Most commentary around branch usage relies on research that supports a specific position. Not because the findings of any specific research report are incorrect. In fact, most of the research is very well done by organizations I rely on regularly. The challenge is in the interpretation and dissemination of the research findings by organizations with a specific mission.

The debate over the need for branch offices by consumers places most people into one of two camps of thought. Many are either in the camp that says, “Consumers love branches”, or the opposite camp that says that “Branches have outlived their usefulness.”

The camp chosen by any person or organization may be determined by their position in the ecosystem (i.e. size of organization), the economic implications (i.e. channel(s) where significant investment has been made) or historical preferences (i.e. fear of change).

Research Says Americans ‘Want’ Branches

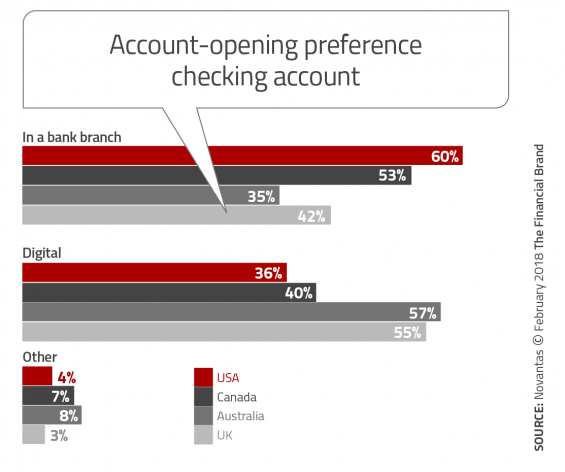

According to research conducted by Novantas, 60% of Americans said they would rather open a new checking account in person at a bank branch than on a phone, tablet or desktop computer. Reinforcing this finding is the reality that most consumers still only use digital channels for the most basic banking functions, such as checking account balances and transferring funds. For more complicated issues, like problems with an account or advice, most consumers prefer human contact.

The question becomes, how often does a consumer have a major issue with their account or go to a local branch for financial advice. Despite what consumers say, the reality is that most consumers don’t back up their preferences with action.

The survey also found that half of U.S. customers feel that online-only banks are “less legitimate” than those with branches. “Folks are still hanging onto this comfort of feeling like there is a branch nearby if, and when, they need it,” said Matthew Sharp of Novantas. Never mind that they are going to branches less often.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Americans Lack Digital Alternatives

I have little doubt that consumers don’t want their branch to go away any more than the majority of consumers didn’t want their preferred retailer to close their doors. Consumers love a choice even when they increasingly shop with keystrokes as opposed to footsteps … because it is easier.

The challenge is that, unlike retailers who developed digital options for consumers to avoid losing business to the likes of Amazon, the banking industry has not responded with strong digital alternatives in most cases. As found in research done by the Digital Banking Report, an overwhelming majority of banks and credit unions do not enable a consumer of open a new deposit account end-to-end without visiting a branch. In many cases where an account can be opened digitally, the process is far from user friendly.

So the question is whether American consumers want to use a branch or if they have to use a branch. Ron Shevlin from Cornerstone Advisers summarized it well when he said, “Americans want to open an account in a bank branch, because the alternatives are even more painful.” Andrew Hovet, a director at Novantas made the point that it is not just about account opening. “Some banks still will not even change a home address for a customer without a personal visit,” said Hovet.

Heavy Branch Preference is an American Anomaly

The reliance on branches in North America is almost double other countries, where better digital offerings have been introduced. In fact, according to Novantas, 75% of consumers in Australia report visiting the branch less than once per month, or even less! The UK is very similar while, interestingly, only about half of US consumers exhibit the same behavior.

Part of the challenge in the U.S. could be consumer education. When asked, consumers in the most branch-centric countries said they still rely on branches to make deposits and withdrawals with a teller and for tasks that “can’t be done in some other way.” This indicates either that organizations in North America have not kept up with digital capabilities or they do not adequately inform consumers how digital channels can make life easier … or both.

The difference between North America and many other countries will most likely be eliminated as innovative technologies are used to make it easier for consumers to complete more complex banking tasks more easily. Like in the retailing industry, why physically visit a branch when it is actually easier to use a mobile device or a computer.

