Financial institutions have a good basic understanding of the consumers they serve, but significant weaknesses in their view are limiting their full comprehension of what consumers want. Most banking executives have a warped perception of people’s preferences — overestimating their desire for digital services, for example. And many financial institutions have an inflated idea of how “loved” they are by the people they serve.

The truth is, consumers feel their financial institutions don’t really know them at all. According to research from Celent, financial institutions don’t really understand the people they serve.

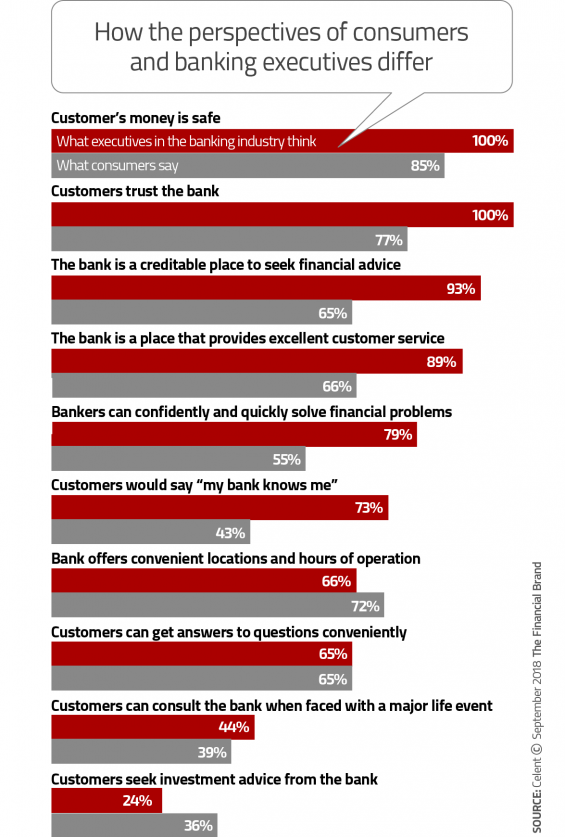

In a new report from Celent, analysts compared the perceptions of bank and credit union executives against actual consumer sentiment. The study found some big disconnects, revealing that many in the banking industry have an overly rosy assessment of how consumers really feel.

The study has multiple implications for financial marketers, including how well financial institutions understand consumer feelings about their providers, how consumers prefer to work with their providers, and what they want out of branches, which for many remain a key part of their banking relationship.

How Consumers Truly Feel About Their Banking Providers

Celent found that executives tend to have an “overinflated” view of how consumers think of their institutions overall. This isn’t to say that the executives surveyed don’t see room for improvement — in some cases, a significant need to do better was acknowledged.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Celent believes consumer responses to other categories of questions, especially where executives’ views don’t match them, are cause for concern — and action.

Bob Meara, Senior Analyst at Celent and author of the report, points to the disconnect between financial executives and banking consumers. Three out of four in the banking industry believe their institution knows consumers well… but that also means that one out of four institutions acknowledge that (at least to some degree) they don’t.

However, only 43% of consumers agree with this assessment — that their institution knows them — a 30-percentage-point gap from the industry’s self-rating. That’s a huge gap. And Celent’s research indicates that the disparity is even wider for large financial institutions.

“This is something financial marketers need to fix,” says Meara.

He suggests one simple place to start: better marketing segmentation and targeting. When consumers receive marketing campaigns that clearly don’t fit their circumstances — such as a home equity line offer sent to a recipient who doesn’t own a home — it sends a message that their banking provider has no clue who they are and what they need, Meara explains.

Celent also found that differences in viewpoint based on respondents’ position in a bank or credit union appeared consistently across multiple survey queries.

The research found that operations staff and line-of-business executives frequently have the most realistic view of consumers, and come closest to the median view of all executives. However, top management as well as executives in charge of strategy and innovation functions tend to not be on the same frequency as most. For example, the report says that executives in strategic and innovation roles tend to overestimate consumer preference for digital channels.

“Operations seems better at knowing what is going on with consumers,” says Meara. “It’s one thing to be pro-digital, but it’s another thing to have an unrealistic assessment of consumers’ current preferences. Listening to the voice of the customer needs to be more than just lip service.”

Who Stands to Lose More? The Consumer or Their Banking Provider?

Celent’s report points out that consumer expectations are higher today than they were just a few years ago, thanks to the customized recommendations made by Amazon and other e-commerce providers. That’s why Meara believes the financial battleground is now all about the customer experience. And customization is a big part of that.

