While about 60% fewer branches have been opened in the years following the Great Recession, compared to pre-recession years, these newer branches are performing significantly better than those opened earlier in terms of deposit growth.

During my 40-year career I’ve opened more than 1,000 new branches. In most cases, the goal was to generate a positive net income in year three of operation and a full payback of the capital investment by the end of year five. Deposit growth is a good way to measure this performance.

For this report I studied 128 branches open about three years to see how many are likely meeting those goals. This review excludes in-store or supermarket-based branches, as their performance is significantly lower than traditional branches, as well as big “corporate offices” that held more than a half billion dollars in deposits in just three years. New branches that had absorbed deposits from another branch closure were also removed where they could be identified.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Averages Mask Big Differences in Deposit Growth

Most new traditional branches cost about $1 to $3 million to build and $750,000 to $1 million annually to operate. In some rural areas, costs might be lower and in some big cities like New York, costs could be significantly higher. For this review let’s use $1 million annual expense as an average. To generate positive cash flow in the third year of operation, the branch would need to have at least $25 million in deposits that year, assuming a fully loaded 4% spread (including fee income).

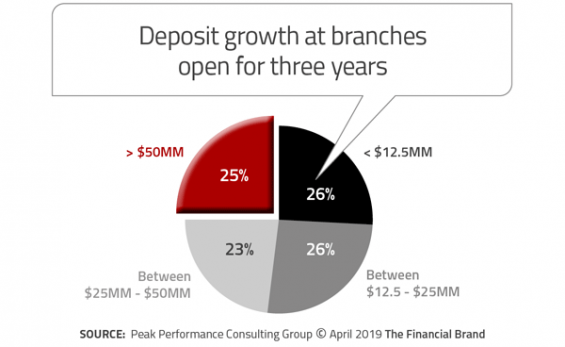

The 128 traditional branches overall exceeded the goal, with average deposits of $39 million after three years. That figure works out to be slightly more than $1 million per month deposit growth, which I’ve found to be a good target for new branches. However, we all know averages can be misleading. Fully half (52%) of these new branches had not yet gathered at least $25 million in deposits after three years. In fact, a quarter of them aren’t even half-way to the goal. This bottom group is growing deposits less than $4 million a year, not nearly enough to generate a positive cash flow anytime soon.

At the top end of performance, 25% of these new branches have gathered more than twice the target level in the first three years. They are likely generating over $2 million in annual revenue. These broad differences make you wonder what’s different about these two groups of branches.

Impact of Market Size and Demand Differences

In the poor-performing group, just over one in four (27%) were built in rural (non MSA) areas. These areas have smaller population bases and generally have very low population density, two factors important to branch performance.

In the good-performing group, none of the branches were built in non-MSA areas. Over the past several years, the largest banks in the country have closed hundreds of branches, most of them in more rural areas. In fact, during my time leading retail distribution strategy and execution at Bank of America, exiting small, low opportunity markets was a key element of the overall strategy. Those markets offered less opportunity and growth.

Furthermore, nearly half (47%) of the branches in the good-performing group were built in the ten largest MSAs in the country, versus only 9% for the poor-performing group. Simply put, bigger markets not only have more opportunity, but they also tend to have more densely populated core cities. I’ve found that more densely populated markets yield greater opportunity in individual branch trade areas.

Read More: Don’t Abandon Branches to Favor Digital Banking Channels

Local Trade Area Powers New-Branch Deposit Growth

Using a five-minute drive time around each branch, I compared daytime households in the likely trade area to determine if local demand makes a difference. The daytime household metric was developed to adjust Census households — which counts where people are at night — to reflect where they are during the daytime when branches are open for business.

In my experience, daytime household count is a better predictor of branch success than residential households.

As you might expect, there are great differences between the good and the weak performers. In the good-performing group, just over half (56%) of branches exceed 10,000 daytime households in the local market and 91% have more than 5,000 daytime households (the rule of thumb for minimum demand). In the poor-performing group, only 27% of the branches have more than 10,000 daytime households in their local trade area, and only 52% have more than 5,000. If there is limited demand locally, it is very difficult to grow quickly.

The “Retail” Location You Choose Really Matters

Beyond market characteristics, I’ve found that location setting and site placement have a huge impact on sales performance, and thus deposit growth.

• Large retail shopping center with busy anchor (generally grocer or big box) and numerous smaller retailers and other draws.

• Community center with smaller anchor or limited small retailers. Limited community draw.

• Generally strip centers with small retail store fronts.

• No local retail nearby.

“Location setting” refers to the type of retail center where the branch is located, such as a grocer-anchored community center or a big-box-anchored center. These two types are generally the best for retail branches.

Other center types include smaller community centers with no major anchor or an off-brand anchor (e.g. dollar store or hardware store), strip centers (a smaller collection of small stores), and even non-retail areas (medical office complex, industrial park, etc.).

Downtown locations offer their own unique challenges and can range from great-to-poor, depending upon concentration of employment. I evaluated all these new branches on the quality of the retail draw at each branch’s location.

What I found is that nearly 60% of good performers are at the two best types of locations, compared to only 27% of poor performers. Also note that 20% of poor performers are isolated and not near any of the retail draws.

Going to the bank is a chore, and consumers still like to bundle chores, so it’s best to be near other retail draws to make it convenient for people.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Assessing the Effects of Site Placement

The main considerations of site placement are visibility and accessibility, but services offered, building size, parking and appearance all matter too.

If consumers can’t find your branch because it’s a small in-line storefront with limited signage, that’s a problem. If it’s visible but hard to access, that’s a problem as well.

• Hard-corner, free-standing with access from both streets. Parking, 24-hour ATMs; usually has drive-up.

• Free-standing, but not at hard corner. May be at entrance to shopping center; clearly visible.

• Store-front, inline space not clearly visible from street. Rarely has drive-up.

• Hard-to-find or small in-store; limited capabilities.

The best sites are free-standing buildings with drive-up capabilities at hard corner intersections with dedicated parking. They get visibility from both streets, may have multiple access points, and should have plenty of parking. The weakest sites are buried in-line space and supermarket branches due to their limited size and visibility.

As with locations, the good performers are also more likely to be good sites. Nearly 91% of good performers are at the best sites, compared to only 52% of poor performers.

Let’s wrap up this brief analysis by saying that there are many factors that can impact new branch deposit performance, but at the end of the day it comes down to the following:

- How big and densely populated is the overall market?

- Do I have enough local demand and the right market conditions to support a new branch?

- Is it a good location with the right type of compatible retailers to enhance the draw/appeal of my branch?

- Can I secure a good site that is visible and easy to access at that location?

These factors apply to your current branches too and might help to explain their historical performance. Perhaps you should ask yourself “How do my branches stack up?”