Since the start of the COVID-19 era here has been a good deal of talk about the acceleration of digital adoption by as much as half a decade. Some larger banking institutions have decided to step up the plans they already had for trimming back their existing branch networks. But now there is evidence that rumors of the demise of branches have been somewhat exaggerated.

New research by Novantas indicates that not only do “branch traditionalists” still very much prefer to bank in person, under normal circumstances, but that several other categories of consumers still feel the need for their financial institutions to maintain branches. The firm’s research also indicates that most consumers still want their banks and credit unions to maintain branches quite close to where they live or work.

And here is a twist that even surprised the firm’s researchers: The Novantas study also finds that while Americans have been growing used to doing business, socializing and attending school via Zoom and other video services since the COVID-related lockdowns began, many have drawn a line. So far they have exhibited very little interest in contacting representatives of their financial institutions through any form of interactive video communication, according to the study.

Overall, the implications of these findings bear on the near-term planning for financial institution distribution channels and the sales that they generate. However, the findings must be considered in light of the potential for ongoing lockdowns, as officials react to shifts in COVID cases and test results.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

“The pandemic has reinforced that many Americans are perfectly comfortable performing even complicated banking tasks online, but the attachment to branches isn’t going away any time soon,” states a report by the firm. “Novantas has found that only about 30% of people agree with the statement ‘Having a branch nearby is not important’.”

“The common wisdom has been that the Branch Traditionalist stick-in-the-muds have seen the digital light. Well, maybe that was just a bit optimistic.”

The firm notes that new checking account sales have been down compared to pre-COVID 2020 levels and down significantly compared to 2019 levels. Analysts attribute this in part to consumers continuing to avoid branches, even though there has been a pickup in digital account opening.

“Sales are still tightly correlated to retail traffic,” explains Brandon Larson, EVP at Novantas in an interview with The Financial Brand. The firm’s research uses anonymous geolocation data from mobile apps that track consumer’s locations. Larson notes that many people in the country’s major cities still don’t leave their homes, to avoid coronavirus exposure.

Branch Dependence Declining But Attachment Remains Strong

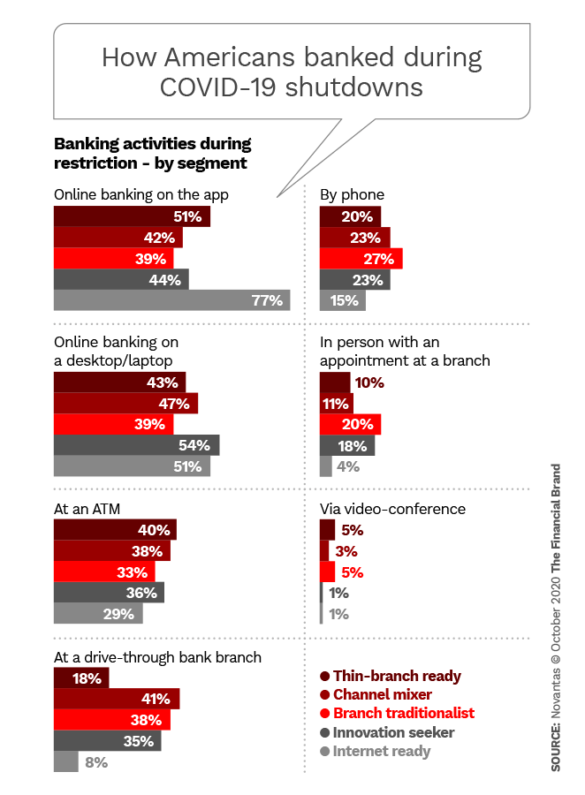

The Novantas research traced how consumers got their banking done during the 2020 shutdowns and this reflected an avoidance of branches by all segments except in those cases where the consumer felt a physical interaction was necessary. Even so, 20% of the “branch traditionalists” among the survey sample used branches by appointment during the lockdown period.

As noted, use of video-conferencing barely registered.

The five classifications that the firm uses in the chart above and others in this article include:

- Thin-Branch Ready: Not dependent on branches, often uses other channels. Prefers to bank with an institution with branches that can be easily visited. (“Thin” in this context refers to the thinness of the institution’s network, not the individual branch. One example is PNC’s thin-branch expansion.) 54% of sample in 2020 versus 39% in 2014’s study.

