In an earlier column, “Banks May Still Need Larger Branch Networks to Find Sales Success,” I wrote about the continuing advantages that a larger branch network provides, basically doubling your probability of gaining more than your “fair share” of market deposits. For short, I call this idea the “6% solution” — if you want to gather more deposits, you’ll want to have at least 6% branch share locally.

Since that earlier column was published, some readers noted that I counted supermarket branches the same way as more traditional branches. These people believed the supermarket branches should only count as one quarter of a branch, due to their limited performance.

I thought this was an interesting point, so I ran some fresh numbers. Here is what I learned.

Supermarket Branches Remain An Inefficient Use of Resources

Now, bankers and credit union executives familiar with my work know that I have strong opinions about supermarket branches. I’ve studied that branch format for over two decades. I know some industry leaders still like them, but I’ve concluded that they represent bad investments.

The typical supermarket branch is 500-750 square feet in size and costs about $500,000 to construct and about $500,000 annually to operate. Operating costs are inflated due to staffing requirements. Most supermarket branches follow the supermarket host’s lead in office hours, so they may be open 12 hours daily. Even though staffing at any one hour likely comprises three or four people, the store branch’s extended operating hours mean more people to cover those longer hours. In my studies, these formats run at about two-thirds the cost of a traditional branch.

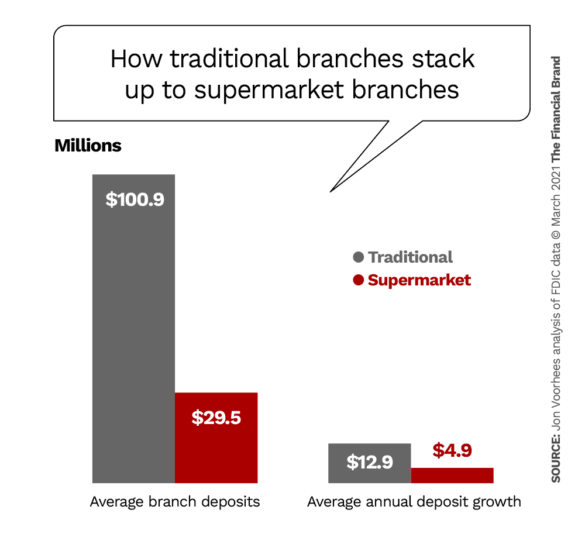

The performance, as in their ability to attract new customers and deposit balances, has been weak industrywide, as can be seen in this chart.

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs Services that scale with you.

Industry Cloud for Banking from PwC

Fractional Marketing for Financial Brands

The nearly 4,000 supermarket branches today, or about 5% of total branches, average 30% of the deposit base of traditional branches and captured about 38% of the deposit growth from the prior FDIC reporting period. (Note that I cap all branch deposits at $500 million to mitigate corporate deposit impacts.)

A Key Fact About Supermarket Branches:

The reasons for this performance difference are many, but the main reason is the limited footprint allocated by their store hosts.

This limits the number of people they can hold to three or four, with only one of them being a personal banker/new account person.

My research over the years shows that no branch, regardless of format, can succeed with only one person driving account, deposit and revenue growth. For those banks and credit unions that have tried a sales-only format with ATMs, they too have found poor performance because consumers want teller functionality too, especially for after-work check cashing.

