What should banks and credit unions do about their branches? A recent Celent report, sponsored by Reflexis Inc., an workforce management firm, notes that there is broad agreement that priority tasks include improving branch sales performance, taking the customer experience to the max, and adopting “digital advocacy” — using branches to educate consumers about how they can bank digitally.

However, while many institutions understand those goals, often they aren’t equipping their staffs with the kinds of tools that will help accomplish them, according to the latest in a series of projects Celent has pursued regarding the future role of branches.

Banks and credit unions “are asking front-line staff to deliver highly personalized customer experiences without the tools to do so,” Celent states in its report, “and are asking managers to orchestrate complex systems of personnel and processes without an adequate understanding of what’s happening across the network.”

This comes at a time when the attitude of banks and credit unions regarding branches increasingly is in a state of flux. Bob Meara, Senior Analyst at Celent, says in an interview with The Financial Brand that for all the talk about the branch being dead, study after study indicates that many consumers still haven’t warmed up to mobile banking.

“They don’t understand that there’s a tsunami coming, because it still looks like a nice day outside.”

— Bob Meara, Celent

Institutions have been trying out all kinds of variations on staffing and service models — typically with multiple templates within the same organization. Half of institutions over $10 billion in assets told the firm that they are in the midst of evolving towards new branch staffing models, while one in five institutions under $10 billion are doing so.

Yet some institutions still just seem stuck.

“Digital advocates are zealous proponents of what they believe, and they see the world through that filter,” Meara states. On the other hand he finds that many executives responsible for branch systems “see things through a lens of a very different color. Some are very dismissive of what’s happening on the digital side.” Meara isn’t a digital-only advocate, but he believes these executives are being short-sighted. “They don’t understand that there’s a tsunami coming, because it still looks like a nice day outside.”

Read More: Rethinking Branches and Retail Banking in a Mobile-First World

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

A Credit Union’s Lesson When Members “Checked In”

When Meara was wrapping up his research, he held a conference call. A small credit union told listeners that it had recently begun asking its members to check in on a tablet when they arrived at branch, recording the reason for the visit. Management was surprised when the most common purpose given was to have something notarized.

The credit union reacted by training more staffers to be notaries. Until the tablet check-ins, the employees hadn’t noticed that the demand to notarize documents was so great that members were leaving because a notary wasn’t available.

“I wondered, ‘How could that possibly be?’,” says Meara. “But it’s true.”

Notary service isn’t even a loss-leader. Typically it’s solely a courtesy service that fulfills a key consumer need. But the story illustrates a key point. Over the course of his project, “Managing Today’s Branches with Yesterday’s Tools,” Meara found that as banks and credit unions continue to debate the role of branches versus digital channels, they frequently do so without suitable data.

“Digital channels represent an information-rich environment,” says Meara. “You can tell exactly where consumers come onto your website, how they move throughout the site, where they jump off, where they encounter problems, and where they find broken links. All that data can be super-useful.”

On the other hand, many institutions face multiple gaps when it comes to knowing what’s going on in their branches.

“If you ask branch bankers about the details of their teller transactions, they can wax eloquent about those metrics,” says Meara. “They can tell you the average number of teller transactions in a branch and even where the peaks and troughs are.”

What is less-often tracked and measured, Meara finds, are factors of current branch activity that relate to what many regard as the increasingly dominant role of branches, as sales and service locations, and regarding the quality of the customer experience.

Read More: Top Branch Trends for Banks and Credit Unions

What Branch System Management Misses

Celent’s research found that many institutions seem confused about what makes for a good branch customer experience. A strong stress is being put on personalized service, for example, and on sales results, while convenience-oriented matters, such as reducing waiting times and differentiating through offering the most convenient hours — which can influence sales — rank lower in priority.

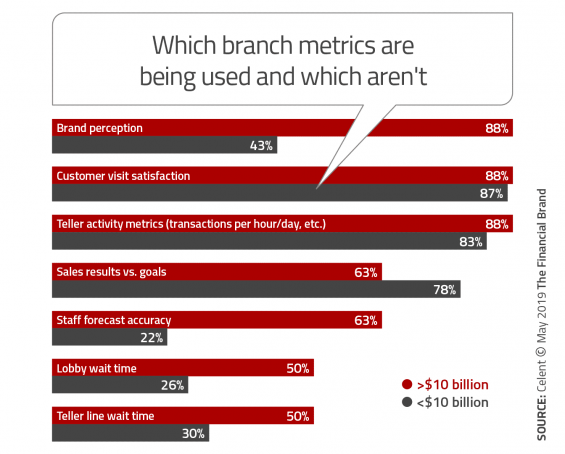

The study found that many banks and credit unions — most notably those under $10 billion, though not exclusively — lack a clear picture of key elements affecting the customer experience. For example, as seen in the chart below, while almost nine out of ten institutions of $10 billion-plus measure overall brand perception, over half of those institutions under $10 billion don’t track this. Teller transactions are well tracked, but the report says that with more routine activity going digital, such measures are less and less relevant.

Lobby and teller line waiting times would be much more important to ascertain, the report suggests, and many fewer institutions track that.

Meara raises another point: “Many institutions are falling all over themselves to perfect the mobile experience for consumers,” says Meara, but they aren’t always striving to do so on the branch front.

By comparison, what makes Apple Stores more than popup showrooms is the Genius Bar all the way in the back, where the perplexed can obtain clarity and the desperate can obtain resuscitation for their digital devices.

