The innovation function at Park National Bank began small, in early 2020, with the simple goal of advancing the bank’s digital capabilities without losing its human touch. At the time, the effort focused on the bank’s mobile app.

When the pandemic began, making that general goal a reality became a must-have, rather than a nice to have, for the Newark, Ohio, bank, which has $9.8 billion in assets. But besides producing an immediate solution, it amped up the Park National’s focus on innovation going forward, resulting in an expanded team and a broader mission.

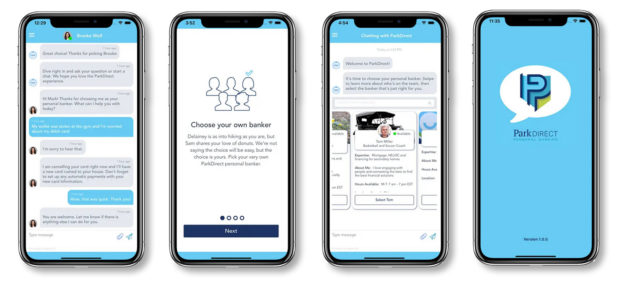

The product of that first push was ParkDirect, the bank’s mobile banking app, which included a special feature that few financial institutions offer. That is the ability to pick a personal banker from a roster of profiles in the app, and communicate with them through a chat-type function for solving problems, getting advice and learning more about Park National services.

ParkDirect blends human and digital help and has proven popular even after pandemic closures went away. Something customers particularly appreciate is that the bankers have the person’s entire financial history in front of them.

One personal banker proved so helpful to a pair of customers that they invited her to their wedding.

Zach Reuscher, head of innovation and corporate treasury director, says ParkDirect became the flagship for the innovation function, but that the most important point about the successful launch was not the technology by itself.

“The biggest thing about it was the recognition that we could move quickly, be able to pivot, and be viable in the industry,” says Reuscher.

Bank Innovators Needn't Be Inventors:

A key innovation lesson for community banks is that they don't need to build everything from scratch. Adaptation can produce viable products.

The personal banker function is built on mobile software from Agent IQ. Ali Gerdeman, innovation leader in Park National’s lab and a member of the original team, explains that staff discovered quickly that taking a tech product off the shelf and molding it to the bank’s specific needs could work well.

The innovation team has learned many lessons since then that other financial institutions’ innovation leaders can benefit from.

One that Reuscher has taken to heart is a good general rule:

Innovation that produces expense reduction is finite — you can only save what you were spending. Conversely, innovation that enhances revenue can grow and grow.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

What Should a Community Bank Innovation Lab Be Doing?

Unlike the innovation labs of some much larger institutions, when innovation has its own home inside a community bank or credit union, the temptation to delve into new technologies for their own sake has to have a short leash. Practical application must be a key goal.

“We have found that we need to prioritize the things that we should be spending time on now,” says Kevin Mongold, Park National’s innovation leader. “Even innovation needs a structure.”

Mongold says the team’s members have to stay abreast of leading-edge developments in financial technology. “We have to keep our eyes and our ideas big,” he says.

However, remaining anchored in near-term needs is critical. “We have to focus on what we are tactically doing this week,” Mongold says.

Team members say this means that they have to think ahead — if they work on this project, where could it lead and when? And how do you avoid constantly getting into the weeds of technology?

And when is a project sufficiently cooked to be of use to a business unit and taken out of the lab’s oven?

“We talk a lot about maximizing time and resources,” says Ilaria Rawlins, the team’s director of retail innovation.

In fact, trying to be a tiny “skunkworks” isn’t the role of a community bank tech lab. Gerdeman says it’s helpful with some projects to think of the innovation staff as a team of internal consultants.

A Lab's Clearinghouse Role:

An essential function for a community bank innovation lab is evaluating products that are already on the market and finding the best fit, or what can be fitted to the bank's needs.

Team members say that vendor product demos at industry events like The Financial Brand Forum are essential to doing their jobs.

“We have very tangible goals for providing value for the bank,” says Gerdeman.

Team members also bring their own experience as consumers of banking services to the table. “Our team members are advocates,” says Mongold. “We try to design processes in the ways we would want them to be as customers.”

Read More:

- Tactics to Spark Innovative Thinking from a Disney Exec

- How Innovation Itself Is Changing Inside U.S. Bank, Ally & Synovus

- What 5 Top Financial Innovation Labs Are Doing

Good Practices for Working with Business Units and Other Bank Functions

To give the lab some space, figuratively as well as physically, its staff works in a separate location from headquarters. However, its offices are not far from HQ, because the idea is that a good deal of consultation will occur. The innovation staff can cover any area of the bank, not just retail banking.

The innovation process has a formal side, and another aspect that is more ongoing give and take. Regarding the first, the innovation team has quarterly consultations with line of business leaders, the chief financial officer and other senior bankers. The discussions include specific needs the units have and briefings on what the innovation lab has been looking at that could solve such issues. Once a project commences, there may be a good deal of less-formal communication between the client group and the innovation staff.

The ability to tap people from elsewhere in the bank helps keep the size of the innovation staff in check.

Team members explain that ideas flow in both directions and sometimes back again. Team members say there is also an element of “teach us to fish,” instead of just handing over innovation; that also goes both ways.

“Sometimes we’ve flipped the script,” says Reuscher, in the hope that innovative ideas that fit one business unit may fit others, which delivers more punch for the cost of the research and development.

Overall, the innovation team tries to avoid “orphan” projects. “It’s important to have senior leadership-level sponsorship of whatever we take on,” says Gerdeman.

Read More:

- How Truist and TD Bank Are Putting New Twists on Innovation Labs

- The Gap Between Products Banks Offer & What Consumers Really Need

- How U.S. Bank Keeps Its Award-Winning Mobile App on the Leading Edge

Working with Innovators from Outside of the Bank

Using the word “lab” can connote secret work not to be shared. But Reuscher says he and his teammates have found that innovators at some other financial institutions aren’t as closed-mouth as you might think.

Gerdeman says that the innovation labs at some financial institutions are strong in some areas, not so strong in others. Sharing with other organizations with complementary strengths turns out to be a good move, says Mongold.

To take advantage of such sharing, Park National has joined various consortia, in part to have access to groups that are vetting potential fintech partners. In addition, some external outreach is an investment in the future. For example, the bank has joined the USDF Consortium, which is working on a bank-run approach to “tokenized deposits.”

“Most people are not holding their cards as closely to the vest,” says Mongold. “That’s because everyone is dealing with the same challenges throughout the industry.”

Reuscher finds the attitude of Toyota, the automaker, inspiring in this regard. Toyota is known for allowing anyone to tour its plants, and has even offered virtual tours.

As someone once said, the secret lies in the execution.