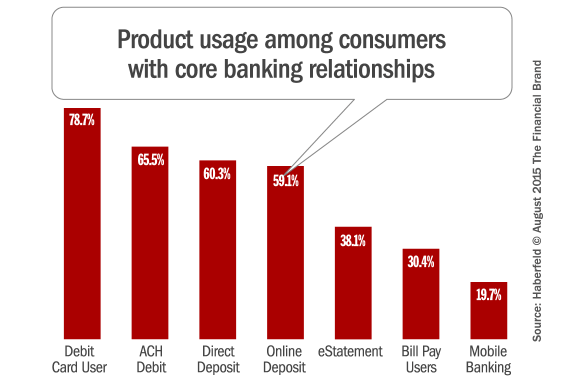

Digital channels are now an integral part of the banking industry. In today’s environment, it would be hard to imagine anyone having a relationship with their primary financial institution without these channels. Indeed, 60% of consumers globally now say they primarily utilize online channels. This is right in line with research from Haberfeld encompassing several million U.S. households holding checking accounts at community banks and credit unions. The top performing community financial institutions in this study led with “sticky” statistics — high penetration with debit cards, direct deposit and online services.

Transitioning from transactional to digital channels can lead bankers down the wrong path with respect to customer acquisition. Financial industry marketers and executives often say they want to attract younger customer segments and consumers who will be more driven by non-traditional channels (e.g., Millennials). In turn, financial institutions frequently look for the solution to customer acquisition almost exclusively in the online channel.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

New PFI Relationships: Online vs. Traditional

Drawing on more than two years worth of data, Haberfeld tracked traditional vs. online checking account openings at over 15 financial institutions ranging from $200 million in assets to over $5 billion in assets. Customer acquisition was a strategic priority for all financial institutions studied. They all invested marketing dollars into traditional marketing (e.g., branches and direct mail), as well as digital channels (e.g., online advertising and social media). During the study participating financial institutions opened 340,384 total checking accounts — an average of roughly 350 accounts per branch per year. But only 8,867 of these were opened online (2.6%).

The study drilled down and examined a six-month slice where over 50,000 new checking accounts were opened. The results were consistent. Only 1,989, or 4.13%, were opened online. The results suggested that financial institutions in the study would see of roughly 200 new checking accounts opened online per year. Even then, 37.7% of online account openings were initially generated through a traditional channel such as direct mail.

Not Much Quantity… What About Quality?

The average age of the new customer attracted from both online and traditional channels is almost identical. Both segments spend $40 per average debit card swipe, however, the online acquired customer swipes their card 35% more often. The online acquired customer has a significantly higher number of overdrafts per year – almost double! While there are definitely some positive trends on fee revenue opportunities, the outlook is not as good when it comes to balances, share-of-wallet, and customer retention.

| Avg. Age |

Avg. # of Monthly Debit Swipes |

Avg. Spend Per Debit Swipe |

Annualized Overdraft Items Per Account |

|

|---|---|---|---|---|

| Accounts Opened Online |

39.0 | 17.5 | $39.90 | 7.73 |

| Accounts Opened in Branches |

39.3 | 13.0 | $40.43 | 3.99 |

Source: Haberfeld Associates

Consumers opening their accounts online have significantly lower balances — 41% lower checking deposits and 57% lower household deposits. They may have higher loan balances, but their retention rate is 16 percentage points lower than accounts opened the traditional way.

| Avg. Checking Balance |

Avg. Balance of All Deposits |

Avg. Balance of All Loans |

Retention Rate After 6 Months |

|

|---|---|---|---|---|

| Accounts Opened Online |

$2,200 | $3,406 | $5,210 | 77.3% |

| Accounts Opened in Branches |

$3,741 | $7,897 | $3,372 | 90.5% |

Source: Haberfeld Associates

If you are considering online account opening or already offer it, where does that leave you? Opening checking accounts online is not wrong, but it is not the panacea that will satisfy the industry’s desire to get more tech-savvy and younger consumers. Be aware that you will likely get a more transitional and fee-based customer, and that it won’t likely drive new the kind of growth most financial institutions would. Just because people open accounts online doesn’t mean you can assume (1) you don’t need traditional channels to make it happen, and (2) that the people you attract will reflect the desired profile you might anticipate — e.g., primarily self-service, preference for digital channels, and (most importantly) profitable. Your branches, your people, your core products and associated policies still have tremendous impact on your success with customer acquisition.

Achim Griesel is Chief Operating Officer at Haberfeld Associates, providing customer acquisition marketing and profitability strategies for community-based financial institutions across the United States. Haberfeld provides consulting, marketing and training services for community banks and credit unions, building off its unique data and benchmarks through the analyses of millions of consumer banking records at community institutions across the country.