The accelerated shift to digital channels for the opening of new relationships in banking changed many of the components of value. No longer was the new account opening experience driven by direct human interaction. Instead, consumers selected where to do banking based on the ease of the process and the speed of engagement.

While many organizations would love to go back in time and encourage branch-based openings once again, consumer behavior is indicating that the past will not be revisited. As a result, financial institutions must focus on the post-sale onboarding process, leveraging data and analytics to drive a digital relationship deepening process that reflects real-time consumer needs as opposed to organizational product objectives.

Read More:

- Most Financial Institutions Still Make Banking Too Difficult

- 21 Steps to Building a Killer Onboarding Strategy in Banking

Fractional Marketing for Financial Brands

Services that scale with you.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

New Digital Customers Have Lower Initial Value Than Branch-Based Customers

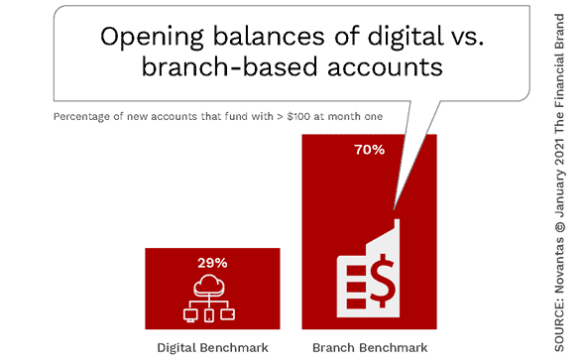

Novantas research found that while banks and credit unions have done relatively well in shifting new customer origination to digital channels, the size of initial balances and longer term value of the relationship have often suffered. For brand-new accounts, Novantas found that only 30% of digital accounts were funded with more than $100, compared to 70% of branch-originated accounts.

When values after four months were analyzed, the new-to-bank balances originated in branches were up to ten times higher than those accounts originated digitally at some organizations. In no instance were branch balances after four months less than double the digital opening balances.

This is not because less valuable customers are opening digital accounts. Instead, this reflects customer experience gaps between the way accounts are onboarded in person as opposed to using digital channels. And, the impact is not only in balances generated.

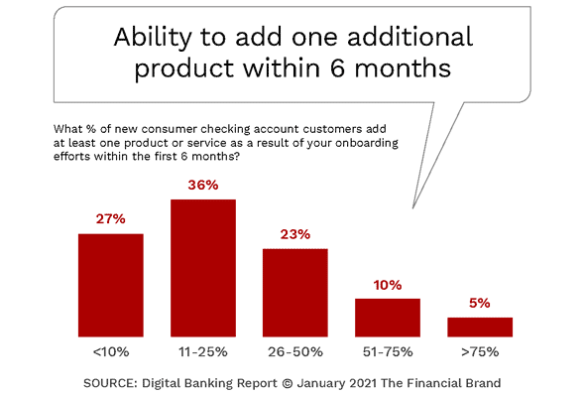

In research conducted by the Digital Banking Report, only 15% of financial institutions worldwide were effective in selling a single product within six months of account opening. More disappointing is that 65% of banks and credit unions sold a product or services in less than one in four instances. This not only impacts future revenue potential, but retention of relationships as well. Bottom line, without an aggressive onboarding process, the value of new digital accounts opened are less likely to reach maturity.

“Banks don’t make it easy to form relationships online,” according to Novantas. “The emotional attachment and information exchange that is driven by a personal account-opening experience just hasn’t been replicated in the digitally-led environment.” In many instances, the focus on speed, standardization and simplicity ignores the importance of creating personalized experiences and educating consumers on product benefits.

How can these challenges be addressed? For many organizations, there is the need to completely revamp current onboarding processes that lack depth of communication, personalized service recommendations, timely engagement, and multichannel integration. Interestingly, organizations should also consider re-engaging existing branch personnel to assist in the onboarding process.

