Financial services industry commentators are taking sides to either condemn branch survivalists as deluded, or else describe, in minute detail, exactly what “the branch of the future” will look like.

In reality, even with the rapid growth of digital banking, the brick-and-mortar branch is still alive. And while there is no single template or formula for successful branches, we’re embarking on an increasingly customized path, where physical branches are being revived by adapting to locational and needs-based consumer niches.

While there is no ‘perfect formula’ for branch design in banking, Connecticut-based branch design-build firm Solidus provides 4 keys to retail banking branch survival:

- Branch location and design that reflects digital channel integration

- Expansion of branch personnel duties

- Utilization of multi-sensory marketing communications

- Focus on overarching efficiency

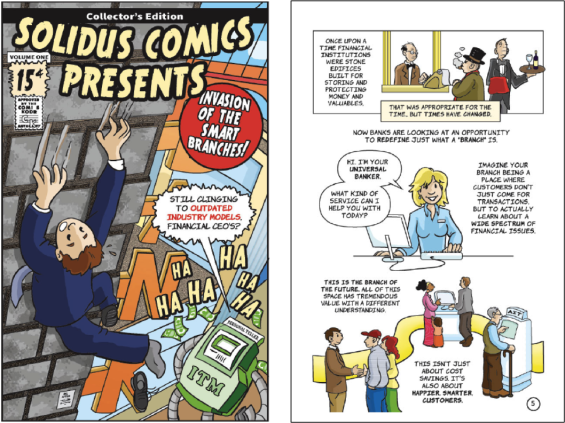

To communicate the vision of tomorrow’s ‘branch of the future,’ Solidus launched a comic book, ‘Invasion of the Smart Branches,’ aimed at bank and credit union C-suite and VPs concerned about the viability of their branches.

While the 16-page full-color digital guide is lighthearted, the message addresses the very serious concerns related to the industry’s most costly, underperforming assets. The guide recognized that many organizations lack the necessary resources to ‘start from scratch,’ and that even fewer may know where to start.

The comic addresses the transition from fortress-like banks of old, to today’s friendlier smaller, more efficient branches. The main message is that the physical branch is about to be rendered extinct unless they adapt to the realities of today’s marketplace.

“We started by visualizing what kinds of things keep bank CEOs up at night, especially those with under-performing branches. The image of a CEO, fretting in anticipation of his next shareholders’ meeting, created the scene we were looking for,” states I. Bernard Hough, Director of Marketing at Solidus. “‘Cartoonifying’ an already compelling business model was like giving the message a big dose of pixie dust.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

1. Bricks + Clicks: Integrating Physical and Digital

Using powerful software and experienced researchers, financial institutions can now leverage reliable data to optimize site selection as part of their growth strategy. Proximity analysis that identifies small business, retail and commercial zones, local competitor branch deposit flows, and demographic profiles are all indicators of a branch’s potential to thrive or fail. Retailers like McDonald’s and CVS pharmacies as well as almost all major restaurant chains have grown optimally due to the application of site location science for years. The banking industry lags far behind these industries.

In response to the decline in branch transactions, physical footprints have been successively reduced over the decades; from as much as 10,000 square feet in the 70’s, to around 3,500 square feet to 2,000 square feet at the turn of the century, to today’s micro-branches that can occupy a space of less than 1,000 square feet.

United Bank in the ShopRite supermarket, East Hartford, CT

The smaller the branch, the more available locations, the less expensive to buy, rent or maintain and the greater the ability to be convenient for a targeted audience. And today, convenience is king.

The financial services industry is currently poised to undergo a personalization revolution to parallel the convenience of custom branches. The so-called ‘Bank of Things‘ (as coined by Accenture) will customize experiences by digitally connecting every consumer to all of their financial relationships, including insurance, health services, real estate investments, loans and even social media interactions.

But the personalized touch will only work in tandem with the human touch.

For the foreseeable future, the key to branch survival is to support the average consumer-in-the-street who still desires warm bodies to advise them when making major investments or purchases, regardless of the digital scope of access to these services. This is where the Universal Banker comes in.

2. Embracing the Concept of Universal Bankers

To increase the effectiveness of physical delivery channels, transaction-based tellers will have to be cross-trained to perform like retail sales associates. Engaging customers with digital tools, such as tablets, the Universal Banker will be able to access personal details to better match needs to solutions. Proficiency with these devices, plus enough expertise to offer reliable counsel, is crucial for success of a Universal Banker.

The multifaceted universal banker role includes (but is not limited to):

- Greeting and guiding customers

- Traditional deposit/withdrawal transactions

- Digital bill paying

- Financial needs assessment based on customer profile

- Relationship expansion advice and facilitation (deposits, loans, investments, insurance, etc.)

- Digital banking self-service education

- Customer relationship development

3. Building Retail Channel Diversity

The true value of smart-branches lies in their retail diversity, not technology. Today’s fetishized “Fortress of Geekitude” will be tomorrow’s obsolete low-tech fossil, usurped by newer machines … but the human touch and human service will never die. For the branch to remain relevant, institutions will need to offer a differentiated experience and advice on money matters the average consumer has yet to learn.

With enhanced retail channels comes improved retail communications as well. Financial institutions are just beginning to embrace the possibilities for effective in-branch merchandising and the digital marketing of products and services. In person, and digitally connected, investment and lending advice, digital connections to various financial accounts and local banking workshops will become more common. And they will be increasingly marketed to information-hungry young professionals.

There’s currently an array of digital kiosks, flat-screen TV’s, interactive walls and endless merchandising displays available to financial institutions for the purposes of shaping customer experience, with still more to come. The coordination of multiple channels within the retail branch environment will assist sales efforts.

Connex Credit Union desk with full video teller service, at Meriden, CT

4. Redefining Efficiency Per Square Foot

It is time to move from a cost per square foot mentality to an efficiency per square foot measurement criteria when evaluating branch locations in banking. Beyond shrinking of branch footprints, efficiency now includes developing LEED-certified projects, utilizing customer-facing audio-visual equipment and installing new cash-counting technologies that can make a branch both more efficient and effective.

Retail companies spend nearly $20 billion on energy each year, according to the US Small Business Administration. Newer branches are being designed according to “green” standards, with energy systems that are more easily tracked and managed. They’re also installing cash recyclers in teller pods that can dispense bills, accept cash and coin, and count thousands of dollars in notes without making a mistake.

As Universal Bankers bring more value-per-employee to the branch through versatility, more basic teller transactions can be performed via remote video links on ITM’s. Video call centers can be staffed by reduced numbers of transaction tellers, eliminating the ‘down time’ common in traditional branch formats.

With improved efficiency using significantly smaller footprints, some organizations may actually increase smart-branch locations in the near-term, offering an expanding array of personal banking services within each unit. Using both permanent and temporary ‘pop-up’ branch facilities, the potential to rethink the traditional banking branch is limitless and could breath new life into branch banking.