The Financial Brand examined asset, member and branch trends in the credit union industry for the years 2007 through 2012. The study revealed a series of massive shifts with serious strategic implications for credit unions of all sizes.

What’s Changed in the Last 5 Years?

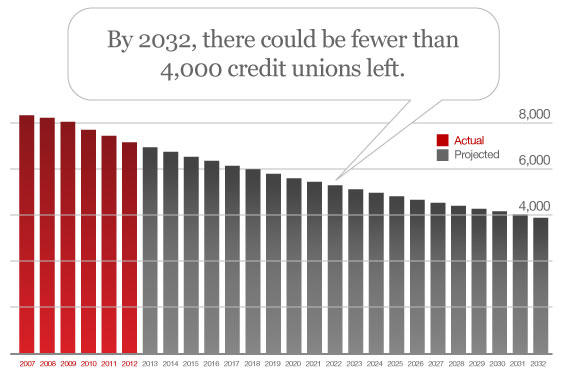

Since 2007, the total number of credit unions has dropped 14%. In 2007, there were 8,332 credit unions. Today, there are only 7,165, a decline of 1,167 credit unions. That average loss of 233 credit unions per year, a little less than one per day.

Key Fact: Every month, the industry sheds about 20 credit unions.

| Total # of all CUs |

# of CUs w/$1+ billion in assets |

% of all CUs with $1+ billion assets |

# of CUs w/less than $100 million in assets |

% of all CUs w/less than $100 million in assets |

|

|---|---|---|---|---|---|

| 2007 | 8,332 | 123 | 1.5% | 7,080 | 85.0% |

| 2008 | 8,215 | 132 | 1.6% | 6,920 | 84.2% |

| 2009 | 8,066 | 137 | 1.7% | 6,760 | 83.8% |

| 2010 | 7,710 | 159 | 2.1% | 6,311 | 81.9% |

| 2011 | 7,442 | 173 | 2.3% | 6,023 | 80.9% |

| 2012 | 7,165 | 194 | 2.7% | 5,700 | 79.6% |

In 2007, credit unions collectively held $760.9 billion in assets. By 2012, that number had climbed to slightly over $1 trillion ($1,015 billion), growing 33.4% cumulatively over a five-year period, or an average of around 6.7% annually. 2010 saw the single biggest year-over-year increase in assets: $82.8 billion, a 10.2% spike. This pace edged to 6.7% in 2011, with credit unions tacking on $63.4 billion in additional assets.

In 2007, there were only 123 credit unions with $1 billion in assets or more. By 2012, that number had grown to 194, 57% more that five years ago.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Net Negative Branch Growth Marks Historic Reversal

The number of branches operated by all credit unions totaled 20,694 in 2007. By 2011, that number climbed to 21,433, a slight increase of only 739 branches.

Key Fact: In 2012, the number of credit union branches declined for the first time in the industry’s 100+ year history. There were 27 fewer credit union branches this year than last. We’ve hit the peak and the trend is now reversing. There will probably never be more credit union branches than there were in 2011.

| Total # of all CU branches |

CUs w/5+ branches |

CUs w/10+ branches |

CUs w/only 1 branch |

% of CUs w/1 branch |

|

|---|---|---|---|---|---|

| 2007 | 20,694 | 1,006 | 341 | 5,393 | 26.1% |

| 2008 | 21,122 | 1,032 | 350 | 5,176 | 24.5% |

| 2009 | 21,290 | 1,058 | 364 | 5,005 | 23.5% |

| 2010 | 21,341 | 1,075 | 367 | 4,520 | 21.2% |

| 2011 | 21,433 | 1,100 | 402 | 4,311 | 20.1% |

| 2012 | 21,406 | 1,116 | 415 | 4,093 | 19.1% |

Big credit unions are the only ones adding more branches. The number of credit unions with five branches or more grew 11% since 2007, up 110 to 1,116 by 2012. Those credit unions with 10 or more branches saw even bigger increases, up 22%, from 341 five years ago to 415 today. The top 100 now hold 14% of all branches in the credit union industry.

Key Fact: Branch growth has been generally flat for credit unions, but not for the top 100. While the industry has only added 712 new branches in the last five years, 552 of those belong to the top 100 (77.5%).

Credit Union Member Growth Fueled by Top 100

Credit union membership in 2012 swelled to 93.7 million, up from 88.5 million in 2007, an increase of 5.2 million (5.87%) over a five-year period. The average annual increase is around 1.5%, with 2012 seeing the largest bump: 1.5 million new members (1.62%).

In 2012, the top 100 credit unions (ranked by assets) added 1.3 million new members, accounting for 84.4% of all new members gained across the entire industry. In 2011, the top 100 credit unions grew by 1.2 million members while the rest of the industry shed a collective 118,287 members. Similarly in 2010, the top 100 credit unions grew by 1.6 million members and the remaining 7,610 lost 286,419 members.

| Total # of all CU members |

Net new members for all CUs |

# of members belonging to Top 100 |

% of all CU members belonging to Top 100 |

# of net new members for Top 100 |

% of net new CU members joining the Top 100 |

|

|---|---|---|---|---|---|---|

| 2010 | 91,175,370 | 1,313,996 | 26,054,728 | 28.6% | 1,600,415 | 121.8% |

| 2011 | 92,236,368 | 1,060,998 | 27,234,013 | 29.5% | 1,179,285 | 111.1% |

| 2012 | 93,735,068 | 1,498,700 | 28,498,526 | 30.4% | 1,264,513 | 84.4% |

Key Fact: Membership gains from the top 100 credit unions are generally offset by the collective membership losses realized by the rest.