What consumer today wouldn’t like to have the assistance of a qualified “Digital Banking Genius”? Yet Celent found that 55% of institutions surveyed don’t staff for such positions at all. One in ten provides a “genius” or a “digital advocate” in all branches, and 35% use them in some locations.

Read More: How Many Branches Can You Chop Before Consumers Make The Switch?

Why Aren’t Branches Tapping Workforce Digitization?

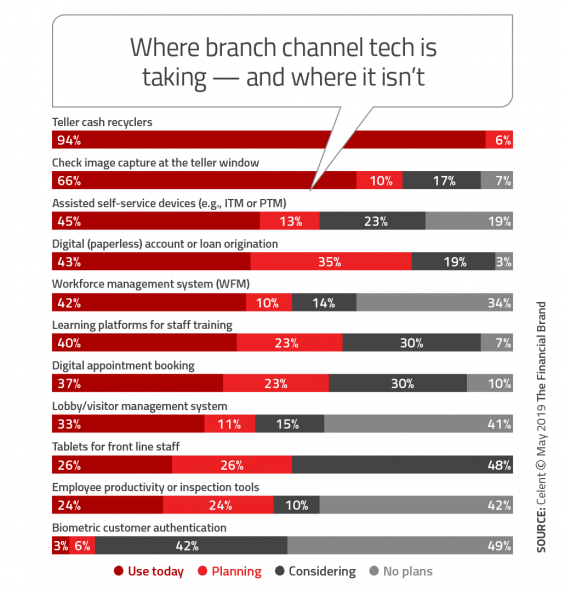

Workforce management systems would help branch officials better manage service quality, but often these aren’t used. As shown in the chart below, while four out of ten institutions use such software currently, 34% don’t — and have no plans to do so. Another 10% are planning to adopt the software and 14% are thinking about it.

“Such software, sets a baseline for having the right people in the right place at the right time,” Meara states. He points out that with limited staffs institutions should be thinking more in terms of optimizing the customer experience with the staff they’ve got, he says.

One aspect of that is cutting the time that branch staff spends on tasks that remove them from consumer contact. The report found that minimizing non-contact time was a lower priority for many institutions under $10 billion — somewhat surprising given the community banking mantra of “great service.” Over the entire sample, two out of three respondents thought that activities taking branch staff away from customers and members “are either not a concern or not a problem needing a solution.”

This astounds Meara, because for about a third of institutions polled, the equivalent of a day’s time is spent away from customers and members each week.

“If I were a banker, I’d want to know exactly how each frontline employee spends their day. I don’t mean that from a Big Brother standpoint, like knowing who’s checking Facebook on company time, but how much time they spend selling, how much advising, versus time spent on compliance, and administrative tasks,” he explains. “In many banks, personnel is roughly half or more of total operating costs. So I would want to know when someone comes to the branch and leaves without having their needs met.”

“I would make that the first thing I saw on my desk every morning,” Meara stresses.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Institutions Aren’t Investing in Modern Branch Tech

Only a small portion of institutions surveyed are investing heavily in technologies that could help optimize use of costly human staff in branches and simultaneously improve the customer experience.

While some tech is widely used, such as teller cash recyclers, usage falls off quickly with other tech that could help. Digital appointment booking is only used by about a third of institutions surveyed and only a quarter of institutions equip frontline staff with tablets, for example.

In spite of branches’ importance to sales, Meara says that many institutions fail to use sales data to reach conclusions about what works and what doesn’t, and how to match good salespeople with those who need coaching.

“It’s not for lack of awareness of these tools,” says Meara. “That much we know.” Nor are institutions being cheap. “I just don’t think they are appreciating the value and importance in investing in some of these technologies.”

Legacy Practices Drag as Much as Legacy Computing

Some executives questioned for the study complained about competition with new channels. Meara noted that the head of ATM services for one of the largest banks in the country said to him, “Bob, I’m competing with the digital people for funds, and I get no respect, I’m just the ATM guy.”

“Maybe there is a little bit of ‘woe is me’ there,” says Meara. “But branch and ATM channels don’t get the priority of digital channels anymore except maybe in some really small financial institutions.”

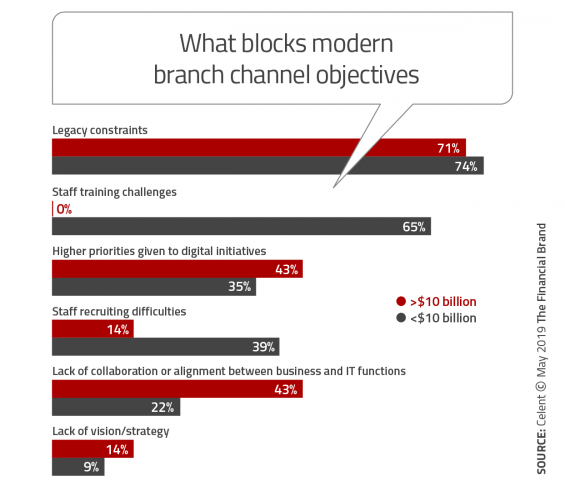

Yet that didn’t show up in the survey. The greatest block among institutions of all sizes to bringing modern tools to branches was “legacy constraints.” Among the barriers cited:

- Legacy onboarding procedures and systems that tie branch staff to desktop computers and paper instead of working with mobile tablets. (Think of how everything from Apple store receipts to Uber bills gets emailed these days.)

- Siloed record systems that prevent frontline employees from understanding the customer journey from end to end.

- Administrative tasks that remain manual and which devour time that could be spent more effectively.