Banks in the U.S. overall have shed 9,000 branches from their peak level in 2009. Several factors have fueled that decline, including financial motivations, overlaps resulting from mergers, and a sharp increase in digital channels reducing traffic in branches.

If someone just read stories in banking publications, you could easily assume that the bulk of closures are the direct and sole result from growth in digital. There are hundreds of articles blaming the displacement of branches on a range of various new digital tools. However, empirical evidence proves otherwise. Data show U.S. banks maintaining the same geographic coverage levels of large markets in 2018 as they offered in 2017, suggesting that the overwhelming majority of closures affected branches with immediately overlapping trade areas.

The trend goes back further. In 2014, Bancography studied the extent to which branch closures actually compromised customer convenience. The study measured the proportion of households in the ten-largest U.S. metro areas who lived within one, two, or three miles of a branch. The study revealed very few cases where banks significantly reduced branch availability (measured in terms of the proportion of households in a market who live within a given range of one of that institution’s branches). Any reductions in branch counts in those markets were most likely intended to eliminate geographic overlaps — i.e., branches in close proximity to one another serving substantially the same trade areas.

Since 2014, total branch counts declined by another 4,500 units. During this period, adoption of online bill pay, mobile banking, remote capture, and other non-branch channels has continued to grow. This gave a reason to revisit the study to determine whether the industry is finally seeing leading banks change course, with the presumption that electronic channels allow consumers to tolerate greater travel times to their branches.

Read More: New Study Shatters Myth That Digital Channels Are Killing Branches

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Fractional Marketing for Financial Brands

Services that scale with you.

How Far Will We Go?

If retail financial institutions believe consumers today are placing less value on branch convenience, then banks and credit unions should be willing to keep closing locations, thereby increasing the distance between one branch and the next. The net result would be that consumers who wanted branch access would have to drive farther.

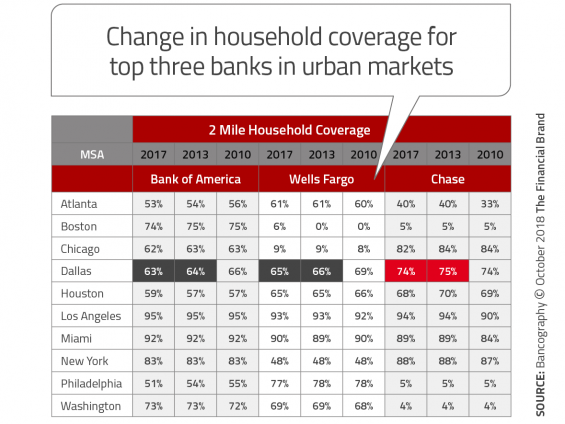

But research reveals little evidence of such behavior. As the table below illustrates, nearly the same percentage of big bank customers are within two miles of their nearest branch today as four years ago. Even going as far back as 2010, there’s been virtually no change. In many cases, branch coverage has either remained unchanged or has actually increased.

These three banks — Wells Fargo, Chase and Bank of America — have the largest branch networks in the nation. Wells Fargo has 6,100 branches nationwide, Chase has 5,300, and BofA has 4,600. BofA shed 1,000 branches nationwide since 2010, and another 500 since 2013. Wells Fargo cut 400 branches since 2010, and 200 more since 2013. Chase has shuttered 400 branches since 2013, but operates roughly the same number of branches today as it did back in 2010. Despite all those closures, these banks’ branch coverage in the largest metropolitan areas in the U.S. remains essentially the same.

Just look at the Dallas market, for example, where Chase closed a net 24 branches between 2013 to 2017. That represents a 9% reduction in its network from the 259 branches it offered across the metro in 2013. Yet its two-mile coverage (highlighted in red) barely declined. In 2013, 75% of all households in the Dallas metro lived within two miles of a Chase branch. Today, even after a net contraction of 24 branches, 74% of households in the market still can find a Chase branch within two miles of their home.

Similarly, Wells Fargo closed 15 locations and BofA lost 12 branches in the Dallas market. But in each case, only one percent of households living within two miles of one of their branches found themselves outside the two-mile zone (highlighted in dark gray).

This same pattern largely holds true in the other large markets, with BofA’s modest coverage reduction in Philadelphia offering one of the few counterexamples.

These Trends Aren’t Unique to Megabanks

You can see the same patterns among financial institutions in the other asset tiers — not just the industry’s biggest banks. In the Atlanta market, research found that few banks are contracting their market coverage, whether you define convenience as one-, two-, or three-mile proximity. Rather, of ten banks in Atlanta that maintain a significant branch presence, two markedly expanded their coverage since 2010 (Chase and Fifth Third), seven maintained constant coverage levels, and only one (BofA) reduced coverage, and even then by only a marginal one percentage point at the one-mile level and by two percentage points at the two-mile level.

Notably, six of the nine institutions maintained their coverage levels even while contracting branches in the market: SunTrust shed 24 branches in Atlanta from 2010 to 2017, while Bank of America closed 21, PNC 11, Wells Fargo 10, and BB&T 8.

This further reinforces the notion that geographic overlaps — many created by acquisitions and mergers — are the main culprit behind branch closures.

No More Easy Cuts Left to Make

So how do large number of branch closures across the industry reconcile with limited coverage changes in the nation’s largest markets? A few hypotheses:

1. At a time when America becomes more and more urbanized, banking providers are closing rural and small-market branches to allow consolidation of their resources in those larger, growing urban markets.

2. To the extent that financial institutions pursue closures in urban markets, they are considering those from a risk-averse posture, consolidating only those branches that will still leave surrounding consumers with other nearby branch options.

3. Given that closures are mostly among closely clustered, overlapping branches, banks and credit unions have likely exhausted the stock of such easy targets. That suggests that either the pace of closures will slow, or that banks will need to gamble on consumers’ willingness to tolerate greater travel times to their branches to find additional network cost savings.

That final hypotheses could indicate a pivotal moment approaching for the industry: As the breadth and capabilities of electronic channels continue to grow, will consumers tolerate greater travel times to their branches, and allow banks to close branches without punishing them by moving accounts to geographically closer providers? And as the cost of building and upgrading digital channels continues to consume a greater share of noninterest expenses, can banks afford not to reduce branch networks in response?

As is often the case in banking, the safest response may be that which minimizes risk, which is to maintain branch coverage but reduce the cost of branch operations. That can occur only through lower-cost operating models — a combination of changes in branch design, technology, processes and staffing levels. That is the motive force behind how transformation and reconfiguration have emerged as preeminent buzzwords in today’s retail-banking environment.