The introduction of the iPad brought with it a whole new world of marketing opportunities for banks and credit unions. The Financial Brand sat down with Brian Nutt, CEO of Codigo, and Jon VanderMeer, CEO of Kiosk & Display, to discuss the ways in which tablets can be used in the brick-and-mortar channel.

What are some examples of things bank and credit union marketers are currently doing with tablet kiosks?

Jon VanderMeer, CEO/Kiosk & Display: The capabilities for kiosks and tablets is about 99% the same, only the form factor is different. Potential tablet uses include:

Jon VanderMeer, CEO/Kiosk & Display: The capabilities for kiosks and tablets is about 99% the same, only the form factor is different. Potential tablet uses include:

- In-branch demos, training and troubleshooting

- Onboarding new customers into online banking

- Digital alternative to printed brochures where branch visitors can review and compare products

- A check-in device to create a customer queue in busy branches

- A diversion to keep customers occupied while service reps step away to process paperwork

- Replace the “drop your name in here” contest boxes

It all depends on the purpose and strategy for the device. Obviously a tablet is way more effective than a brochure to demonstrate online services like bill pay, remote capture, funds transfers, etc. But our company has had many inquiries for tablets where the bank or credit union ended up buying larger screen, full function PC-based kiosks instead.

Brian Nutt, CEO/Codigo: We’ve found that the most effective product to market via the tablet kiosk is online services. It makes sense – the tablet kiosk brings the online world into the branch. So, someone who wouldn’t normally be online or care about online banking has the chance, while in the branch, to experiment. It also provides tellers a chance to educate customers on the benefits of online banking.

Codigo clients are also using their tablet kiosks to allow their customers to view or compare products and services, open and print brochures, and fill out interactive forms for online account opening, loan applications, or basic contact information. Other options include features like financial calculators, video libraries, and a mapped list of branch locations.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

What does the future hold? What else could banks and credit unions be doing with tablets?

BN/Codigo: The range of options is limitless, but it’s a question of what’s possible vs. what’s practical. Banks and credit unions need to first determine their goals in deploying tablet kiosks. There are myriad possible things banks and credit unions can do with the tablet kiosk, both in and outside of the branch. At Codigo, we prefer to go the practical route— low cost, mass implementation.

In addition to tablet use within a branch, our customers have found the mobility of the tablet design to be a big advantage. When a financial institution’s business development staff go out into the field for either a client visit or larger community event, they are armed with the most up-to-date information on a highly engaging and interactive device. This also gives the financial institution’s marketing department control over brand and message presentation.

At this point, tablet kiosks are generally limited to data input and collection. However, the tablet kiosk will develop into a cashless-transaction center for online bill pay, remote deposit, and more.

Can you give readers an idea of what it costs to deploy a tablet kiosk?

JVM/Kiosk & Display: Tablets are $300-500, with simple stands running $500-1000.

BN/Codigo: Codigo’s tablet kiosk has three areas of cost – hardware, management, and design. The hardware costs consist of the tablet itself and any enclosure or stand. However, Codigo allows its clients to purchase their own hardware if they prefer. A monthly management fee covers all reporting, content updates, and software upgrades. The design cost is on a project-by-project basis. Since some kiosk interface designs are more complex than others, most projects are priced on an hourly basis.

Where should tablet kiosks be placed within the branch for maximum impact?

JVM/Kiosk & Display: Placement really depends on privacy required, branch design factors, outlet locations, etc. If I had to weight success factors, I’d say 95% hinges on having a well developed kiosk and tablet program including strategy, purpose, training and measurement. Location is only 5% of the riddle.

BN/Codigo: The beauty of a tablet kiosk is its flexibility. The small, compact kiosk can be placed just about anywhere in the branch. However, the effectiveness of the kiosk depends on more than where it’s placed. Before implementing any kind of kiosk, tablet or otherwise, a clearly defined purpose must be established. Once a goal is defined, the decision as to where to place a kiosk becomes much easier. For example, if the purpose of the tablet kiosk is to cross-sell products and services, then placing the kiosks at the point-of-sale (i.e. teller counters) would provide maximum impact for this particular goal. Plus, a clearly defined goal guides the direction of content design—the location means nothing if the kiosk doesn’t have relevant content to engage the user.

Customers can use iPads to kill time and learn more about DBS, or (more practically) complete any necessary forms while they wait for their number in the queue.

More: Innovation, iPads Transform Customer Experience at DBS Flagship Branch

How do financial marketers manage their content on tablet kiosks?

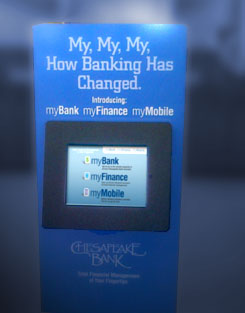

Zions Bank uses iPads as interactive merchandising displays for its products and services.

BN/Codigo: At this point, we offer our clients a managed solution: All necessary updates to content are performed by the Codigo team. We work with clients to design high-impact kiosk interfaces then use our software to remotely update any and all kiosks they have in the field. With the release of Codigo4 in the coming months a single interface will control content across our entire product range.

The next big thing for the tablet kiosk is all-in-one management— combining content design and deliverability into one online platform. Codigo’s new online platform looks ties this capability along with other retail media such as digital signage and on-hold messaging into a single source login.

JVM/Kiosk & Display: A financial institution’s digital merchandising vendor should be able to provide a back-end remote update and monitoring capability that is seamless and unnoticeable by branch visitors.

Any words of caution for financial marketers regarding iPad kiosks?

JVM/Kiosk & Display: Like any kiosk project, tablets are more than just shoving a device in a branch and hoping people use it. Those programs fail miserably… and slowly. There should be a clearly marked purpose/function for the tablet/kiosk. Some banks start tablet(and kiosk) projects without any clear goals. SECU has a very successful kiosk program because it is measured and has goals, member purpose & staff awareness

Tablets have some drawbacks. Tablets can look small in a branch and require big merchandising displays to promote them. The small screens make it tough to browse many online banking sites. Any kind of wireless connectivity is shunned by many financial institutions’ I.T. departments. And theft lockdown makes them uninviting and not fun to use.

Commonwealth Bank (Australia). Branch visitors are encouraged to explore the bank’s mobile banking experience via docked iPod Touch and iPad devices.

When the erstwhile ING Direct opened its San Francisco cafe, there were iPads everywhere you looked. iPad kiosks were mounted on tables below multi-screen displays and at a “tech bar.” ING Direct’s iPad kiosks were housed in a stained wood finish, reinforced by a steel enclosure and secured with a key lock.

ING Direct – iPad Kiosks in San Francisco Café