With adoption rates for digital banking solutions skyrocketing, one question continues to vex bankers worldwide: Why do people still use branches?

One popular theory that attempts to explain the enduring branch phenomenon places blame on digital banking’s inadequacies. People wouldn’t use branches ever, the theory goes, if digital banking tools were better. The assumption is that no one wants to go to a bank or credit union branch, but they have to because online and mobile channels can’t get the job done.

But a new report from Celent shatters this theory. The study, based on research commissioned by Samsung, examined how roughly 2,500 consumers in the U.S. prefer to engage and interact with their banking providers. According to the findings, Americans don’t feel that they are being forced to use branches at all; they actually like using branches for many banking activities, particularly those involving more in-depth and complex matters.

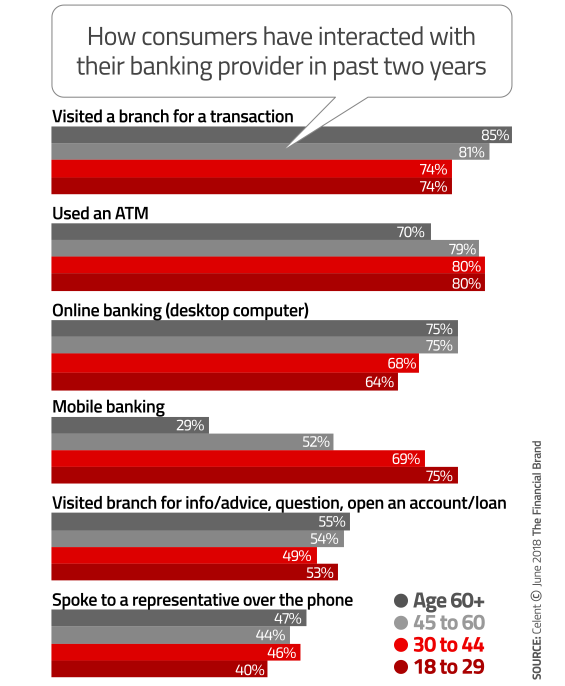

In the study, more than three quarters of respondents said they had visited a branch to conduct a transaction in the past two years. Half of all consumers — including Millennials — also visited a branch for information, to get a question answered, to open a new account, or to get a loan.

Read More: Will Branches Survive the Shift to Digital?

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

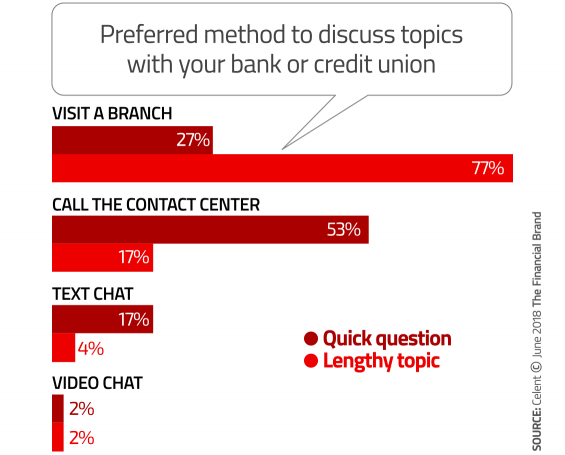

While consumers prefer digital channels when it comes to making quick transactions, such as withdrawing cash or transferring funds, when there are more substantive conversations to be had, they would rather deal with humans.

For quick questions, most consumers (53%) prefer picking up the phone and calling the contact center rather than dealing with a digital solution. But for lengthier topics, complex issues and more involved discussions, more than three quarters (77%) said they will head into a branch to seek out a face-to-face interaction.

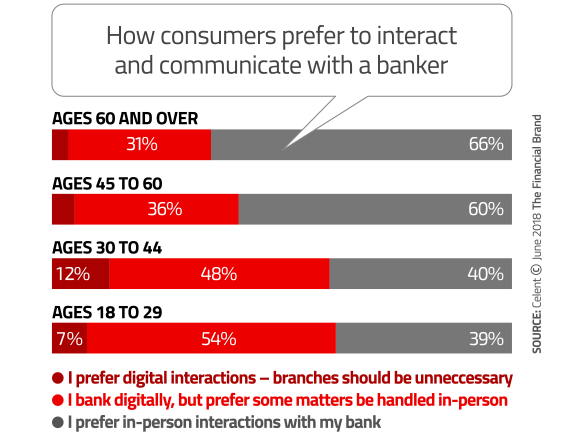

When Celent asked survey participants how they would like to interact with their banker, just 6% of all adults said they prefer fully digital interactions. Two out of five said they usually bank digitally but prefer some matters be handled in-person. However, the majority (55%) prefer in-person interactions.

“Faced with massive growth in mobile banking alongside declining branch traffic, many bankers conclude that people would rather interact with their bank digitally,” Celent wrote in their report. “This is only partially true. Consumers increasingly prefer to transact digitally, but prefer to engage face-to-face. Simply said, many banks are blowing it.”