The Big Just Keep Getting Bigger

The top 100 credit unions also contribute the lion’s share of asset growth in the industry. In 2012, assets of the top 100 equaled $387 billion, or 38% of all assets held by the entire industry. The top 100 credit unions in 2012 added $28.7 billion in assets, accounting for 45.3% of the $63.4 billion gained by the entire industry last year.

| Total assets for all CUs (billions) |

Net asset growth for all CUs (billions) |

Total assets for Top 100 CUs |

% of all assets belonging to Top 100 CUs |

Net asset growth for Top 100 (billions) |

% of CU industry’s net asset growth coming from Top 100 |

|

|---|---|---|---|---|---|---|

| 2010 | $896.8 | $82.8 | $330.3 | 36.8% | $30.0 | 36.2% |

| 2011 | $951.6 | $54.8 | $358.0 | 37.6% | $27.7 | 50.5% |

| 2012 | $1,015.0 | $63.4 | $386.7 | 38.1% | $28.7 | 45.3% |

Key Fact: Almost all the gains made by credit unions — in terms of assets, members and branches — come from a handful of the industry’s largest institutions. While the top 100 only represent 1.4% of all credit unions, they contribute half of the industry’s asset growth and about 90%+ of the industry’s member growth.

The Small Get Smaller

By any measure, the future for small credit unions looks bleak. The number of credit unions with less than $100 million in assets has plummeted from over 7,000 in 2007 to 5,700 in 2012 — that’s 1,380 fewer than five years ago, a 20% drop. The number of credit unions with only one branch declined by a similar percentage, down to 4,093 from 5,393 five years prior. Mirroring this trend, there were nearly 2,200 credit unions with under a thousand members in 2007, but only 1,700 remain today.

Key Fact: Over a five-year period, small credit unions (those with less than $100 million in assets) have collectively lost $5 billion in assets and nearly six million members.

In 2007, credit unions with less than $100 million in assets collectively held $131 billion in assets and 23.6 million members. By 2012, those number dropped to $126 billion in assets and 17.6 million members.

Today, 80% of all credit unions have less than $100 million in assets, down 5% from five years ago. In 2007, they accounted for 17% of all credit union assets and 27% of all members. They now represent only 13% of all assets and 19% of all members.

| Total members for all CUs w/less than $100 million |

Total assets for all CUs w/less than $100 million |

|

|---|---|---|

| 2007 | 23,611,594 | $130,955,476,177 |

| 2008 | 22,893,541 | $130,436,860,982 |

| 2009 | 22,175,487 | $128,981,918,784 |

| 2010 | 19,936,802 | $126,602,264,544 |

| 2011 | 18,825,575 | $127,632,660,886 |

| 2012 | 17,646,314 | $125,867,933,673 |

| NET LOSS | –5,965,280 | –$5,087,542,504 |

2032: What Will Credit Unions Look Like 20 Years From Now

If you stretch current trends out 20 years from now, the credit union industry will look remarkably different than it does today.

For starters, there will be half as many credit unions as there are now. Assuming the industry maintains its current pace — an annual decline of about 3% annually — there will be 3,269 fewer credit unions by 2032. That means one out of every two credit unions alive today will disappear.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Twenty years from now, there will be 1,218 credit unions with $1 billion in assets or more — that’s 31.3% of all credit unions vs. 2.7% today. Only 319 (8.2%) of credit unions will have less than $100 million in two decades.

On a brighter note, overall industry assets should more than double, hitting $2.2 trillion if credit unions sustain an 4% annual growth over the next 20 years. And if membership gains average 1.5% per year, credit unions will hit 126.2 million members by 2032, an increase of 32.5 million new members. If those numbers indeed materialize, that would mean exactly one in every three people in the U.S. would belong to a credit union in 2032 (vs. 29.3% today, a 4% increase). Of course, the vast majority of those members will be associated with the biggest credit unions in the country.

As for the size of the credit union industry’s branch network, a five-year retrospective analysis isn’t very helpful. At face value, the data might suggest the number of credit union branches will plateau, perhaps holding steady around the 20,000 level. That’s not likely to be the case. Experts in the banking industry broadly agree that branches are on the decline. If their predictions come true, there could easily be half the credit union branches there are today. Or even fewer.

Bottom Line: Asset growth will come much easier than member growth… for those credit unions that survive the coming purge. Membership growth has always been — and will almost certainly continue to be — the biggest challenge credit unions face. Small credit unions will have to fight just to avoid losses, both assets and members.

A world with only a couple thousand credit unions — each with only one or two branch locations — could be closer than you think.