Current Onboarding Processes Lack Depth

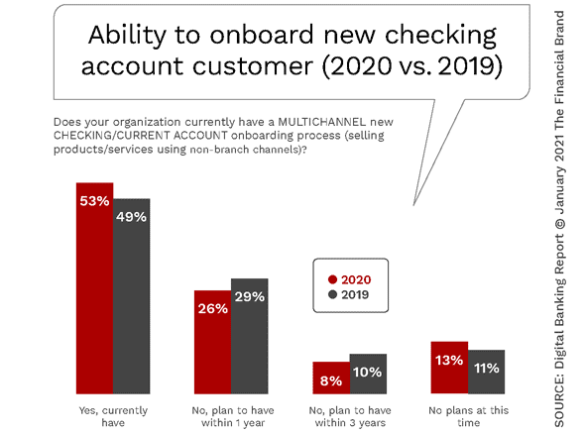

The Digital Banking Report has found that, despite the importance of engaging with new relationships after the initial sale, a disturbing number of organizations (47%) still have no formal onboarding process. As more accounts are opened on digital channels, this lack of communication leaves the building of a relationship entirely up to the consumer. This pattern is not optimal for the financial institution or the new customer. The lack of a formal onboarding process for new loan customers is also lacking, with less than half of financial institutions (45%) saying they communicate with the customer after a new loan is booked.

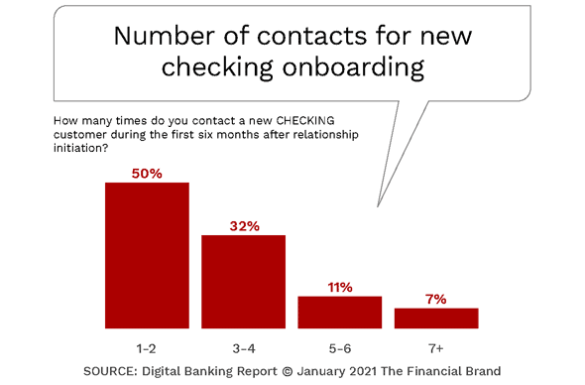

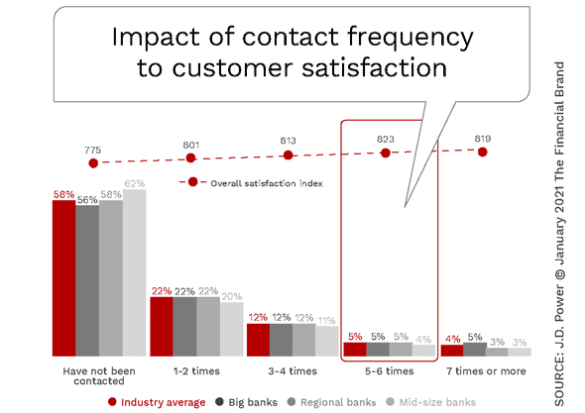

When organizations that had an onboarding process were asked how extensive their communication process was, 50% stated that less than two contacts were made with the customer to expand (or secure) the relationship. Again, this level of engagement is far from optimal. According to J.D. Power, customer satisfaction increases as the number of customer communications increase – up to seven messages in the first six months.

Onboarding Challenges that Continue to Dog Financial Institutions

As the process of account opening have shifted to digital channels, the importance of targeting, personalization and onboarding become much more important. As consumers move away from opening new accounts in a physical facility, financial institutions must move from a lead-generation mentality (propensity to buy) to a expected value targeting strategy driven by stronger offers and simplified processes. Strategies such as a higher rate (or incentives) for higher balances can help to address low initial balances.

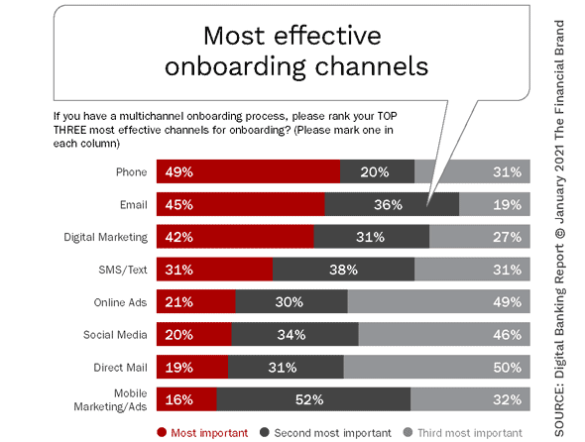

Even when incentives are provided for higher potential relationships, it is still important to simplify the access to related products and services, encourage engagement with local branch personnel, increase customization of communication, and leverage all channels possible. Often, organizations don’t leverage the most effective channel (SMS messaging) that combines timeliness with high open rates.

