While COVID-19 disrupted most business sectors and raised consumer anxiety, the pandemic accelerated financial institutions’ digital transformation and put the role of the branch experience under more intensive scrutiny than ever.

Initially, this will lead to more closures and relocations and shrinking branch footprints. The pandemic experience demonstrated that the fear of losing consumers and businesses due to such changes is a vestige of the past.

But banks and credit unions must also confront the need to evolve their broader branch channel strategy: Most financial institutions’ mindset remains one of offering the same services as ever, just in different sizes of shoeboxes. This needs to change to providing curated branch-level ecosystems that target unmet customer needs.

And forward thinking must build in something else: Despite the significant shift to online and digital banking during the pandemic, the physical branch remains the key driver of growth.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Think in Terms of Ecosystems, Not in Terms of Banking

Now that many more consumers have tried online and mobile channels, there’s going to be a rush to move people to digital platforms to manage the cost of transactions. Appealing as that is, it could lead to unforeseen consequences. My firm did a report on “stealth attrition” and identified potential erosion of brand loyalty as consumers shift to relationships based only on digital banking. Ultimately banks and credit unions must explore new offerings and services they historically were reluctant to provide.

Take business banking. As our recent COVID-19 Banking Study identified, the economic after-effects of the pandemic and the lockdowns is raising a high level of anxiety and financial loss with the growing insolvency of small businesses. Those who survive face the need to repay substantial government aid or to qualify for forgiveness. Institutions’ ability to generate revenues is being challenged.

The new model of providing value means rethinking the entire channel strategy and looking at the banking customer through the lens of hidden needs. Most financial institutions solve only a fraction of the issues facing people eager to grow their wealth, business or family legacy.

Many of these unmet needs are fulfilled by fintech start-ups who are not constrained by the outdated and highly regulated models banks and credit unions labor under. Often they act as advocate to consumers and businesses. The gap between traditional institutions’ offerings and customers’ requirements is growing. And that shortfall is eroding the long-term viability and trust that traditional institutions have worked diligently to foster. History has consistently demonstrated that lack of relevance is a precursor to significant market disruption.

A new banking model is vital in ensuring that traditional institutions reclaim their lost expert role in providing customers with financial advice and a broader range of relevant products and services. I define this model as an “ecosystem,” borrowed from nature’s lexicon on how different facets and inter-reliance of an environment all play a role in supporting its inhabitants. An ecosystem operates very differently as it includes actors that are traditionally and typically seen as competing or not relevant to the institution’s health.