Celent said there were predictable variations in people’s preferences depending on the respondent’s age, but the differences were not pronounced. Predictably, consumers over the age of 60 prefer in-person interactions almost exclusively, while Millennials are the least branch-centric. However, the significant majority of Millennials in the Celent survey (93%) said they prefer to handle at least some matters in branches.

These findings align with many other studies The Financial Brand has seen, showing that Millennials are just as interested in using branches — if not more so — than other generations, despite their heavy use of digital banking channels. In the Celent study, a mere 7% of Millennials said they think branches should be unnecessary because they prefer interacting with their banking provider’s service representatives exclusively through digital channels. Two out of five Millennials said they prefer interacting with bankers in branches, while half said they prefer a mix of both digital+branches.

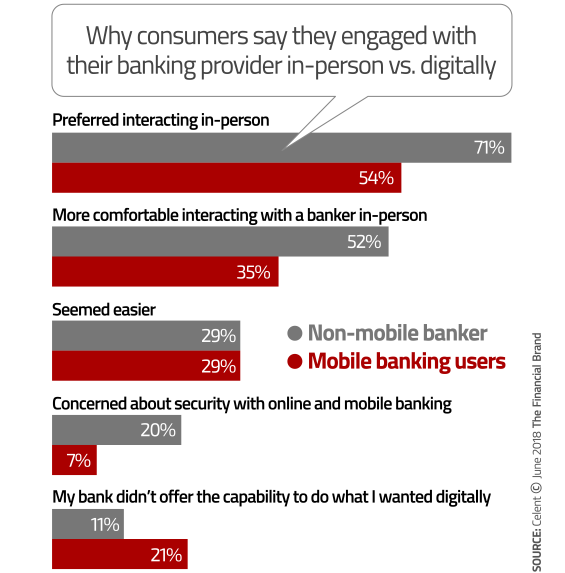

When consumers were asked why they chose to engage with their banking provider in-person vs. digitally, more than half of all mobile banking users (54%) said it was their preference. A third of mobile bankers said they were more comfortable interacting with a banker in person, and it also seemed easier. Only one in five mobile banking users (21%) said they felt like they were forced into a branch because their bank or credit union didn’t offer the capability to do what they wanted digitally.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

“Many in the banking industry wrongly believe that face-to-face channels are losing relevance,” says Bob Meara, an analyst with Celent. “They invariably cite seismic changes in consumer digital habits and downward trends in branch traffic. But such trends are a lousy predictor of how people actually prefer to engage with their bank.”

“These results highlight the continued premium placed on face-to-face interactions when it comes to banking,” Meara explains. “Investments in technology and staffing must reinforce the branches’ current and future strategic role. If banks do not provide a compelling sales and service in-branch experience to customers, it may be costly.”

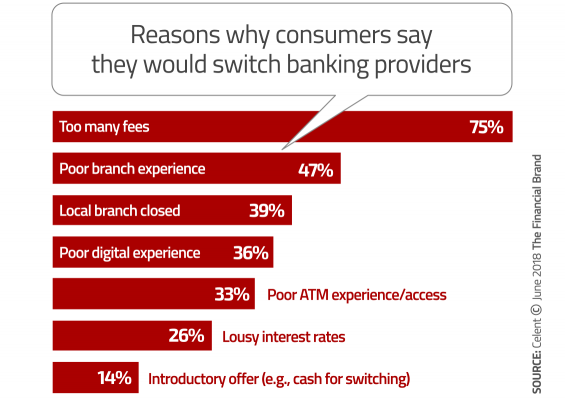

Consumers may prefer heading to branches for certain transactions, but a poor branch experience is likely to keep them away, or even consider switching banks. The biggest pain points most likely to prompt switching banks included unprepared banking associates (68%), long wait times (55%), impersonal service (49%), and the unavailability of specialists (43%).

When it comes to improving physical bank branches, the changes customers were most open to translated to faster, more convenient, and personalized service through tech adoption. Consumers were most excited by greeters prepared for their arrival with personalized information (62%), an expanded mobile app where they could check-in or compare wait times at local branches (55%), and interactive touchscreen displays to explore products and get advice while waiting (53%).

In Celent’s view, these findings emphasize the importance of a comprehensive omnichannel approach to retail delivery.

“For the past several years, banks have been heavily invested in online and mobile technology, at the detriment of their branch experience,” says Julie Godfrey, U.S. Lead of Financial Services Solutions and Innovation at Samsung Electronics America. “Banking providers need to deliver excellent service no matter the consumer’s engagement preference. Over-reliance on investments in digital channels would be a huge mistake.”

Godfrey warns banks and credit unions not to abandon branches, because they play an important role at pivotal (if not infrequent) times in consumers’ financial lives.

“Keep in mind that milestone moments happen only a few times in each customer’s life,” Godfrey cautions. “If you don’t get those interactions right, it could come back to bite you — or more accurately, not come back at all.”