When financial marketers don’t get their audience and what makes them tick, they lose opportunities. Meara says banking providers need to better understand consumers if they have any hope to sell more products and deepen customer relationships.

“To what extent do people care about having a ‘full-service relationship?’,” asks Meara rhetorically. All consumers want is a financial institution that gives them exactly what they want, when they need it. People don’t care if they have to work with multiple different providers, if that’s what it takes. It may not be the ideal situation, but they’ll make it work… just like they have for decades.

According to Meara, financial marketers that exhibit genuine empathy — developing and applying real knowledge about who they serve — will win the war for people’s affections and loyalties. And empathy can help institutions anticipate and serve real consumer needs.

For instance, many consumers don’t see their institutions as able to confidently and quickly solve financial problems nor as being a reliable, consultative support when faced with a major life event. That’s something clearly missing from retail banking, says Meara.

Meara suggests events like Saturday morning financial workshops in branches to improve the perception of the institution as a source of both empathy and expertise. Such efforts would not only provide better outreach, but feedback that can guide further development. Meara likes to paraphrase hockey star Wayne Gretzky, admonishing financial decision makers to “skate to where the puck is going,” not where it is.

Synching Up With What People Want

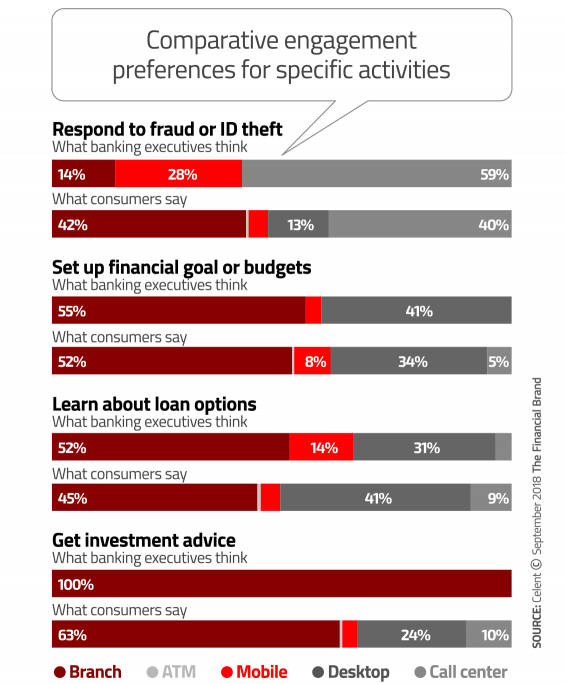

Institutions have a good handle on their transactional relationships with consumers — activities that can be easily counted and tracked — according to Celent. However, things get a little murky from there, starting with consumers’ preferences for interactions and other engagements.

“It’s not like consumers come in for a checking account and leave unexpectedly with a mortgage.”

— Bob Meara, Celent

Sometimes bankers’ delusional wishful thinking creates nasty mismatches between reality and the hoped-for. Take the idea of cross-selling, something institutions have sweated to improve for decades. Meara notes that even as banking services continue to become more digital, the majority of sales continue to occur in branches. Dreams of cross-selling can be unrealistic.

“It’s not like consumers come in for a checking account and leave unexpectedly with a mortgage,” jokes Meara.

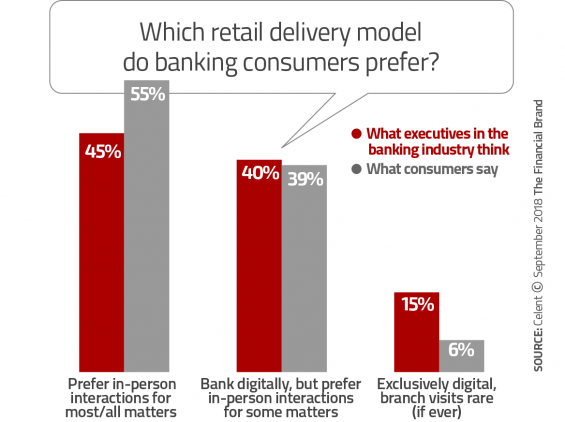

Many executives Celent surveyed in the banking industry believe that their own institutions’ outdated systems and workflows force people into branches when they’d prefer using digital channels instead. It’s almost as if these officers have just accepted all the fintech talk about the “friction” inherent with any traditional banking provider.

