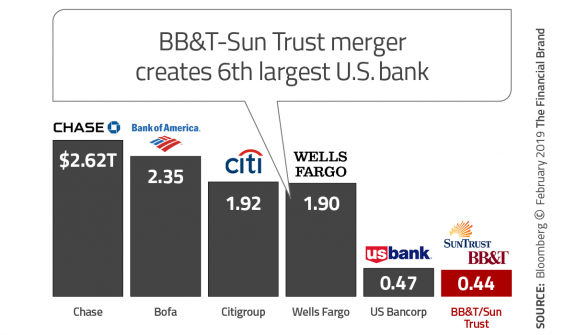

The announced merger of regional powers BB&T and SunTrust, with combined consumer banking assets of over $400 billion, would create the sixth-largest financial institution in the U.S. The rationale, explained in the joint press release, was to be in a better competitive position against larger traditional financial organizations as well as big tech firms like Facebook, Amazon, Google and Apple, that are increasingly introducing financial products. The deal is the industry’s biggest since Bank of America’s $40.5 billion takeover of Merrill Lynch in January 2009.

“We face a fundamental choice: disrupt our business, or be disrupted,” stated BB&T’s CEO Kelly King. “Our clients now demand what I call ‘real-time satisfaction.’ They want what they want, when they want it,” King explained in an interview.

Addressing these challenges takes money — lots of it. In the merger announcement, the banks told investors that they have allocated millions in additional technological investments as part of their future plans.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The rationale for the merger of two regional banking leaders was to grow enough to be better positioned in the quickly changing banking ecosystem. They stated the belief that growing was one of the only ways to survive in the future from a cost, innovation, technology and product perspective.

The question is, can smaller financial institutions survive as well? Are the benefits and value proposition of traditional small and mid-sized institutions enough to compete going forward? How important are the benefits of using data and advanced analytics to meet the increasing expectations of current and prospective customers? Is the current positioning of smaller banks and credit unions enough to grow, or simply support status quo? Finally, are traditional customers changing enough that they will ignore inertia and switch to more progressive banking organizations?

Reality Check: Digital and technological changes are happening faster than ever before, and they will never happen this slowly again. Winners in the banking industry will be determined by those organizations able to invest in the technologies that will drive digital transformation, be able to further cut costs reflective of distribution realities, and recruit the talent necessary to disrupt themselves.

If successful, the BB&T+SunTrust merger could be the first of several deals in the banking industry. The number of commercial banks insured by FDIC has been in decline for decades, dropping more than 40% since 2000 to just 4,774 institutions, but mergers have been concentrated among small banks.

According to JP Nicols, an international expert on the banking industry, another wave of consolidation is overdue. “Most banks’ ROE is below their cost of capital, and their efficiency ratios are too high,” Nicols says. “Predicting the next one is hard because merger math can be complex, but not nearly as hard as trying to handicap board and management egos. One of the things that has been holding back that wave has been unrealistic price expectations from potential sellers. But these CEOs aren’t getting any younger, and too many of them have kicked the can down the road about as far as they can.”

Banking Battlefield Redefined

The digital technology gap between the biggest financial institutions and the rest of the industry has never been bigger. Research by the Digital Banking Report on customer experience, digital account opening and onboarding, the use of artificial intelligence, and the ability to deliver personalized solutions all show that the biggest banks in the world are moving at a much faster pace than regional or community banks.

While there are some exceptions, and evidence that some credit unions are making needed changes, evidence indicates that the odds are stacked against smaller organizations. Government regulations don’t help. Many of the compliance changes put in place to help smaller banks have created a cost burden that impacts the ability to invest in advanced systems and technology.

The redefinition of the banking battlefield is also impacted by the continued proliferation of fintech start-ups that have focused on small segments of banking such as lending, savings, financial management tools, etc. The vast majority don’t have a bank charter, but are partnering with established banks to either go it alone or offer services in an open banking model.

According to CB Insights, venture capital spending on fintech start-ups was close to $40 billion globally in 2018, more than double the amount in 2017. And not all are small start-ups. According to CB Insights, there are now 39 fintech “unicorns,” valued at more than $1 billion.

The competition also includes the large technology companies that have become household names. Not only do consumers trust these firms comparable to traditional financial institutions, but they are becoming more and more willing to partner with these firms for various financial services. While much of the focus has been in the payments sector up till now, the potential for leveraging vast amounts of consumer data and advanced digital systems positions many of these firms as a potential threat.

According to Brett King, “Consolidation is inevitable, especially among those where digital transformation has lagged. As costs of servicing customers through branches increase, and interaction through branches decline, rollups of this sort will attempt to consolidate back-end costs while pooling assets. That’s a short-term fix to the problem of a fundamental shift in retail banking economics. By 2030 we can likely expect 30-40% of existing banks to go under or be consolidated this way. Big players like HSBC and Deutsche are clearly at risk because of their lack of digital maturity and overreliance on traditional branch networks.”

As the impact of digital consumers (which extend well beyond Millennials) increases, decisions around who to bank with become more defined by the ability to deliver best-in-class mobile and online services, as opposed to being “convenient” or “friendly.” This puts the traditional competitive differentiation of smaller organizations at risk — especially when fewer and fewer consumers visit branch offices to do their banking.

