Banking, while efficient and creative in its own ways, can truly stand to benefit from industries that have very little — if anything — to do with finance.

Not that banking would be the first one to lift game-day plans out of another industry’s playbook. 3M — famous with consumers for its innovative technologies that allow people to hang items on walls and doors without using permanent fixtures — now designs infection-fighting tools after taking inspiration from a makeup specialist.

Some financial institutions have done the same, looking outside their comfort zone to learn what people like from other companies. Others would do well to follow suit.

Chris Skinner — CEO of The Finanser, author and global speaker — tells The Financial Brand that he talks to leading banks and suggests they write down a list of companies they highly respect: the Amazons, Facebooks, Spotifys and Netflixs of the world. From there, a crucial step is figuring out the lessons that can be learned from these companies and adding these lessons into their own strategy.

“It’s not rocket science, but it’s also not easy,” he points out, adding that the organizational structure of banking is one reason why. While companies like those mentioned above are often organized to be agile with easy communication across departments, banking has always been very hierarchal. But Skinner says he’s witnessed some change. One bank even commented to him that “we used to have a company of 30,000 employees. We now have 3,000 teams.”

Below are eight ideas, most of them from outside banking, that may stimulate fresh thinking at your institution.

Retooling the Retail Network

Amazon — Adding a Physical Touch. Amazon may very well be the retail industry’s greatest success story. The multinational conglomerate “has become the gold standard for online shopping by making the digital experience so seamless that it might as well be invisible,” observes Bruce Lowthers, Co-Chief Operating Officer of FIS, writing in Business Insider.

Many books have already been written about Amazon, but the company’s evolving strategy of combining of physical commerce with its core e-commerce is relevant to banking.

Juliet D’Ambrosio, Managing Director of Strategy at Adrenaline, points out that branches aren’t dead, regardless of the all the heated rhetoric on the topic. She maintains that the actions of a digital master like Amazon has proven this theory.

“We’ve been hearing ‘Retail is dead or dying’ for a long time,” she says. Yet during the pandemic and moving forward, the ecommerce giant has been opening Amazon Fresh or Amazon Go stores that people can choose to come in to if that’s the kind of shopping experience they want, D’Ambrosio observes.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Amazon Fresh is opening physical locations as an extension of its grocery delivery service. The company soft launched its first location in a Los Angeles neighborhood in August 2020 and more have popped up nationally since.

It’s important that the banking industry recognizes Amazon’s new idea not as a digital giant moving backward, but as a company acknowledging people’s desires to merge their online shopping experience with a more traditional one. But, it’s also a nod to the idea of a fully customizable experience.

“They could have curbside pickup, they could have delivery, they can buy online and pick up in store — they can sort of interact with us in the way that they choose,” D’Ambrosio explains. She notes Chase Bank has sampled from this style in designing its own retail expansion the past several years.

Best Buy & Apple — Store-in-Store. Converting single-function retailing outlets into places that meet multiple consumer needs has become a specialty tool for various retail companies. Take, for instance, Best Buy’s contract with Apple, which allows for the latter to set up a small section with Apple-only products inside of each Best Buy retail location.

D’Ambrosio says it’s called ‘store-in-store’, a tactic which JCPenney and Sephora also use today. It is all about creating a multi-purpose experience out of a single geographical location.

Although people used to run to JCPenney for just clothing or shoes, now these retail stores have optimized their customer base to generate revenue they didn’t have before from Sephora’s line of beauty products. Banks and credit unions can utilize a similar strategy and offer customers and members products, tools or features that may not be part of their traditional lineup.

“I think that it could be something that the financial industry could consider doing and especially with things like hospitality or vacation brands where the consumer is already in a financial environment,” D’Ambrosio states. “What if there were an Airbnb planning section within a financial institution where you pull those connected activities together?”

Learn More: Digital Channel Experience Lessons From Big Box Retailers

IKEA — Branch Layout. Many institutions are shifting portions of their retail branch network to condensed versions of their formerly expansive branches. They’re often equipped with technology like ATMs and ITMs and have a reduced staff count. With this, financial institutions might assume that it will make it easier for their customers or members to maneuver through the new location.

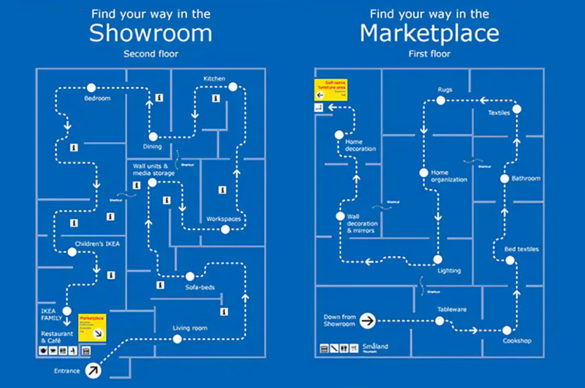

Financial marketing agency Banktastic, however, points out that banking customers don’t always know what they want. Sometimes, they come in with an idea in mind but without any real way to execute it. The agency says looking at how IKEA guides people through their home furnishing stores might suggest an approach banks and credit unions can adapt for their branches — whatever it may look like.

