Standard Chartered is issuing RFID chips to select customers at its newest Korean location, eliminating the need for affluent individuals to wait in lines at the branch.

When a customer holding an RFID tag enters the facility, the system immediately notifies the branch manager and a relationship manager who can greet the customer personally at the door.

The RFID units won’t be available to just anyone. Only those in the bank’s top three banking tiers will be given special RFID treatment. Recipients will be hand-picked from a select group of Standard Chartered’s Preferred Banking, Priority Banking and Private Banking customers. Preference will be given to those who visit the branch frequently, are open to new technology, and have a strong relationship with the bank.

Standard Chartered caters to a wealthy, international audience, with over 1,700 branches in 70 countries. Its Preferred Banking customers maintain deposits with the bank totaling around $50,000. Priority Banking customers, twice that. Preferred Banking customers — those in the top tier — have nearly $1 million in deposits. These are swanky jet-setters with no time to waste in bank branches.

Standard Chartered says it is the first bank in the world to adopt RFID tags as part of an “intelligent queuing system,” however Yes Bank in India claims to have rolled out an RFID system back in 2009.

Branch prototype serves as testing facility

Standard Chartered’s new branch in Korea represents more than just an advancement in queuing. It’s a prototype branch serving as a beta-testing site for future improvement at other locations. Standard Chartered is exploring the integration of new technologies like video conferencing and digital merchandising.

The sophisticated open-style interior design of the Korean branch will be applied to new, relocated and remodeled branches. After the bank has had the opportunity to evaluate customer reactions, it will then decide whether or not to implement its new, experimental technologies on a wider scale.

“This new branch is expected to appeal to next generation customers, and increase customer transactions through its innovative design and systems,” said Standard Chartered’s Head of Consumer Banking. “I also hope it encourages customers to purchase more products.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Standard Chartered Korea

This branch features the personalized Q-matic RFID system, iPads for staff/customer engagement and entertainment, digital merchandising/marketing materials, video conferencing, digital whiteboard and an internet kiosk.

Standard Chartered – Singapore

The Marina Bay Financial Center is Standard Charter’s flagship branch in Singapore. This branch illustrates how Standard Chartered creates two distinct spaces, separating experiences for Personal vs. Priority Banking customers. The mass market side of the branch is skews retail, while the upscale side is decidedly more sophisticated.

PERSONAL BANKING – Notice the bright blue-and-green color combination used in the retail banking side of the branch. Shown here: “Quick Service Station” against a merchandising backdrop incorporating Standard Chartered’s “trustmark” logo.

PERSONAL BANKING – Technology, retail merchandising, bright colors and functional decor define the retail banking experience.

PERSONAL BANKING – The digital displays above the teller bays seem like they might lend themselves to a “now serving” queuing system.

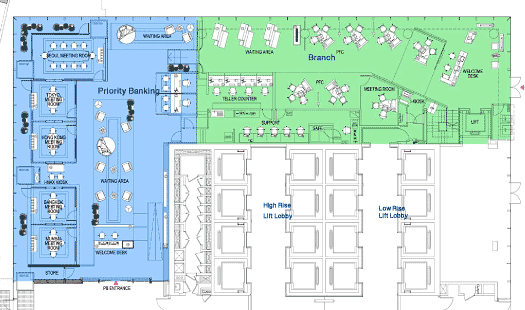

FLOOR PLAN – Personal Banking occurs in the green space, while Priority Banking customers get the blue treatment. Notice the passageway between the two halves of the branch. Where’s the vault?