Cost Cutting Conundrum

Most banks are currently facing a cost-cutting conundrum. Most of the cost-cutting efforts over the past decade have been successful. The challenge is that there is little cost cutting potential available without either a significant structural change, or a reduction in physical assets that most banks have avoided up until now. In other words, to cut costs further will require either a significant investment in technology and restructuring and/or a closing of branches.

Because of these choices, many in the investment community believe the BB&T+SunTrust merger may be the tipping point for future consolidation of the industry. One benefit of the just announced combination of regional giants is the ability to reduce overhead and benefit from bigger scale and scope.

BB&T closed 148 branches in 2017 and had announced plans to close about 150 more in 2018. The merger of two overlapping organizations should result in significant consolidation between the banks. The chief financial officer at SunTrust stated that the banks have more than 3,100 total branches, with 24% of BB&T’s and SunTrust’s branches being within 2 miles of one another, creating “opportunities to reshape and modernize our brick-and-mortar footprint.” This also frees up capital and may set the stage for several more regional consolidations in the near future. The combination is expected to generate an estimated $1.6 billion in net cost savings by 2022, the companies said.

Not everyone is praising this combination though. “At the risk of ticking off my friends at the two banks – and contradicting other analysts who are positive about the merger – the combination of these two banks is a real snoozer as far as I’m concerned,” states Ron Shevlin. “What is BB&T getting beyond an opportunity to cut costs here? Not much, and I don’t mean that as a slight to the folks at SunTrust. Previous megamergers in the banking industry at least helped the acquirer expand its physical footprint. The more interesting acquisitions in the space are those like Capital One acquiring a design firm, or banks taking stakes in firms with emerging technologies (e.g., TD Bank acquiring Layer 6). Bank of America and Wells Fargo must be drooling anticipating the opportunity to go after BB&T and SunTrust customers. Well, if Wells fixes its mobile banking app it will be drooling.”

This transaction may not be the last merger of regional giants, made possible by easing regulations and the U.S. tax overhaul, which helped financial institutions build a war chest to spend on acquiring new clients and technology. However, the banking industry will be closely watching how regulators react to the BB&T+SunTrust deal. If it succeeds, the mega-merger could usher in an era of deal-making. If it is blocked, the decade-long drought of banking consolidations would likely continue.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Technology and Innovation Positioned for the Future

The stated basis for making this merger, as stated by both banks, is that it will allow the combined organization to innovate and develop better technology than either could have done on its own. They plan to reinvest $1.6 billion in projected cost savings from the merger into technology and innovation, according to the investor announcement.

“The combined company will take advantage of its enhanced scale to focus on selecting best of breed systems and processes and making significant investments in technology to create a sustainable competitive advantage in an increasingly digital-first world,” according to the investor statement.

The companies also plan to create an innovation and technology center at the merged organization’s new headquarters in Charlotte, N.C. This is an interesting move for organizations currently headquartered in Winston-Salem (BB&T) and Atlanta (SunTrust), but not completely unexpected given the vast wealth of young tech talent in the Charlotte area. In fact, Charlotte was named the top location in the U.S. for find tech talent according to Forrester.

Disrupting Culturally Conservative Organizations

Cutting costs and investing in technology is not enough. With a history of being culturally conservative organizations, both BB&T and SunTrust may find that the most difficult part of the merger is in the disruption of legacy cultures. Moving a headquarters to Charlotte doesn’t assure a cultural change any more than a potential name change.

“Our shared culture embraces the disruption of technology and we will take this innovative mindset to expand our leadership in the next chapter of these historic brands,” explained William Rogers, Jr., Chairman and CEO of SunTrust. “With our geographic position, enhanced scale and leading financial profile, these two companies will achieve substantially more for clients, teammates, associates, communities, and shareholders than we could alone.”

This is a noble mission, but far harder to change than a back office system. This is why some of the largest financial institutions are developing digital-only banks – it’s hard to stop bankers from being… well, bankers. As stated by JP Nicols, “Merger math beyond asset size and geography is complex. Add in executive and board egos, and they are so hard to predict.”

Another challenge is consumer perception of the merger. Bank mergers often move consumers to consider alternative financial partners as they become acutely aware of even the smallest change in their relationship that may not have caused concern before a merger. Despite vast communication and PR efforts, mergers can create changes that consumers won’t like – from branch closings, to redesigned mobile or online banking sites, to new products. The question will be whether the consumer gets an improved digital banking option, better value or a better customer experience out of the blocks.

Finally, while the combined BB&T+SunTrust leadership said they will introduce an entirely new brand, is this the best strategy? Jeffry Pilcher, CEO/President of The Financial Brand and former branding consultant to the banking industry states, “They should carry the SunTrust brand forward. To most consumers, BB&T will be a meaningless jumble of letters. It’s an acronym that isn’t very differentiated. Even when you expand ‘BB&T’ out to ‘Branch Banking and Trust Company,’ it still sounds bland and undifferentiated, and it’s certainly dated. No one in banking wants to tether their brand to the branch-based models of the past (even though the origin of the word ‘branch’ was a person’s name).”

Pilcher continues, “Suntrust has a lot of good things going for it. The ‘sun’ component in the name evokes themes of warmth and power. ‘Trust’ has positive connotations in the banking industry. Comparing the two logos, SunTrust is the winner — hands down. Its radiant and colorful geometry is fresh, contemporary and structured. BB&T, on the other hand, looks blocky, stiff and dated.”

Pilcher concludes, “There’s no need to throw both brands out and start over. Capitalize on the brand equity and strengths of SunTrust and go forward.”