Up until early March, direct banking was a growing corner of the banking business, providing financial services through online and mobile channels and typically no branches at all.

One of the stock in trades of direct banks has been high-yield savings accounts, sharing some of the savings of being branchless with consumers.

Then COVID-19 came along.

Suddenly direct banking found itself center stage, not for its favorable rates, but for its ideal fit with a socially separating world.

“Direct banking used to be a niche business, but now it’s the new model for banking,” says Bob Neuhaus, Vice-President of Financial Services Intelligence for J.D. Power.

At the same time that traditional banks and credit unions have been scurrying to protect the public and employees by closing branch lobbies or restricting access to appointments only, and pushing transactions out to the drive-through, “direct banks have shown that there is a branchless model that has high levels of satisfaction and trust,” adds Neuhaus.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Suddenly Branchless Looks Positively Inspired

J.D. Power has been tracking and ranking direct banks for several years via its U.S. Direct Banking Satisfaction Study. Now that many are urging consumers to use digital channels whenever possible, direct banks take on a different cast. (The roster of institutions analyzed by the firm include such players as Ally Bank, Discover Bank, CIT Bank, Marcus by Goldman Sachs and Charles Schwab Bank, ranked top in overall customer satisfaction.)

The firm’s research indicates that even before the arrival of the coronavirus, direct banks were pulling deposit market share from traditional institutions. Direct banks have also enjoyed strong success among younger consumers, especially Generation Z.

However, even these digital innovators have issues, from which traditional institutions can learn.

One is that while Gen Z likes direct banks, J.D. Power research makes it clear that this is a demanding generation. It is one that will have no qualms about moving to another direct banking provider, or perhaps a fintech or a neobank, if their direct bank doesn’t make them very happy. This comes in the context of the company’s research indicating that, overall, direct banks as a group produce much higher overall satisfaction ratings than do traditional institutions.

“Direct banks are working to become the primary financial institution for more consumers.”

Another is that because consumers using direct banks cannot go to a branch when there is a glitch, they will use contact centers twice as much as consumers using traditional banks — and that was before COVID-19 hit the U.S. The research found that direct banks have challenges with satisfying consumers through contact centers when they have issues that require human intervention.

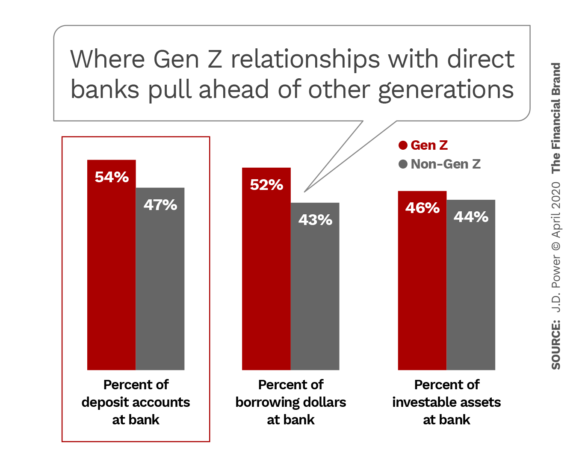

Even before COVID-19, Neuhaus says, direct banks have been broadening their product lines, adding checking accounts, for example. He says they are working to become the primary financial institution for more consumers. The firm’s research indicates that many consumers had been coming to direct banks for juicy rates for savings, such that direct banks, on average, hold 47% of a consumer’s total deposits. By contrast, large, regional, and midsize banks typically hold roughly 70%. However, the firm found that once a consumer begins banking with a direct player this eats deeply into the traditional bank’s share.

This continuing direct-bank appeal plays into the hands of neobanks too, so long as they can keep their rates up. “If fintechs can be much more nimble and offer accounts more efficiently, people will be willing to consider more alternatives,” says Neuhaus.

Such has been the potential of direct banking, especially for entering new markets, that some large banks had begun to launch their own direct banking operations in parallel with their traditional systems and footprints or as a means to go beyond them. Typically they have also emulated the rate appeal of direct banks, not unlike the neobanks that has used rates subsidized by venture capital as a sales point.

