As consumer banking preferences continue to change, it is important for financial institutions to transform their branch networks. Some of this transformation will certainly involve branch closings. In the remaining cases, branch networks will need to respond to the desires of the increasingly digital consumer while becoming both more cost efficient and sales effective. Central to this branch evolution is new self-service technology that can replace tellers and improve platform personnel sales results.

“The urgency for institutions to transform branches is intense,” said Andy Orent, President and CEO, Hyosung Americas. “Robust digital channel adoption and rapidly changing consumer behavior have made the branch as we know it today irrelevant. It is clear that institutions need to transform branches to make them more cost-effective, while serving crucial customer needs.”

In a study by Hyosung, a list of best practices were provided to help institutions with branch transformation initiatives. The best practices are meant to help institutions that recognize the benefits and demand for branch evolution, but may not understand how to best take action on the mission of branch transformation.

1. Create a Positive Self-Service Experience

Research on bank customer behavior by Lextant looked at the reasons why customers decided to go to a teller rather than an ATM and reveals a lot about what customers want from self-service options.

To be successful, it was determined that in-branch self-service options must be:

- Fast: Self-services options that are immediately available and ready to perform transactions or provide needed services.

- Easy: Technology that involves minimal mental and physical effort on the part of consumers, avoiding the need to ‘learn the machine,’ which could impact acceptance.

- Secure: Physical improvements such as providing ample personal space, with well-considered buffer zones, provides the privacy desired by consumers.

As could be expected, consumers must see an advantage to self-service options to leave their teller. At Chase, this is hoped to be achieved by self-service kiosks providing ATM-like services with check cashing, custom denomination withdrawals, credit card bill pay, prepaid cards and money orders. In addition, banks with tablets are available to provide assistance like opening accounts.

Chase Bank office with self service kiosks

Read More: 14 ‘Branch of the Future’ Designs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

2. Develop a Holistic Approach: Integrate People, Process, and Technology

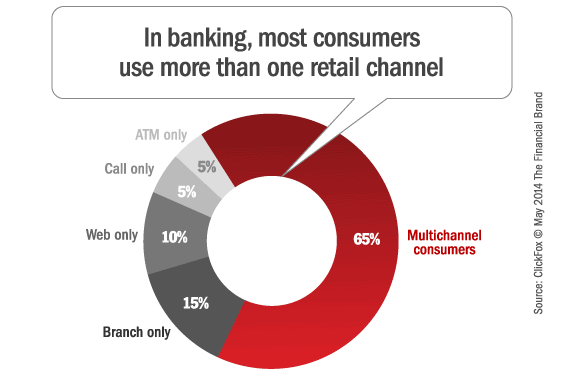

Movement to an in-branch, self-service solution does not mean the elimination of human interaction, but the integration of human interface as part of the digital delivery of service. A McKinsey & Company study found that as opposed to moving completely away from branch transactions, customers using mobile and online banking more than once a week are also over 60 percent more likely to be active retail branch users.

So, while customers have embraced multichannel access, they also expect higher value face-to-face interactions at their bank branch and call center.

3. Understand Volume Challenges: Moving Transactions Away From Tellers

According to the Federal Reserve Bank of San Francisco, banks and credit unions still handle cash and 12 percent of cash withdrawals still occur within the branches and through teller lines. In other words, branches still are processing a large number of basic transactions that can be better handled in an automated manner.

In order for these transactions to move away from the teller line, people must feel confident. The Hyosung study states, “This means helping consumers understand that new devices actually provide a better experience overall when used to self-serve and complete transactions.”

This goes beyond just basic withdrawal and deposit transactions to include split deposits across multiple accounts and selecting the currency denominations when withdrawing cash. With in-person demonstrations on self-service devices that provide easy-to-use instructions, consumer confidence can be built that will move volume away from the teller.

Commonwealth Bank in Australia is rolling out a number of ‘teller-less’ banks that include machines that do a variety of basic transactions at any time of the day or night.

Commonwealth Bank, Australia Self Service Stations

4. Develop an ROI Model: Understand The Data Needed For The Transformation Strategy

To move forward with a branch transformation project, Hyosung recommends that banks and credit unions assign values to all cost components of branch operations, including real estate costs, human resources, equipment, etc. Branch transaction costs, as well as the costs of online and mobile alternatives must also be understood to make better branch transformation decisions.

On the revenue side, the potential for increased branch sales should be considered as personnel are redeployed from transaction-based roles to customer service and selling roles. With 60% to 70% of sales still occurring in the branch, this increased potential for revenue is the driver to keep certain branches open.