“At IKEA, there’s a prescribed path from the entrance to the checkout. IKEA wants to be sure its shoppers know about everything it has to offer — not merely what they came to shop for — so it leads customers through the store with illuminated arrows on the floor. While we don’t propose that you force people to walk through your bank along a certain route, you should ask yourself whether customers really know everything you have to offer them,” Banktastic writes in a blog post.

Consumers might think they know what they want, but it is ultimately the responsibility of the banker to help get them to the tools they need. “You must lead and educate so that customers get what they need, not just what they came to buy.”

Chick-Fil-A — Easy Access. Chick-Fil-A, in more ways than one, is the model of a perfect company, according to Silver Lake Bank President Patrick Gideon. From the finesse of the fast-food company’s wait line strategies to the always-expected smile from the employees at every stage of the buying process, Chick-Fil-A’s knowledge of the ultimate customer experience can’t be overstated.

“I often point to that example with our employees,” Gideon tells BAI. “It’s about getting things across the finish line. If we tell customers we are going to do something for them, we should deliver like Chick-fil-A does.”

D’Ambrosio helped Chick-Fil-A establish its renowned drive-thru line strategy, which is designed so people feel taken care of, no matter how long the line is. Although most fast food restaurants wait until cars get to the first drive-thru window to take orders, Chick-Fil-A has employees stationed along the line to ensure customers order and get their food quicker.

“What Chick-Fil-A does incredibly well is they built everything from the point of view of the guest,” says D’Ambrosio. “They’re not called customers or diners, they are considered guests.”

This “guest experience” is embedded into the easy-to-read design of the menu boards and employee training (they are taught to say “my pleasure” in reply to “thank you” — anything else isn’t allowed).

Financial Health & Wellness

Tinder/Hinge — Matchmaking. Dating apps are one of the most innovative takes on the 21st century. Finding a significant other (or others) prior to the Tinders and Hinges of the world required significantly more legwork. There was no easy way to personalize and filter out the interests and values of a prospective girlfriend or boyfriend. Online dating revolutionized it.

In a perfect example of adapting a good idea from another industry, Northwestern Mutual modeled the insurance company’s financial advice program on dating apps. “Like dating sites, there is a massive amount of trust and chemistry in financial planning,” Chief Marketing Officer, Aditi Javeri Gokhale, told the AdExchanger.

The idea, she explains, is that the bank’s algorithm matches customers looking for financial advice with an advisor that fits the bill, leading to what Gokhale says is a 95% match rate. The algorithm uses assets, age and geography as three determining factors.

Zola — Financial Planning. The wedding registry service Zola was ranked one of the 50 most innovative companies in the world in 2019 because of its unique approach to e-commerce, according to Forbes. If you think a financial institution would have nothing to learn from a wedding registry website, you might be surprised.

The company doesn’t just offer a wedding registry service or extend features that allow people to ship out registry items automatically. It’s much more comprehensive. It also works with newly engaged couples, offering to help plan their weddings online, on social media and — with the introduction of its pop-up shops — in person.

It doesn’t take much to keep people happy — just a little bit of added convenience. If your institution can help customers plan out some big events in their lives — college, marriage or buying a house — they’ll be that much more likely to stay loyal to your institution for the long haul.

Tim Hortons (and Others) — Use of Games. It is seldom — outside of maybe opening a checking account for the first time as a teenager — that banking is associated with the word “fun.” Instead, banking has been marked as a necessary but tedious experience for most Americans, and most of the time, it intrinsically lacks any sort of entertainment.

Food and beverage companies, however, might be able to teach the financial industry how to make their branding a bit more fun.

For instance, New York City-based brewery SingleCut Beersmith added a QR code to its beer bottles and cans, which takes people to music trivia games and “name that tune” contests. Tim Hortons and Malibu Rum adopted similar strategies, creating loyalty with built-in games to keep people coming back.

What if banks and credit unions could do that with the younger generations, embedding a QR code on debit or credit cards connected to financial literacy games and courses?

Idea Bank — Okay, this isn’t strictly speaking an idea from outside the industry, given that Idea Bank is (or was) indeed a financial institution. However, The Financial Brand found it in our research and we decided it was an interesting out-of-the-box idea for other financial institutions to draw inspiration from.

A daily commute can be a monotonous and downright unpleasant experience. In many midsize or larger cities people use the train in hopes that they can get some downtime or at least chip away at work during the ride to and from work.

Idea Bank, an aptly named Polish institution, recognized the struggles for these populations. In 2017, the bank — which catered primarily to small and medium-sized business customers — launched its sponsored train cars, which allowed Idea Bank customers to work at desks and in conference spaces. These cars came fully equipped with coffee, office supplies and even banking services.

Although the bank has since been absorbed by Polish bank Pekao, Idea Bank’s train cars live on as a great idea.