Approach Traditional Markets Broadly to Win More Business

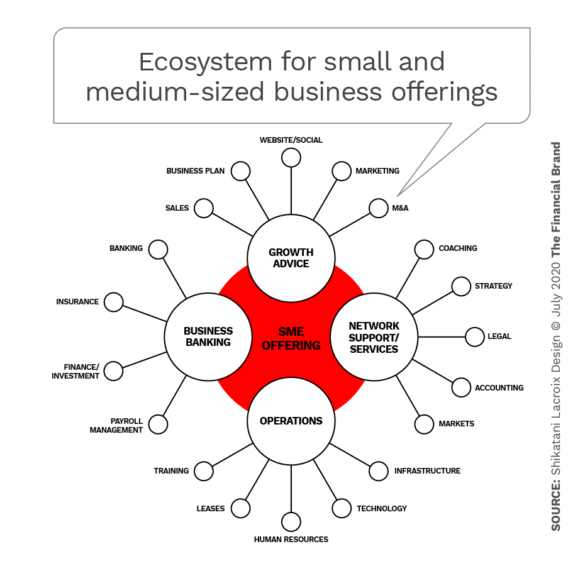

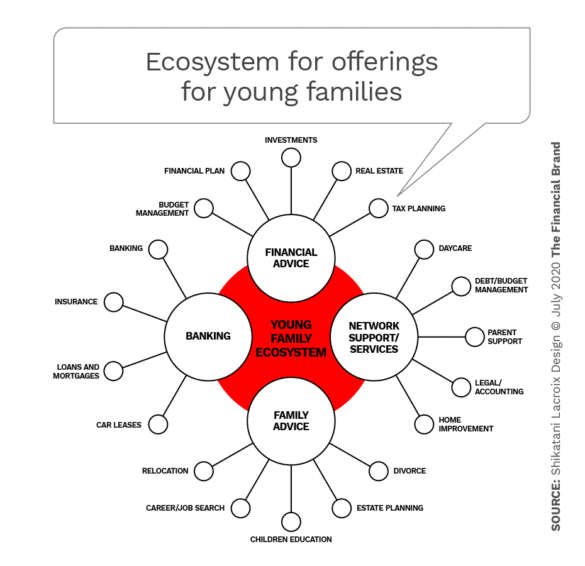

By applying this model to banking, we discover that financial institutions have the ability and network scale to answer unmet financial needs for consumers and businesses. However, they will first need to look much differently at the market segments that they serve. They need to move away from the conventional branch base to need-based segments such small businesses, start-ups, families and wealth seekers. These segments reflect the need for services and knowledge beyond traditional banking, even while finance remains at the industry’s core.

In addition, institutions will need to ensure the ecosystem model provides a curation and brokering of a range of services that answer each of the evolving segments’ broader needs and aspirations.

By offering services beyond current banking offerings, such as human resources, marketing, operations and infrastructure technologies for businesses, for example, financial institutions can help provide further value to customers. They will draw revenues from the management and delivery of these services while ensuring their customers’ long-term vitality. They will shift how they bring value from a transactional model towards one where the payout is through the on-going growth and prosperity of businesses and consumers.

Ecosystem Approach Changes Customer Experience

The new banking ecosystem will evolve from the current customer experience 3.0 towards a 4.0 model. The hierarchy looks like this:

- Customer experience 1.0: This is product led, with the focus on delivering banking products.

- Customer experience 2.0: This is demand led, with the focus on delivering value.

- Customer experience 3.0: This is experience led, with the focus on easy and convenient banking.

- Customer experience 4.0: This is customer led, with the focus on helping to answer the customer’s emotional financial needs.

With 3.0, convenience was the driving value, which often meant focusing on digital banking channels. Customer experience 4.0 will derive its value by creating the customer-centric ecosystems that cater to crucial customer segments.

The physical experience will remain the hub of the relationship. That will come through allowing customers to gain knowledge and confidence through financial coaches whose sole purpose is to ensure their customers’ economic success. The new environment will borrow from co-working spaces, educational centers, personal advice boutiques and places to host social and networking events. These empowering growth hubs will morph into learning centers where advice and coaching will blend with like-minded networking. These offerings will be delivered through well-developed integrated services and devices to help specific types of businesses and consumers and to support their financial health as part of their daily interactions.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Ecosystem Concept Has Been Getting a Tryout

The move towards an ecosystem customer experience 4.0 has already started among pioneers. A sampling of efforts that have been tried in recent years by institutions in the U.S. and in other countries:

Next Door, located in Chicago, is a community of people helping each other make progress on tasks like starting businesses, learning new job skills, and improving people’s finances. Since State Farm launched Next Door in 2011, its Financial Coaches have worked with thousands of individuals to help them be just a little smarter with their money.

Eagle Labs, launched in Europe by Barclays, is designed to help individuals, businesses and corporations to innovate and grow.

B Works, another example, from Clydesdale and Yorkshire Bank, created a shared environment and facilitated small and medium-size business cooperative learning, working and banking, allowing companies to generate new ideas. (The company is in the midst of a rebranding since its acquisition of Virgin Money.)

Royal Bank of Canada created a Future Launch program to help Millennials and Gen Z build their financial and career confidence. The program is branded and includes a physical learning center in addition to a partnership with many career development and training organizations.

Making Ecosystem Shift Means Getting Over Tradition

The biggest hurdle for traditional banks and credit unions in shifting to a customer experience 4.0 approach is their own bias as to what defines success and current revenue models. The metrics top management uses to track results will need to change.

Many market dynamics — such as the shrinking of the middle class and the rise of fintech competitors — will force institutions to accelerate their rate of change and need to explore new customer experience models. Recent events have given banks and credit unions an opportunity to start exploring a new customer experience 4.0 model, embracing an ecosystem approach to providing customer-centric services.

They won’t have much longer to try it out. History has shown that disruptive players are willing to fill the void where there is an unmet need and existing players dither.