There is no shortage of evidence that a digital-first customer experience has become an imperative for any bank or credit union hoping to remain relevant to their customers and competitive in the market. The events of 2020 have increased the pressure on financial institutions to accelerate their digital transformation efforts across devices and channels to meet the digital expectations of their customers.

The issue for many is how to harness this transformation to reposition the institution for a new era — one of refreshing how they serve customers and delivering new forms of value.

There is limitless technology available to enable a digital-first customer experience, and there has never been more data within reach to personalize financial services offerings in ways that anticipate and respond to customer needs. But viewing the digital transformation challenge as one of technology or data will cause any leadership team to under-deliver versus what is possible, and jeopardize expected returns on digital investments.

Technology and data can be powerful enablers, but will do little good if a financial institution doesn’t first deal with five innovation essentials.

1. Establish a Customer Experience Ambition

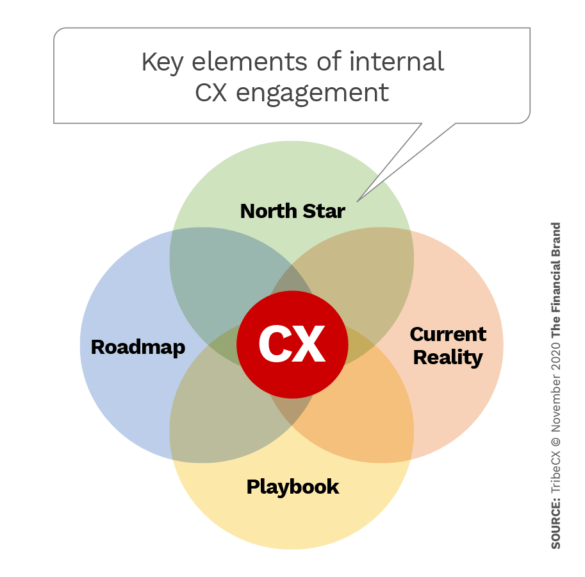

This means having a CX North Star — that is, defining the branded experience for the customer segments the institution wants to serve. A good North Star calls out both the rational and emotional attributes of the experience, and is based on an understanding of each segment’s unique needs and preferences.

This goal is not a slogan, tagline or mission statement. Rather, it is the guidepost for how the bank or credit union designs and delivers experiences, products and services, and how the organization listens to customers and measures success.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

2. Articulate an Honest View of the Current Customer Experience

This involves assessing current capabilities and resources — what’s working and what could be better — in a way that employees see as constructive and forward-thinking. Releasing people from the constraints of “the way things have always been done” is the hardest part of any transformation for most banks and credit unions. Steering people clear of feeling the need to defend the past is a critical leadership responsibility to generating a realistic assessment.

Tactical suggestion One of the most practical tools for getting the right customer perspective is journey mapping — quite simply, a way to visualize how customers actually go about the end-to-end journey that moves from …

- Becoming aware of a need, to

- Surfacing and evaluating solutions, to

- Making a decision and purchase, and

- Pursuing an ongoing relationship with the brand.

Journey maps that capture how customers actually behave — not how brands would like their customers to behave — are always eye-opening and can very quickly surface the gaps between the North Star and the current customer experience. These insights lead to a defined list of action items that have the greatest potential to deliver results.

Read More:

- Digital Transformation Demands a Culture of Innovation

- Data Reveals a Surprise Driver of CX Satisfaction in Banking

- Banking Needs 360-Degree View of Customer Journey

- Finding Your Financial Institution’s ‘New Normal’ CX

3. Developing the Plan to Deliver Your CX North Star

Not every possible action revealed by the journey maps will be a priority right now, and the overall output may feel overwhelming. Get past this by separating improvements into what should be done: “Now,” “Next” and “Later.”

Most important to building momentum is to prove results, which requires establishing metrics up front. Focus on metrics that are appropriate to small-scale proofs-of-concept. Demonstrating success in this way will get the organization excited, deepen C-suite buy-in, and can be shared with the board so directors can contribute their perspectives.

Tactical suggestion Identify two or three initiatives that can be conducted as pilots — ideally in 90 days or less. Make sure they are headed by people with a track record of overcoming obstacles, leading with optimism, and building diverse and inclusive teams. Collaboration will fuel success and establish the basis for further wins.

4. Build Broad Engagement to Accelerate Scaling

Digital transformation efforts in banking often become siloed and as a result, opportunities to spread enthusiasm and leverage the expertise of the entire organization are lost. Scaling-up concepts from small pilots requires identifying repeatable processes and harnessing the knowledge, expertise and energy of people all around the organization.

Tactical suggestion Consider capturing the accumulating knowledge of how to accomplish the bank’s North Star customer experience in a playbook. Such a tool can codify what the target experience looks like and recognize the contributions of teams from around the institution whose efforts are improving the customer experience.

What’s missing from the goal of achieving a digitally transformed customer experience is well within reach of any bank or credit union: A solid North Star, a current-state understanding reflecting the customer’s view, and new ways to execute based on processes, tools and metrics that are fit for the purpose of operating and serving a fundamentally changed market.