Read More: When Opening Accounts in Branches Becomes Impossible

Direct Banking and Generation Z: Dating, Not Married

While the trend up until now has been for many to consider their direct bank accounts to be a secondary relationship, J.D. Power found that among Gen Z consumers there is a strong tendency to think of their direct bank as their primary financial institution.

A major reason for that is that direct banking and Gen Z live in the same neighborhood. That is, direct banking, starting as online-only, now offers extensive mobile access, and Gen Z consumers spend a good chunk of their lives on their devices. A 2018 study by the Center for Generational Kinetics found that 26% of Gen Z spends ten hours or more on their smart phones.

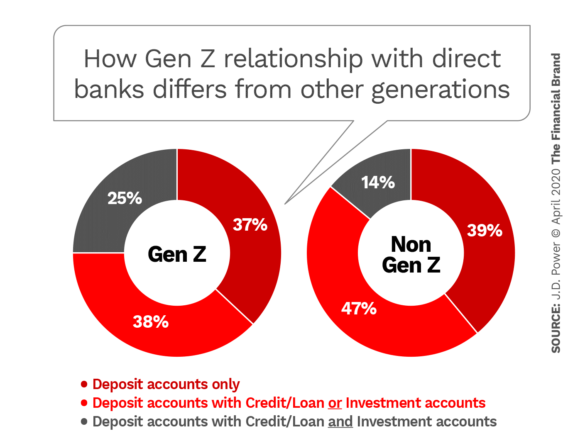

As the charts above demonstrate, the Gen Z direct bank users tend to keep a larger portion of their deposits at their direct bank, versus older users. In addition, they tend to have broader relationships with their direct banking providers, including not only deposits but also credit or investment relationships, or both.

Traditional banking strategy considers such multi-relationship consumers to be “stickier.” Also, with direct banks there is no geographical tie that would cause a consumer to leave because they move, such as after college.

Or so one might think.

Gen Z doesn’t fit that concept. J.D. Power found that they are less satisfied with direct bank offerings, overall. While non-Gen-Z people average 869 in overall satisfaction with direct banking, Gen Z comes in at only 814. In the firm’s trust index rating, as well, Gen Z comes in lower, at 829, than do the other generations, at 876. And the net promoter score they would give to direct banks is only 32 — just a bit over half of the 62 score other generations give.

In fact, Gen Z would willingly move to another direct bank if they perceived a better deal. 34% of Gen Zers surveyed said they would likely make a switch, twice the 17% reported by other consumers. Interestingly, the gaps seen between various aspects of satisfaction for Gen Z and other generations is more dramatic in the direct banking study than in a study J.D. Power does of retail bank satisfaction.

Neuhaus has a hypothesis regarding Gen Z’s feelings about direct banks and their willingness to move. He believes older consumers compare today’s digital offerings to earlier, clunkier digital efforts, or even non-digital options. They are impressed because they have a point of comparison. By contrast, Gen Z consumers, being digital natives, aren’t impressed by digital offerings just because they are digital — it’s really all they know and they expect digital fulfillment.

Frankly, says Neuhaus, “what banking is doing doesn’t seem that special to them.”

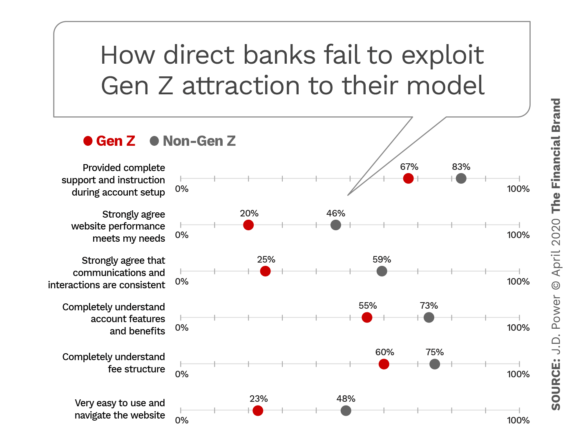

In fact, as the chart below demonstrates, direct banks are falling short in multiple customer-service categories with Gen Z versus non-Gen-Z consumers.