Looking At The ‘6% Solution’ In A Fresh Light

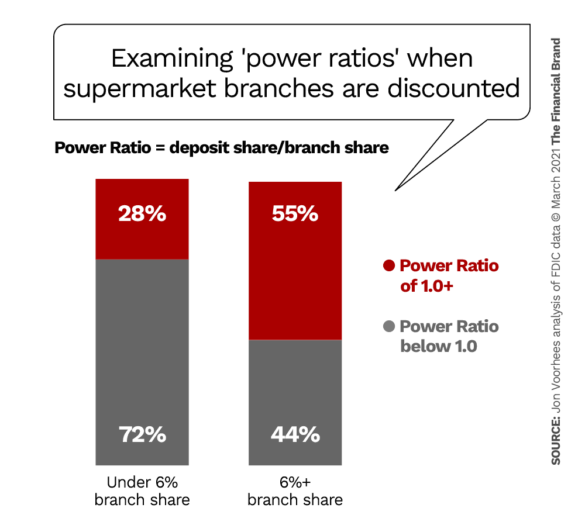

In my original article, I treated all retail branch sites identically, meaning that a supermarket branch counted the same as a traditional branch. In this article, based on the reader input noted earlier, I have weighted those approximately 4,000 supermarket branches as 25% of a branch. Let’s see how that change impacts the probability of outsized deposits of a 6%+ branch share.

Banks with less than 6% branch share in a metro area only have a 28% chance of having a Power Ratio (deposit share/branch share) of 1.0 or greater. Banks with at least a 6% branch share have a 55% chance of reaching that level of above “fair share.” We still see a doubling of the probability of outsized success even with supermarket branches discounted.

Banks with less than 6% branch share in a metro area only have a 28% chance of having a Power Ratio (deposit share/branch share) of 1.0 or greater. Banks with at least a 6% branch share have a 55% chance of reaching that level of above “fair share.” We still see a doubling of the probability of outsized success even with supermarket branches discounted.

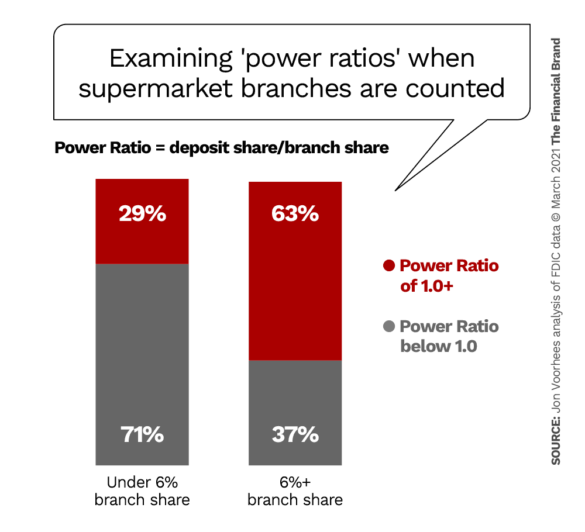

In the original analysis where supermarket branches were treated the same as traditional branches those percentages were not much different for sub-6% branch networks. In the 6%+ local branch networks, the probability was a little higher (63% versus 55%).

I attribute the change in probabilities due to the shift of bank/markets combinations on the edge of the 6% branch share or the 1.0 power ratio. A few hundred combinations changed categories, impacting the probability outcomes.

The Lessons Of This Simulation For Branch Planners

Supermarket branches have been a staple of bank and credit union networks for over 50 years. While it’s difficult to count how many of the 21,000 credit union branches are this format (probably around 1,000), we do know there are just under 4,000 bank branches in this format today, down from about 7,000 two decades ago.

Why It Matters:

Those who believe in supermarket strategy stress that supermarket branches are cheaper to build and have lots of foot traffic. True. But the problem is lack of revenue and profitability, not cost or traffic.

Back in 1997, researcher Christopher Williams of the Federal Reserve Bank of St. Louis had this to say about supermarket branches:

“Supermarket branches date to the 1960s,” Williams wrote in an essay. “Instead of growing into profit centers, however, these outlets generally became mere check-cashing centers. Accordingly, many failed and were subsequently closed.”

Despite these facts, there are still banks pursuing this strategy. I wish them well — but the odds remain against them.

The Bottom Line:

If you think you can hit 6% branch share and get more than your fair share of deposits through the deployment of supermarket branches, don’t try it. They average only 30% of the deposits of traditional branches.

And here’s a strategic suggestion: If you rely on a branch network to reach new customers and serve your existing base, you may want to consider a concentrated strategy focusing on building share in fewer markets rather than small networks in many markets. Unless you are going to operate as a single unit bank in a market, it pays to build a larger branch network.