In an exclusive interview by The Financial Brand with Andy Orent, he stated, “A successful branch transformation program will accomplish the goals of cost reduction, but should also enhance customers service and support, while providing more people to drive sales. As basic transactions are moved to self-service, or assisted self-service – reducing the headcount requirement for that function – the savings can be shifted to increased sales personnel.”

At National Australia Bank, their ‘Smart Store’ design blends iPads, touchscreens and self-service technology allowing for both self-service and high service interactions. While there are no traditional tellers, customers instead choose from a range of self-service ‘intelligent machines’ or can meet with sales personnel who work with iPads and large touchscreen devices. The new stores are 25% smaller than traditional branches, and are open longer hours than traditional branches.

NAB ‘Smart Store’ design in Australia

Read More: NAB Unveils First ‘Smart Store’ Branch Design

5. Align Transformation With Institution And Branch Business Goals

It follows logic that branch transformation goals should be in line with the business goals of the institution and the data that supports those goals. As the role of the branch is modified, it is important for financial institutions to take into account how their products are sold and serviced currently, local consumer demographics and competitive dynamics.

Current branch staff roles must also be taken into account, since individuals will either need to be retrained, redeployed and/or new personnel hired. This transition can be sensitive, however, when employees believe their job is at stake as many organizations have found when new technology.

Ultimately, there is not a one-size-fits-all answer to branch transformation. According to Hyosung, the integration of people, process and technology will allow for varying sized branch formats, which will improve ROI while maintaining or improving current customer service levels.

The marketplace has seen several different strategies by different financial institutions, including Chase, Wells Fargo and Bank of America. While many of these strategies are part of a branch reduction process, several banks are introducing completely new branch concepts, like PNC’s portable pop-up branches.

PNC ‘Pop-Up’ portable branch test design

Read More: PNC Rolls Out First Ever Portable Pop-Up Branch

6. Learn From The Past

Several financial institution branch design phases have occurred through the years based on the perceived needs of the marketplace combined with the objectives of specific organizations. From the ‘superstore’ branches of the 1980s, to the supermarket branches of the 1990s, and now the mini-branches of today, banks and credit unions need to learn from the past as they build for the future.

The best branch designs for the future will most likely be a combination of elements used in the past, adjusted for the digital future. The key will be to provide a cost efficient design that delivers the best customer experience in alignment with the brand and objectives of the organization.

A great example of a bank that combines digital technology with a strong sense of brand is Umpqua Bank. Umpqua’s San Francisco location feels more like a contemporary store or upscale café than a bank branch. It features mobile concierges, iPads, interactive touch screens, outdoor seating and a free “loaner” bike.

Umpqua Bank branch in San Francisco

Read More: Innovation, iPads Transform Customer Experience At DBS Flagship Branch

7. Take a Strategic Approach

According to the Hyosung study, many internal constituencies from various divisions will likely have a seat at the ‘branch transformation table,’ including Retail Distribution, ATM Business Delivery and Kiosk Strategy, E-Commerce and Mobile Delivery and Operations — all of which have different responsibilities and views on what may work. Having so many parties at the table with vested interests can slow the process down, but is necessary.

As the process proceeds, it is important to keep the overarching strategy front and center and to make sure that the overarching objectives are met. It is also important to view this as a transformation process that is ongoing as opposed to a one-and-done project.

Not all new branch designs need to be built in compact spaces. For instance, a concept branch for DBS in Singapore sprawls over 8,500 square feet, boasting features like iPads, digital queuing, electronic forms and virtual assistants with artificial intelligence. The floor plan for DBS is divided into six main areas: the exterior zone, the welcome zone, the quick-service zone, the teller zone, the self-service zone and the consultative zone.

A flagship branch for DBS in Singapore with over 8,500 square feet

Transformation Challenges and Next Steps

Branch transformation is not an option in an environment where costs need to be reduced and the customer experience needs to be improved. But there are challenges that will be faced during the transformation process. According to Andy Orent from Hyosung, the biggest challenge is the process of modernizing a historical bank.

“It is very difficult to get the staff who have worked in older institutions properly onboard with the changes required to transform a distribution network … which is now becoming increasing self-service,” said Orent in our exclusive interview. “You have to account for the different rules between self-service and manual assistance, such as limits on cash withdrawal and the difference in identification necessary to take out that money.”

According to Orent, the three most important things that financial institutions should consider all come from building strategy. “A bank has to build a strategy and plan around people, a strategy and a plan around process, and a plan and a strategy around technology. Simply installing a new, multifunctional device will not by itself have much impact. If branch employees aren’t being taught how to use these newer devices, they cannot properly leverage them and demonstrate their value to the consumer.”