But that’s not what consumers told Celent. Only 16% of consumers said they visit branches because their bank fails to offer the means to accomplish the same thing digitally. 14% said they have visited branches because they had questions and thought that was the only way to get them answered. Only 1 in 25 respondents said they didn’t see any need to periodically interact with branch staff.

In fact, when asked what would motivate them to switch institutions consumers’ top beef with their current providers was “too many fees.” Three quarters of respondents complained about charges, far more than the 47% that griped about other issues like long waits or unknowledgeable staff.

“For most consumers, it comes down to a simple preference for (62%) and comfort with (43%) face-to-face interaction,” the report states.

Celent found differences in how consumers wish to engage with their institutions, overall, depending on whether they have a quick query or something more significant. For simple matters, 53% reach out to call centers, 27% to branches, and 20% use digital channels. Executives generally understood that.

Consumers needing to deal with a lengthier query widely preferred to go to branches (77%), with 17% going to call centers, and 5% using digital means. Here, Celent again found bankers were out of touch; they believed the mix was more 60% branch, 30% call center, and 10% digital.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Strategic Role of Branches

While the banking industry debates the need for branches, consumers go right on using them.

“Consumers don’t visit branches very often,” Celent’s report states, “but when they do it is important to deliver an exceptional experience.”

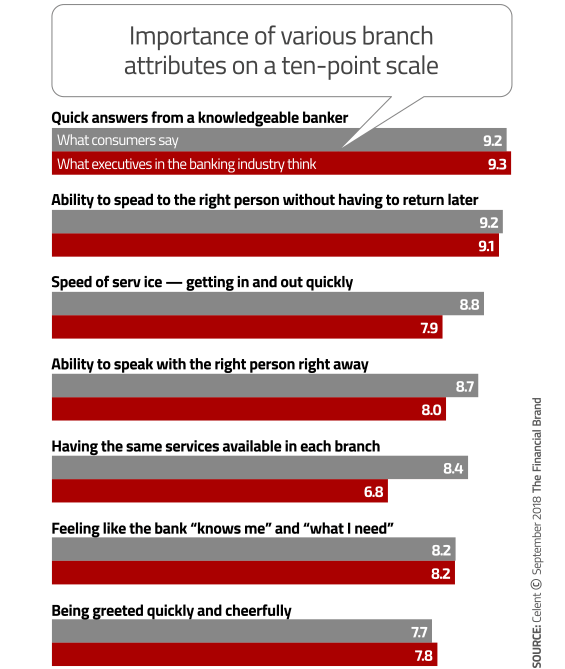

Celent compared industry understanding of how consumers feel about specific aspects of branches with executives’ understanding. Many executives have a good understanding of most aspects and their importance to consumers.

The study found that many financial executives don’t appreciate the importance to consumers of having the same services available in each branch. This can be extremely costly for financial institutions, which is why the “hub-and-spoke” system has gained such favor. The hub offices provide full service, while the spokes provide a basic selection.

“If not implemented exceptionally well, this can leave customers guessing what can be accomplished in each branch,” the study said. Key to making this cost-saving strategy work is strong communication with customers, Celent says.

Meara sees efforts like Umpqua Bank’s “Best Financial Friend” effort as a potential winner as well. Umpqua’s initiative — renamed “Umpqua Go-To” in September — features a human+digital approach that is intended to bring a private banking experience to the mass retail market.

“Delivering personalized relationships is really challenging,” says Meara, especially doing that in digital channels and at scale.

The survey also found that some of the “cool” new approaches to branch banking excite financial executives more than they do consumers.

“Consumers aren’t enamored with high-tech branches,” the report states. “Average receptivity to video tellers and unmanned branches received among the lowest scores.”

The firm suggests that institutions offering high-tech branch solutions promote the advantages of the technology to consumers, rather than the technology itself.

One example cited: explaining how use of video tellers can extend operating hours or how video service can make a branch with remote experts practical where a full-service branch could not be justified.

This might be one of those cases where financial marketers, understanding consumers, can do a better selling job than innovation staffers who like to hang with the cool kids.

Interestingly, Meara says something executives must take seriously is consumers’ desire to get what they come to a branch for done in one trip.

While digital fans in the industry talk about creating omnichannel experiences that will let consumers start matters on one channel and finish on another, seamlessly, what they really want is to cross the matter off their list in one step.