The digital banking competitive marketplace in the U.S. seems to be heating up again, after years of relative inactivity compared to other markets worldwide. While legacy banking organizations have focused on improving digital bank offerings, with much of the activity (and market share) going to the big 5 banks, a challenger bank from Europe and a brand new digital offering from Chase Bank are looking to shake up the banking ecosystem.

The Berlin-based mobile bank N26 (originally known as Number 26) announced plans to enter the U.S. market, representing the first non-EU market for the challenger bank. U.S. consumers can sign up for a wait list immediately and will be able to open an account beginning in mid 2018. According to N26, the offering for U.S. customers will be similar to the existing bank account currently available in the European market with additional services tailored to the U.S. market.

Europe’s First Mobile Bank Looking to Duplicate Success in U.S.

In Europe, N26 has reached 500.000 customers across 17 countries, only 2.5 years after its launch. The exponential growth has been primarily organic, driven by recommendations of N26 customers who prefer a digital banking experience as opposed to requiring the services of a physical branch.

“As a fully mobile product, we don’t own or operate bank branches, making it easier to scale and reach customers who might not typically have access to digital financial services. Branches are expensive and difficult to maintain. We pass these savings to our customers,” states N26.

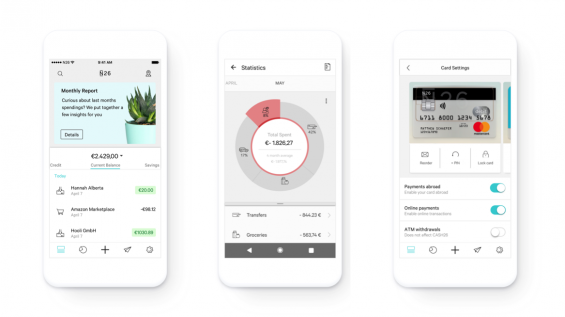

As a digital-only bank, N26 develops products as a mobile-first application, as opposed to traditional banks that usually add on a mobile interface to legacy infrastructure that often dates back to the mid-70s. Simplicity, transparency and a specially designed rewards program are at the foundation of the N26 product offering.

From the seamless digital account opening process (an account can be opened entirely on a smartphone within eight minutes of applying) to accessing account statistics, every functionality uses a bare minimum of taps on a phone. Debit cards can be locked and unlocked instantly within the N26 app and customers can receive real-time push notifications with every transaction they make … in real time.

Valentin Stalf, Founder & CEO of N26, stated: “We believe that N26 is a role model for the bank of the future. Customers around the globe are looking for a new banking experience, as user behavior among Millennials has shifted dramatically towards a mobile experience. The US is an exciting new market which offers a huge opportunity for N26. We offer easy-to-use, transparent, and contemporary banking for all customers looking for modern, mobile banking.”

The bank will initially offer a checking account with full use of a debit card, digital money transfers, cash withdrawals at ATMs, and an attractive customer rewards program customized for the U.S. market. Changing a PIN, setting payment limits, and locking or unlocking functionality online and abroad will be possible in-app.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Over time, N26 intends to expand their service offering with the goal of being a one-stop shop for the digital banking needs of its customers. In Germany, N26 has leveraged partnering with other fintech firms to launch credit lines, peer-to–peer money-transfer services (through TransferWise), savings accounts (Raisin), investment services (Vaamo), and insurance products (with German insurance platform Clark). It is expected that separate partnerships will be built for the U.S.

As has been done initially by digital-first banks such as Moven, Simple and BankMobile, N26 will be using a partner bank to streamline regulatory requirements. As with the digital-only banks that preceding them, N26 is going to take care of the user-facing features, while a third-party chartered bank is going to manage the money.

N26 currently operates in Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain and employs 290 people. The Berlin-based startup has raised more than $55 million from investors to date.

Read More: Digital Payment Platforms Are Poised To Take Over Cash

Chase Becomes First Major U.S. Bank to Offer Mobile-Only Alternative

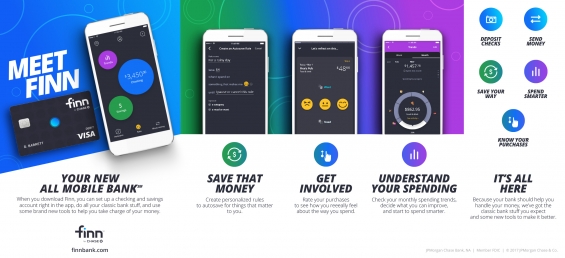

In reaction to the exodus from physical to digital banking by an increasing number of consumers led by Millennials, JPMorgan Chase & Co announced the introduction of a new smartphone app named Finn. Finn by Chase, will allow customers to use a phone to open a bank account, make deposits, issue checks, track spending and set up savings plans.

Finn debit cards will be delivered by mail, with an initial test of the mobile account for Apple phone users in St. Louis, where Chase has no branches. Chase plans to market Finn in other U.S. cities and for Android phones in 2018, with mobile enrollment being targeted to the bank’s standard checking and savings account customers later in 2017.

The bank says the design of the Finn product was done by working closely with Millennials for more than a year to understand their unique money challenges and what influences their spending. Chase states that research found that emotions played a large part in the decisions of Millennials, but that they didn’t have a way to understand the impact it had on their financial lives.

“When it comes to money, Millennials told us they don’t want to feel like they’re being judged,” said Bill Wallace, CEO of Digital at Chase. “So, we designed Finn to put them in charge, no matter where or how they’re spending.”

Some financial management tools being offered by Finn that are geared to Millennials include:

- Rate purchases: Customers can rate transactions as something they “want” or “need,” and assign emojis for how those purchases made them feel.

- Automatically build savings: Customers can save by setting personal automatic saving rules on their terms, like saving $5 every time they go shopping. This makes saving more automatic and painless.

- Stop overspending: Being a prepaid debit form of product, Finn only lets customers spend what they have.

Read More:

- Advanced Analytics And The Future of Digital Lending

- Digital Borrowers Expect Money in Seconds… Not Days

The Finn app is supported by Chase’s digital account opening platform, which allows consumers to sign up directly from their phone and start banking in minutes. The Finn debit card will provide fee-free access to more than 29,000 Chase and other ATMs. Location of fee-free ATMs will be available within the Finn app. About two-thirds of Chase customers continue to visit branches at least once every three months, according to the bank. “This is for a different set of customers,” said Melissa Feldsher, head of Finn.

With the cost of expanding beyond the 23 states where Chase has branches, the new Finn app may provide a low cost source of new deposit customers, especially among the highly coveted Millennial segment. Expanding with a mobile app like Finn also doesn’t require additional regulatory approval.

The Beginning of a New Wave of Mobile Banking Alternatives?

While challenger bank activity has been robust worldwide, the influx of mobile-only banking alternatives has been lackluster in the U.S. Moven and Simple are the most prominent examples of mobile-only banks in the U.S., with Simple having been acquired by BBVA, and Moven adjusting their business model, partnering with traditional banking organizations like TD Bank and other organizations worldwide with great success.

Could this be the beginning of a new wave of mobile-only offerings in the U.S.? Could the introduction of new digital banking alternatives jump-start both non-traditional fintech growth and expanded use of open banking APIs for the development of expanding financial offerings?

Obviously, only time will tell in a market that has lagged virtually every other country worldwide in banking innovation and the loosening of regulatory requirements. Suffice it to say that the banking ecosystem in the U.S. is prime for transformation and the potential of new financial solutions expected by increasingly digital consumers.