Given that Gen Z is the next big generation for financial services, this indicates that direct banks — all financial brands, really — must begin to make their needs and the way they see things a bigger part of the design and marketing picture.

Neuhaus suggests that advertising, social media and other messaging be tailored more towards Gen Z. In addition, greater concentration on financial health themes will be of growing importance in the wake of COVID-19 for all generations, he says, but especially for Gen Z, a generation just starting out but with its own issues.

Read More:

- Financial Marketing Channels Evolve as Gen Z Starts Banking

- 15 Things Banks & Credit Unions Must Know Before Targeting Gen Z

Contact Centers Were a Weak Spot Even Before Coronavirus

All types of financial institutions with contact centers have something to learn from this part of the study. The report discusses the importance of digital platforms for serving consumers with direct banking relationships. “While customers are using the website and mobile app, it limits the need to contact their bank via other channels (e.g., contact center), which are much more costly,” the report states.

That said, in the report, conducted prior to the coronavirus’ arrival, 40% of direct banking consumers who used their institution’s contact center reported having to wait five minutes or longer for assistance. This is noteworthy in the context of the report research because the firm found that delays over five minute long tended to drive lower satisfaction scores.

Of course, given the extensive delays that contact centers are experiencing now, and the curtailed hours some have had to implement in light of employee illness and contact center staff working remotely, five minutes seems infinitesimal.

However, the importance of this point shouldn’t be dismissed, especially in light of Neuhaus’ own experience. Right now, it is typical for financial institution websites to provide contact center phone numbers, but to refer to severe delays, with the suggestion to try mobile channels.

Neuhaus tried that, and was told through the mobile channel that he could have an appointment … in ten days.

He says that was too long for what was involved, and called the contact center. After waiting 30 minutes, he reached a representative, and eventually got through to someone who could help. But as a professional bank watcher, he felt the channel the institution was encouraging people to use should not have given such a poor result as a ten-day wait. It sends the wrong message and doesn’t make it a good alternative for consumers.

Communication Pays Off for Direct Banks When It’s Frequent

A point that’s been made during the period of dealing with COVID-19 is that some brands have had little to say to customers while others have over-communicated, clogging email inboxes with many messages that say little that’s new or helpful.

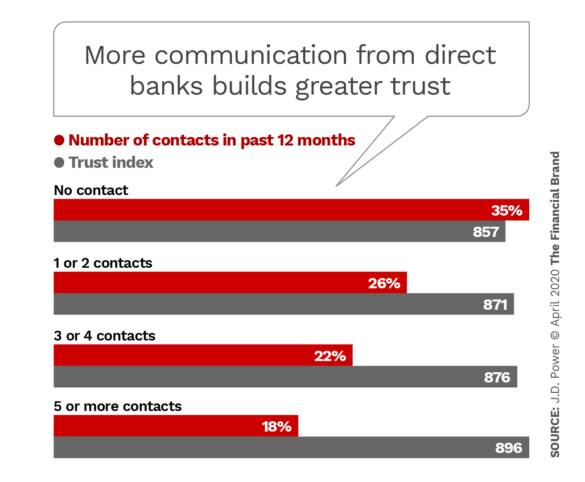

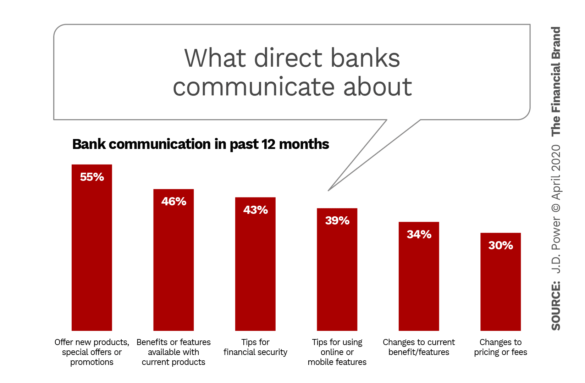

For many brands, these may be lessons to learn for now, but the study suggests that failure to communicate is not a good recipe in more normal times. The research found that the more frequently direct banks communicate, the more trust they earn with consumers.

As the nation comes to some new equilibrium post-COVID-19, the time will come to communicate more frequently.