Read More: What The @$#& Are Banks Supposed To Do With All Those Branches?

Banking Industry Must Play Digital ‘Catch Up’

The Novantas findings show that banks that can afford to keep branch offices currently may have an advantage over online upstarts when signing new customers for primary accounts. But for most organizations, future investment is better placed building improved digital options that are quick and easy to use.

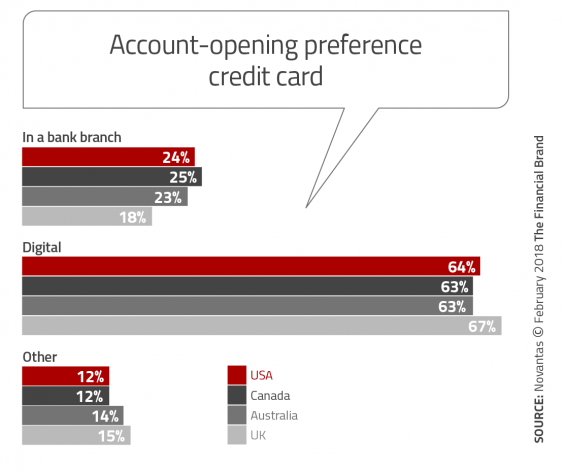

To illustrate that consumers will move to digital channels, Novantas found that far more people use digital channels for credit cards and savings account opening than for checking accounts. This is because the process is usually painless compared to opening a new checking account or applying for a consumer loan.

As expected, most bank customers still prefer the branch for more complex products like HELOC and first mortgages. That said, consumers did report a growing preference for opening these accounts digitally, indicating the influence of alternative lending organizations like Quicken and Rocket Mortgage. In other words, it is a matter of when, not if.

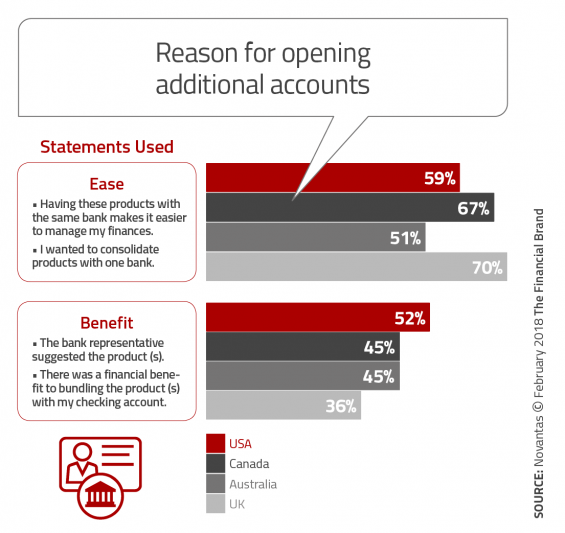

The importance of building a simplified digital account opening capability is highlighted by the fact that a consumer usually doesn’t just open a single account when a new relationship is established. Whether the account is opened in a branch or digitally, consumers are open to expanding the relationship for long-term convenience.

Organizations With Divergent Branch Strategies

The banking industry has seen the closure of 1,700 branches in the 12 months ending in June 2017 – the largest one-year decline on record. Capital One Financial Corp. has cut 32% of its branches from mid-2012 to mid-2017, while SunTrust Banks Inc. cut 22% and Regions Financial Corp. has cut 12%.

At the same time, JPMorgan Chase & Co and Bank of America Corp have said they will build branches to fill in distribution ‘gaps’ across the country. In fact, JPMorgan intends to add as many as 400 branches in cities such as Boston and Washington, D.C.

Finally, firms like Ally Financial Inc, Goldman Sachs Group Inc, Quicken and Rocket Mortgage are leveraging their digital advantage to design easy-to-use digital account opening apps that are far ahead of traditional banking organizations.

Each organization needs to make an independent choice whether to double down on branches or allocate future distribution investments to digital capabilities. Even if a pro-branch decision is made, it will still be important to build strong digital capabilities to support an increasing digital marketplace.

As Novantas has found in earlier research, consumers are no longer defining ‘convenience’ based on space or distance. They define convenience based on how any organization can make their life easier during a point in time. This increases the importance of developing solutions that leverage the newest technologies to deliver what the consumer desires at the time, place and speed they expect.