ATMs crossed the half-century mark in 2019, a year that’s seen use of digital wallets and contactless cards start to surge. Little wonder, then, that many banks and credit unions no longer regard ATMs as a core functionality. But many of their customers feel otherwise.

Modern ATMs can do a great many things, including being activated by a mobile phone. Yet their primary function remains dispensing cash, and while cash transactions are declining, they are still the largest payment category by number of transactions — well ahead of debit cards — according to Federal Reserve data. Dollar volume is another matter, where cash is the third-smallest category (just ahead of prepaid cards and “other”). However, the dollar value of cash transactions has remained steady for six years.

As many banks and credit unions refocus on customer acquisition in the face of pressure from fintech providers, neobanks and big tech/bank partnerships, they have heavily invested in digital channels, while keeping a sharp eye on efficiency as well. But overall, the emphasis today is, or should be, on “perceived convenience,” maintains Justin Upton, General Manager of ATM Branding Solutions at Cardtronics, the big third-party ATM network operator. How you package that convenience across platforms — which include websites and digital apps along with physical access to funds — is extremely important, he says.

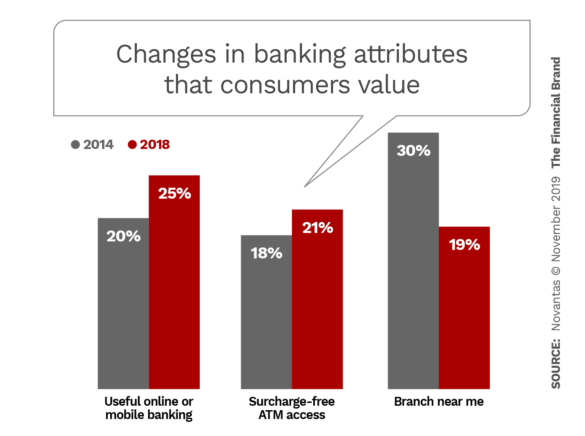

Reviewing retail banking trends during a webinar hosted by The Financial Brand, Upton noted that having “a branch near me” used to be the key differentiator for how consumers chose where to do their banking. That factor has dropped significantly, whereas mobile and online banking as well as surcharge-free ATM access have both grown in importance.

“As branches become used less and less frequently as customers shift to digital, there’s still that need to build brand equity and for customers to access cash,” Upton noted. In addition, Cardtronics research has found that consumers are not willing to travel very far in order to get cash. Typically one to two miles from either their home or their place of work.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Evaluating Branded ATM vs. Surcharge-Free Options

Partnering with a third-party provider to have ATMs branded with the financial institution’s name and logo (with a “billboard” atop the unit) and placed in a retail or other location is not a new concept, but one that has new significance as retail banking has evolved. The approach can be used strategically to augment a reduced branch network, to defend an existing market when a new competitor enters, or as a less expensive way to enter a new market, according to Upton.

Customer retention would benefit too if ATMs were fully integrated with other channels, particularly if a financial institution is using, or has contracted to use, ATMs that have the latest functionality. “In a perfect world,” Upton stated, “you would have a very synergistic omnichannel platform from your website to your mobile experience to the ATM channels so that they all look and feel very congruent, thus improving the user experience.”

Upton was asked during the webinar how a branded ATM arrangement would be more beneficial for a financial institution than joining a surcharge-free ATM network like MoneyPass, Allpoint, or Co-op Financial Services.

Upton pointed out that Allpoint is part of Cardtronics and so he could speak to both sides of the argument.

A surcharge-free network relationship is a great way for a bank or credit union to quickly get broad access to a large number of customers, Upton stated, expanding its marketing message and giving it more physical distribution points than the largest financial institutions in the U.S. “What you don’t get with a surcharge-free network is the brand equity that you would get with an ATM branding relationship, where the ATM looks and feels like your own proprietary ATM,” Upton stated.

ATM branding is a unique marketing channel, he pointed out. “The branding ‘billboard’ is right there when a consumer is doing a transaction — when they’re thinking about their banking relationship. Whereas when you drive by an outdoor billboard, you might be thinking about what happened at work or what you’re going to cook for dinner.”

Read More:

- Omnichannel Banking: Essential Capability? Or Unrealistic Fantasy?

- More Americans Say Farewell to Cash

- Why Cardless ATMs Are The Next Big Thing

Pros and Cons of Rebating Surcharge Fees

It’s a common practice for banks and credit unions to rebate all or some ATM surcharge fees as part of a retail banking offer. That practice and using branded ATMs are not mutually exclusive. However, Upton observed that over the past few years, surcharge rates have increased, making rebates an expensive proposition.

Most banks and credit unions offer rebating as a service to retain existing customers, said Upton, but also as a marketing message to attract new customers. “That means that as you acquire new customers, your rebate expense grows,” he adds. “It’s really an unsustainable business model.”

Upton suggested that ATM branding is not only for large institutions. He said it would make sense for a small community bank or credit union that has a single branch location in a growth market to add branded ATMs as a way to expand — putting them in convenience stores, pharmacies and grocery stores. “That’s where the population of that community shops every day.” He maintains that using that approach would be less expensive than building out your own ATM network around the branch.

Upton acknowledged that it has been tough to quantify the value of ATM branding and that Cardtronics has tried various approaches over time. The company recently worked with Novantas to research the value of the concept.

That effort produced several specific examples that were covered in the webinar. In one, a financial institution that had a 10% branch share in an existing market used branded ATMs to increase its ATM percentage from 4% of the market to 8% of the market. Upton stated that the institution increased its customer acquisition rate by 0.43%.