not limited to, improving site navigation and design, removing steps in processes, accelerating loading speeds and transforming the overall customer journey.

Financial institutions will also need to increase investment in AI and robotic process automation (RPA) that will reduce the need for repetitive work and the opportunity for human error, resulting in both increased customer satisfaction and cost savings.

A commitment to technology investment will become one of the most important components of a financial institution’s digital banking transformation efforts in 2021. This commitment must serve the dual role of reducing costs and improving experiences.

To address both of these objectives, banks and credit unions should reexamine the build/buy/outsource alternatives for technology projects. According to Deloitte, 50% of respondents said their institutions’ inclination to outsource has somewhat or significantly increased during the pandemic, while about 40% indicated a decline in their institution’s intent to build or buy. There was also a greater inclination to deploy managed services to cut costs for critical but less-differentiating activities.

Digital transformation and investment in advanced technology will fundamentally change bank models in the next decade. To sustain long-term success, banks will need to invest in both short-term and long-term initiatives to provide clients with new digital solutions that improve the lives of consumers.