- Channel Mixer: “Branch attached,” but only goes there for certain needs. May use other channels but values branches when selecting an institution. 17%, 29%

- Branch Traditionalist: Strong relationship with branches. Places high value on live service and prefers visiting a branch for most needs. 13%, 15%

- Innovation Seeker: “Branch detached,” and does not prioritize branch access when choosing an institution. But does still sometimes use branches. 8%, 10%

- Internet Ready: “Branch detached,” not branch dependent, and conducts most banking through digital channels. Apathetic about banking relationships. 8%, 7%

Two out of five Branch Traditionalists used mobile banking via app and a like share used online banking on a computer. This group was also one of the heaviest users of drive-throughs, where they were available. The research found that older Americans tended to dominate drive-throughs, desiring continued access to branches under COVID conditions.

Having accomplished a shift towards mobile and online banking, the common wisdom has been that the Branch Traditionalist stick-in-the-muds have seen the digital light. Well, maybe that was just a bit optimistic. They see it, but that doesn’t make them wholehearted converts yet.

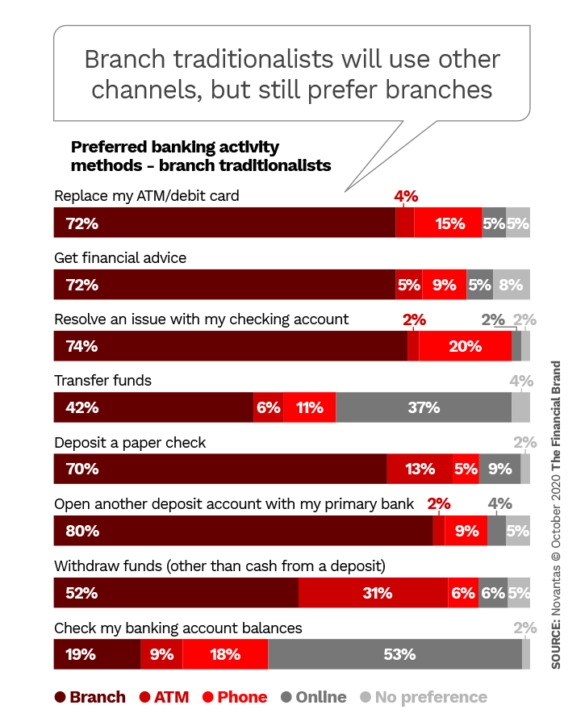

The study found that, overall, transactions are trending out of branches, no argument there. However, branch traditionalists continue to favor them even though they’ve been exposed to the digital world by necessity.

At 13% of the sample, “Branch Traditionalists” doesn’t represent a majority. On the other hand, each institution must determine how important people falling into this group are to their institution’s present and future profit base. In terms of the overall base, branches remain of at least some interest to 84% of consumers (the sum of Thin-Branch Readys, Channel Mixers and Branch Traditionalists).

‘You Want Me to Go How Far to Do My Banking?’

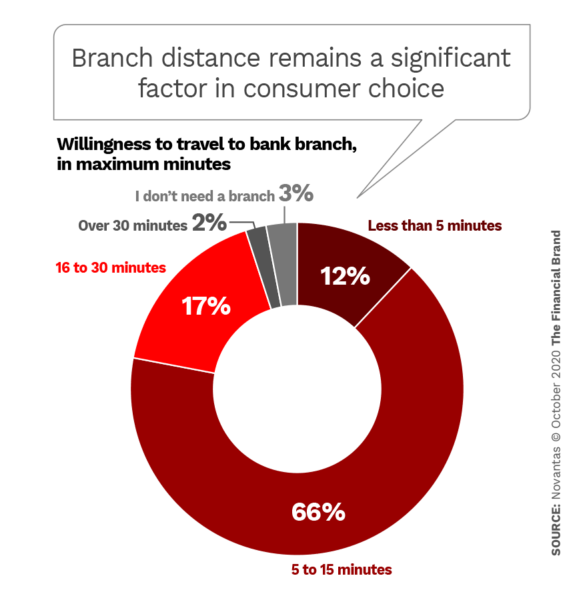

That total must be considered when examining another key finding of Novantas. Other research has suggested that institutions can thin their branch networks in a given city or town, either closing or consolidating locations to cover the market but with fewer locations.

