The ability to put people face to face virtually, using videoconferencing technology, has existed for years, but the pandemic and digital devices have made it more practical and more desirable for some consumers than ever. Now it is possible that virtual bank branches will not only become acceptable, but even potentially popular as Americans rethink what “convenience” means.

In many aspects of life people are routinely interacting in ways that used to be unusual. Public affairs gatherings from congressional hearings to town board meetings have been held virtually or in hybrid form. Virtual classes in all levels of education have become normal, and telehealth appointments where doctor and patient confer via video are commonplace.

And of course what bank or credit union executive hasn’t had more Zoom or Teams meetings during the pandemic than they can remember?

All that evolution may be coming close to a payoff. While chat and call centers have been providing interactive remote retail banking channels for years, the addition of video and file sharing tools for “physicalizing” digital transactions makes a broader range of virtual banking experiences possible.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

What Virtual Branching Can Accomplish

The virtual branch represents an effort to provide the type of experience that many consumers still claim to want — advice, the human element and more of the traditional branch banking experience — in a virtual format.

Patelco Credit Union conducted a soft-launch of its virtual branch in 2021 after spending the latter part of 2020 developing its approach in response to Covid-19. The credit union is fully adopting the approach in 2022, providing basically a full-service virtual version of its 37 physical branches in northern California.

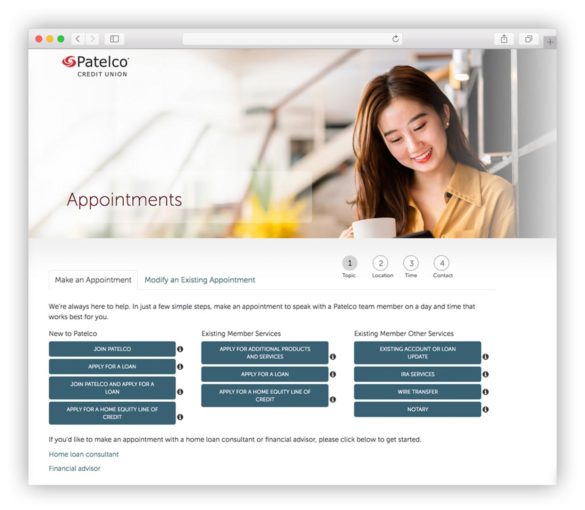

Consumers enter through Patelco CU’s website, either by appointment or as a “walk in,” which initiates a Zoom connection that provides the virtual space that the branch conversation takes place in.

Patelco CU’s concept has evolved to a point where in some ways the virtual branch experience offers greater flexibility to bring in exactly the right kind of staff expertise to handle peoples’ needs than a live location. In addition, members can obtain more flexible means of bringing multiple family members into a financial conversation, even where they aren’t in the same physical spot.

For example, a student away at college, parents and a Patelco CU retail banker can gather in one Zoom room. Similarly the credit union representative, a retirement specialist, an elder parent and adult children can all confer from remote places.

Beyond that, the virtual branch not only handles needs by appointment but can also accommodate virtual walk-in traffic, according to Ameet Seth, Vice President and Head of Retail, Investments and Membership. This includes new relationships, over 500 of which were opened in the virtual branch since it went live, according to Seth.

Along the way, Seth says, Patelco CU learned what aspects of physical branches could not be adopted as-is to the virtual format. (Cash transactions are out, obviously.)

In some cases the answer hasn’t always been adapting the branch process but instead coming up with an alternative solution. Case in point: When a customer needs a cashier’s check with which to buy a car, the institution came up with an automated solution avoiding the need for a physical check. (Should a check be absolutely necessary, it could be delivered by express service or through a physical branch, given sufficient notice.)

Besides bringing a new level of convenience to people, Seth says the credit union has created an additional branch to members at a small fraction of the cost of a real branch. The chief cost is the time of staffers assigned to it, with there being no need to maintain a property or to keep cash on hand. The virtual branch is actually built into the credit union’s branch locator function in addition to having links around the website. Various products on the institution’s site offer buttons allowing people to visit the virtual branch to open an account.

Read More: Why Bankers Won’t Ditch Branches, Despite Digital’s Explosive Growth

Building a Virtual Branch Experience

During the soft-launch phase Patelco CU balanced a fine line between marketing to encourage growth in use of the virtual branch and controlling traffic in order to avoid too much demand on the systems.

“We were mindful that we couldn’t turn the water on completely,” says Seth. However, during 2021 the credit union saw virtual branch traffic grow between 5% and 10% per month as management began to understand how to forecast demand for staff.

“We’re one of the only financial institutions that offers what we call ‘meet-now functionality.”

— Ameet Seth, Patelco Credit Union

This impromptu access connects people with the virtual branch’s concierge, who can handle many routine matters as well as pulling in experts for specialized advice or more specific transactions. The concierge effectively serves as live branch manager.

In 2022 the plan is to adopt dedicated staff for the virtual branch. At times as many as 15 staffers may be hooked into the branch. Seth explains that increasingly it will be used to handle inbound sales queries. “The role will be more consultative and advisory versus the traditional contact center function of servicing accounts,” says Seth. The two functions will each continue in their separate tracks and experts who are not on the virtual branch roster can be drafted as needed.

As the types of transactions handled virtually grows, Seth expects tools like Docusign will be helpful. When he was interviewed the credit union was still working on options for transactions that required notarization.

Consumers always see the virtual staffers — who are all human, no avatars here. It is up to the members or prospects whether they want to turn on their own cameras.

Read More:

Virtual Branch Augments But Doesn’t Replace Current Network

While the economics of a virtual branch prove attractive, Seth doesn’t think it will kill physical offices.

“Our branches do a great job engaging with local communities,” he says. “Because of who we are as a credit union, we see real branches being intact and we see continued growth there in coming years. We’re not going to force people out of any channel. This will be an extra added piece that we offer for our members from a convenience and engagement perspective.”

In the future Seth suggests that a hybrid approach could help the credit union try out “branching” into a new market before laying a single actual brick. A virtual branch could establish identity with an area and be followed by physical facilities at a later date if the potential is there. This is similar in concept to the “branch-light” approaches some of the larger banks are using, putting offices with small footprints into new geographic markets that those institutions have only served with credit cards or other remote products initially.

“So we’d be serving them with just about everything except cash,” says Seth. “Over time we think we will have a lot of members who join because of the added human element piece that we’ll offer. This can help people who do not want to take the digital journey completely.”