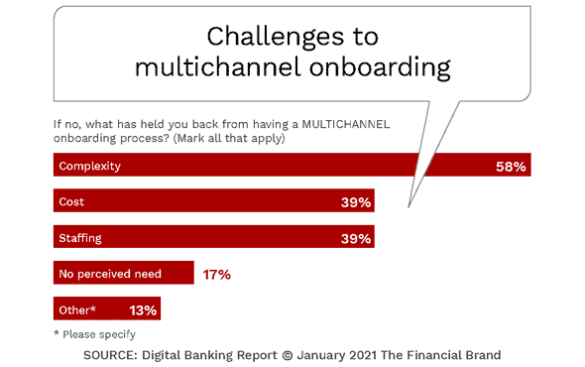

According to research done by the Digital Banking Report, there are several challenges that stand in the way of effective onboarding in a digital world. The most mentioned challenge is the complexity of developing an onboarding process (58%), despite many solution providers who can provide effective support for a new onboarding process.

After the complexity, the most mentioned challenges in the research were the cost and staffing required for effective onboarding (39%). The question is, can organizations afford not to create a way to make new relationships profitable?

Read More: Multichannel Onboarding Trends in Banking

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Building an Onboarding Process in a Digital World

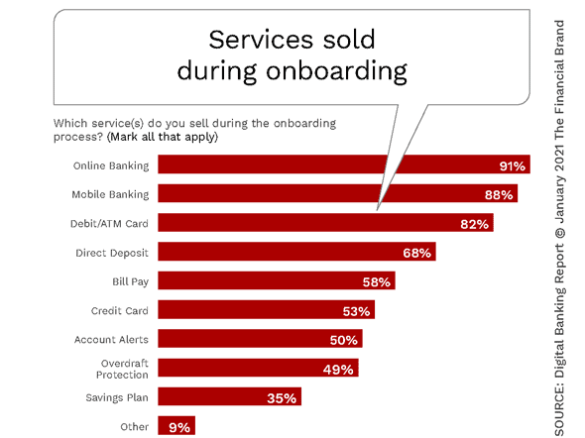

There are many ways to create and execute an effective onboarding process, but there are still some very clear similarities in the objectives and strategies for new customer engagement after account opening. The most important step for almost all new customer communications begins with an email, direct mail, text or phone call that encourages the new customer or member to set up online and/or mobile banking accounts as well as direct deposit/mobile deposit. The sooner this is done, the better. The benefit presented is for the customer to have 24/7/365 access to their account which improves account management capabilities.

Just because there has been an increase in digital account opening does not mean branch engagement should be ignored. In fact, the importance of quick engagement from the team at the nearest branch may be greater than ever. According to Novantas, “Digital teams must coordinate better with their front-line branch counterparts where excess capacity is underutilized, and the technology to distribute and manage distributed calling has been battle-tested during COVID-19 temporary closures.”

Another key to success is to reinforce the level of personalization you used to acquire the new account even after the relationship has been initiated. Unfortunately, most financial institutions use a one-size-fits-all approach to onboarding as opposed to building a contact strategy that reflects the individual customer journey that has just begun. Each new customer should get a customized series of messages on the channels most likely to be effective. Machine learning and AI can assist in this effort.

Bottom line, there is a requirement that the communication be customer-centric as opposed to product-centric. The key is to continue to reinforce why the product purchased (and additional engagement services) will benefit the new customer. In addition, you need to make sure the message relates to their specific lifestage situation as opposed to generalizing the message. Personalization can be around insights collected as part of the new account opening process, demographic data, product usage insights acquired as the account is used over time, and even real-time contextual engagement delivered when a need is identified.

Every year, roughly 25% of organizations state they are planning to build and execute a new account onboarding program in the next 12 months. Never has this commitment been more important. It is clear that not only do current onboarding programs need a major refresh, but those organizations that do not have an onboarding process on the front burner need to prioritize the investment in onboarding immediately.

The pandemic has proved that financial institutions have the ability to be agile in the development of processes never before put in place. This same level of urgency is needed to maximize the value of new digital accounts.