A mid-2020 study by Simon-Kucher, for example, found that consumers in urban areas would be willing to travel nearly 37 minutes by foot to get to a branch and, in the case of suburban and rural areas, consumers were willing to drive 27 minutes. (Some perspective: A key proviso was that these times would only be acceptable if the consumers were experiencing top-notch digital service — which the same research indicates many didn’t feel they were getting.)

By contrast, Novantas found that as of September 2020 consumers were much less willing to travel. Two-thirds of the sample would go a maximum of 15 minutes to find a branch.

Interestingly, a similar preference for 5-to-15 minute travel time is seen across all five consumer classifications:

- Thin-Branch Ready: 65%

- Channel Mixer: 73%

- Branch Traditionalist: 67%

- Innovation Seeker: 65%

- Internet Ready: 52%

Andrew Hovet, Director at Novantas, says in an interview with The Financial Brand that the relative uniformity among the classes came as a surprise. The clear winner in all groups is the 5-to-15 minute trip to a branch.

Marketing Considerations Amid Trimming

During third quarter 2020 earnings briefings some large banks indicated that they will be stepping up plans for branch closures and consolidations and Hovet says that the firm expects to see a wave of such shrinkage into the first half of 2022. This suggests that these institutions foresee that they can maintain enough presence to keep Branch Traditionalists and others who value branches happy while cutting their costs and freeing up funds for thin expansion into new markets.

While direct banks like Ally and Marcus have shown that an institution can grow without any branches, a basic of branching that Novantas still thinks has value is “branch as billboard.” Typically in a market there is “unaided awareness” that reflects a brand’s soaking into a consumer’s awareness over time, says Brandon Larson. Branches are good for that, and ubiquity can make an institution top of mind when a consumer thinks “banking.”

How do fintechs and challenger banks experience such growth and recognition, then, with no branches at all? Hovet points out that they do a lot of marketing digitally, which chews up plenty of the funding they raise. He notes also that they still enjoy a certain novelty that brings free publicity that they can exploit.

“Many have compelling offers that people talk about,” adds Hovet.

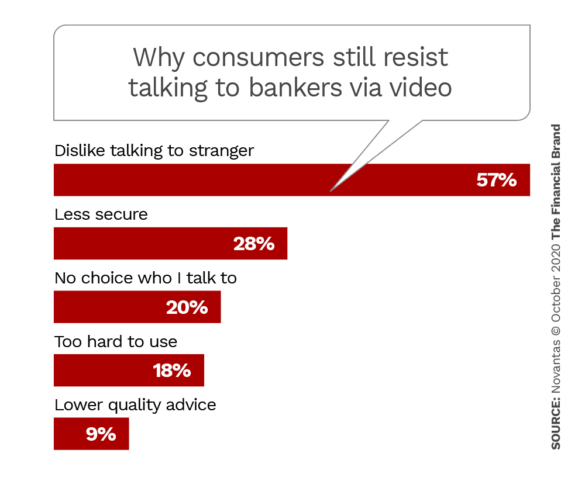

Video Channel Isn’t Quite Ready for Prime-Time Yet

Despite the pandemic’s impact on use of video conferencing in business, Novantas found that video banking consultation did not have many fans. The chart below tracks many of the reasons.

Worth considering is that this chart concerns video calls with a representative such as a call center employee. Hovet points out that some consumers may simply feel uncomfortable going face-to-face virtually with a complete stranger. Given that the interactive call is a two-way video connection, he continues, this means that “a stranger is looking into my home.”

“It doesn’t seem like customers are ready to go there,” not with contact center bankers, says Hovet. A text-based effort like Umpqua’s Go-To Banker program offers access plus visual privacy, he points out.

But this also suggests a next step that institutions can consider, the researchers say. Platform officers and other banking officers with assigned consumer relationships are not strangers — they should literally be familiar friendly faces.

So Hovet suggests that institutions consider giving relationship managers the ability to video chat with consumers they know from their work stations, at home or in the office. That would add a comfort level that might even make a Branch Traditionalist happy.