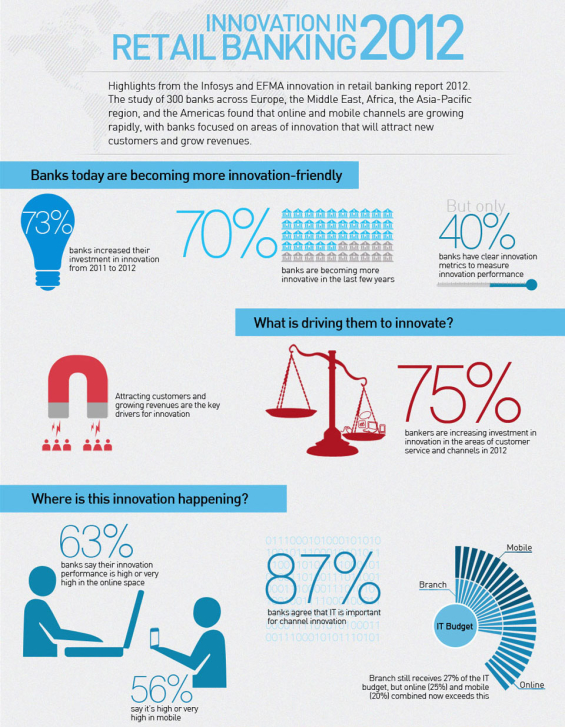

According to “Innovation in Retail Banking,” a report by Infosys and Efma, over 70% of banks say they have plans to increase their budgets for innovation.

The study of 300 bankers in 66 countries around the world also found that online and mobile channels are growing rapidly, with banks focused on areas of innovation that will attract new customers and grow revenues.

79% of banks see innovation as strategically important to the future success of their business. 76% said that investment in innovation has already increased over the previous year, mostly in the areas of channels and customer experience.

Bank branches receive the highest proportion of discretionary IT budget at 27%, compared to 26% for online and 20% for mobile – yet there was a consistent view across the regions that online and mobile are the most important channels for innovation.

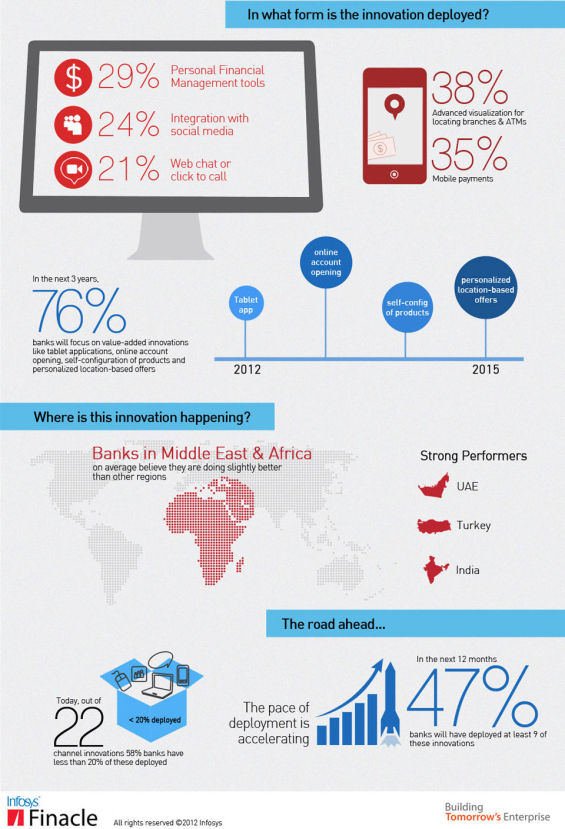

93% of banks expect to offer mobile payment services and 89% plan to offer tablet banking applications to customers within the next three years. The area of fastest growth comes from innovations in value-added services such as personalized location-based offers, a space where within three years more than 76% of banks will shift focus to, up from just 8% today.

87% of banks are focused on integration with social media, and 86% on interactive services, such as web chat, video conferencing, and click-to-call.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Fractional Marketing for Financial Brands

Services that scale with you.