As innovative technologies and new digital tools continue to reshape the retail banking landscape, consumer preferences and patterns of behavior are also shifting. Few places are these changes more visible than in the brick and mortar channel. Branches — and how consumers utilize them — aren’t anything like they were just 10 or 20 years ago.

A new survey from Kronos and FMSI examines why people visit branches, the types of transactions that they need help with, and when they prefer to consult on their financial needs. The study found that branch service plays a crucial role in the context of an omnichannel delivery strategy.

The findings revealed that many consumers still crave a face-to-face experience with a financial professional, despite rapid adoption of mobile- and self-service solutions. But that doesn’t mean consumers will waste their time standing in a queue or sitting around waiting in a lobby for the next available representative. According to the research, what they really appreciate is the ability to schedule an appointment in the branch of their choice, preferably using a scheduling tool in their institution’s mobile app.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Fractional Marketing for Financial Brands

Services that scale with you.

What Are The Most Popular Times People Schedule Appointments?

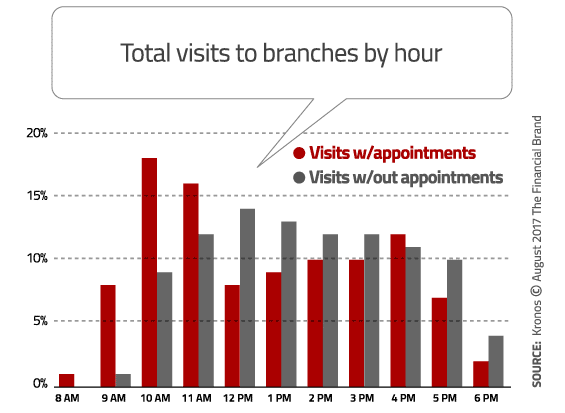

Researchers looked at data from nearly 1,500 appointments scheduled across more than 160 branches in North America to identify patterns and preferences for both time and day of the week. Interestingly, the study found that branch visits scheduled by appointment outnumber walk-in traffic during several prime business hours, specifically during the morning and late afternoon hours. Consumers most frequently scheduled appointments for the 10:00 am, 11:00 am and 4:00 pm hours. In comparison, walk-in traffic during these times was typically low, spiking instead during the noon lunch hour.

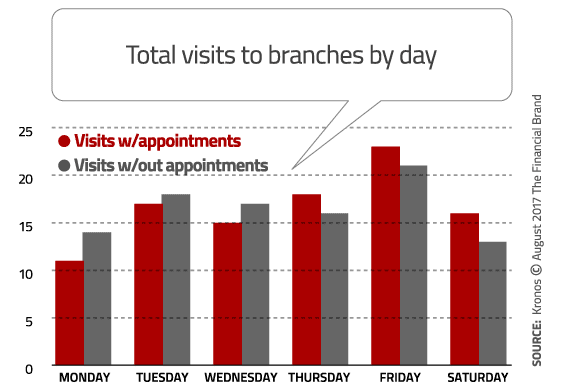

Fridays have traditionally been the busiest days in branches, a trend reflected in the study. However, visits by appointment outpace walk-ins on Fridays, as well as Thursdays and Saturdays. This suggests that people want take advantage of the option to book appointments on days when they know branches will be busy.

The study also quantified appointments kept vs. no-shows. The vast majority of accountholders who took the time to schedule an appointment showed up and met with branch staff. In fact, 84% of appointments made were completed; 12% were canceled prior the appointment, and only 4% were no-shows. Among no-shows, 43% occurred during the 9:00 am and 10:00 am time slots. For appointments made during these times, financial institutions should send reminders to consumers the day before.

What Do People Schedule Appointments For?

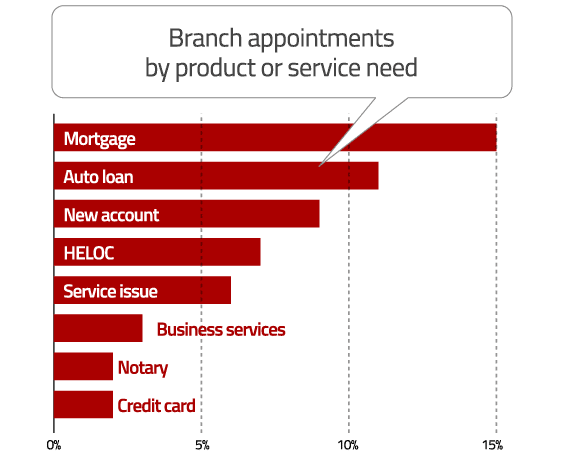

Researchers also identified the types of services requested by consumers scheduling branch visits. The majority of the appointments involved high-value products — lending consultations, consumer loans, mortgages, auto loans and home equity loans/lines of credit. This finding highlights the continuing role and relevance of branches with respect to loan revenue.

Additional categories consumers specified when scheduling appointments included new membership enrollment (for credit unions), account service questions, business services, credit card issues, and requests to have documents notarized. For financial institutions, allowing consumers to schedule appointments can help with scheduling staff. When you know in advance what services, assistance and expertise people will need, you can ensure that the right people are available at the right times.

Clicks and Bricks: A Modern Marriage

The implementation and use of appointment-scheduling apps in banking shows how technology is revolutionizing the retail experience in every industry. Companies like Sprint and Apple also offer their customers the option to schedule appointments rather than stand in line at a store, and McDonald’s is experimenting with touchscreen kiosks where customers can place their order, pick up an in-store locator, and have their meal delivered to their table. Starbucks and Subway offer apps that allow customers to pay for purchases and accrue special discounts and other promotions. Such innovations are creating a more efficient, personalized experience that acknowledge consumers’ preferences, save them time and/or money, and can reward their loyalty.

The results of the study suggest several strategies financial institutions should consider to improve frontline service and branch efficiency and productivity:

Make the omnichannel experience easy. For all the attention that mobile and other digital channels receive, keep in mind that account holders will gladly welcome new delivery options… but they are reluctant to surrender the ones they are already using. They expect that existing channels will remain in place, not be replaced. Offering a mobile appointment app can underscore that your institution offers a full range of options, and places a priority on convenient access. Even those consumers who rely heavily on digital channels will appreciate the option to schedule appointments when they need guidance from financial professionals on more complex matters.

Optimize frontline resources to drive service and revenue. Inviting account holders to schedule branch appointments saves them time and simultaneously provides branch managers with valuable data for smarter scheduling. Financial professionals trained to provide specialized services can be scheduled to meet demand and be ready to serve with the appropriate materials lined up in advance to streamline the interaction. You can also offer more specialized services on specific days and/or at certain locations. As a result, employees spend less time waiting for customers, and — more importantly — management can increase branch efficiency, improve productivity and decrease costs by optimizing staff resources.

Take a data-driven approach to branch sales and service. Appointment scheduling tools and lobby tracking software provide useful information about what services account holders want and when they are most likely to visit a branch for the kinds of interactions that result in increased sales. Detailed information about branch traffic patterns can guide decisions about scheduling, sales training and marketing based on demand for services at each location.

Additional analysis and management tips based on the Kronos/FMSI study are available for download in a PDF white paper.

Chad Davis is Senior Industry Marketing Manager, Financial Services Practice Group at Kronos, a leading provider of workforce management and human capital management cloud solutions. Kronos industry-centric workforce applications are purpose-built for financial institutions of all sizes. To contact Chad, you can send him an email.