It is clear that digital experiences and expectations are being set by industries and platforms outside of banking. From Amazon shopping to Uber ridesharing, consumers are expecting digital engagement to be quick and easy to initiate and use over time.

Despite these increased expectations, a new study from Deloitte Center for Financial Services found that the majority of consumers (73%) found the account opening experience at banking organizations favorable to registration experiences in many other industries. They even understand that regulations require more insight to be collected and that the process many involve many steps.

Despite the overall satisfaction, however, an increasing share of consumers – primarily Millennials under 35 years old, mobile banking users, and newer customers – want an improved process. In other words, while current, less digitally proficient customers accept the status quo, the expanding digital consumer base wants a process that is faster, more intuitive and more contextual.To respond to these consumer demands, banks and credit unions will need to invest in improved technology to improve the digital interface with customers and members. There is also the need to leverage internal and external insights that can improve the sales process.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Younger, Digital Consumers Most Demanding

The Deloitte study found that younger, digital consumers were the most likely to be dissatisfied with digital channel interfaces. In fact, of those who believed the account opening process needed to be improved, 42% were under 35 years of age. And, although only 5% of respondents opened an account through a mobile application, these consumers were far more likely to say the process needed improvement.

As was discussed in the 2017 Account Opening and Onboarding Benchmarking Study, financial organizations should not become complacent when looking at the low percentage of consumers who currently open new accounts via mobile devices. This is because most organizations don’t provide a strong mobile opening option, and since this channel is the fastest growing for new customers. Existing customer with a shorter tenure (under 5 years) also were the most demanding of an improved digital account opening experience, according the the Deloitte research.

Account Opening Compared to Other Early Engagements

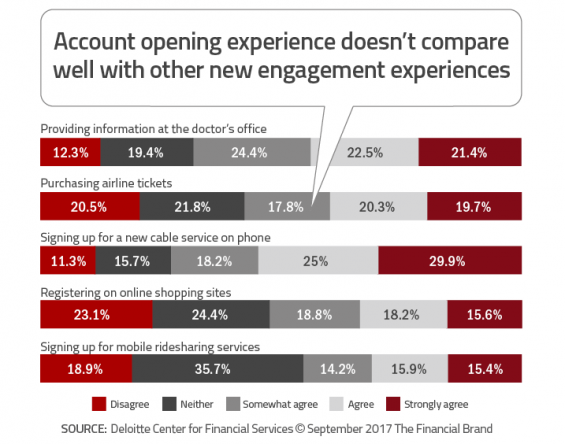

When consumers were asked about bank account opening experiences versus other early engagements in other industries, the impressions were varied. While account opening in banking compared well to providing information at a doctor’s office or signing up for a new cable or phone service, the process was considered more difficult than signing up for online shopping or ridesharing services.

Part of the tolerance for friction and complexity may be due to the understanding that consumers have around regulatory requirements that are not part of early engagements in other industries.

To help improve the account opening process — especially for Millennials — Deloitte provided the following five suggestions based on a deeper understanding of those who were less satisfied.

1. The Need for Speed

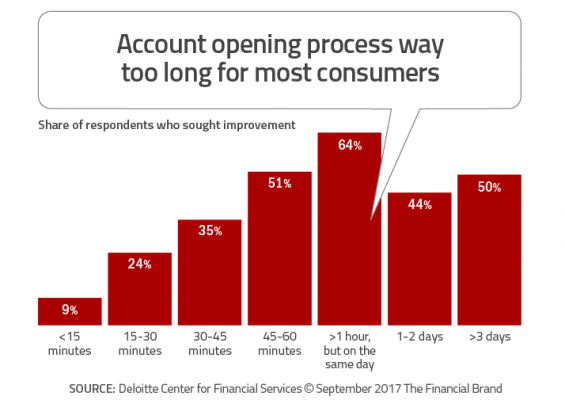

The time required to open an account was one of the most correlated variables to the level of satisfaction among Millennials and digital consumers. For example, a need for improvement was 5 times more likely to be mentioned if the new account opening process took 45-60 minutes than if the process took less than 15 minutes.

2. Don’t Over-Promise

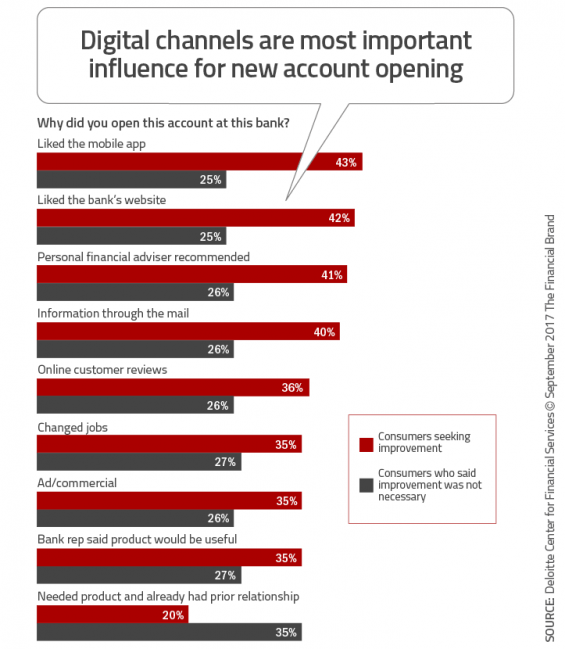

Consumers who were more likely to want improvement were also more likely to open an account due to liking the organization’s mobile app or website, or to be influenced by external stimuli (advisor recommendation or direct marketing). This points to the need to meet expectations that are being set in the marketplace as it relates to digital engagement.

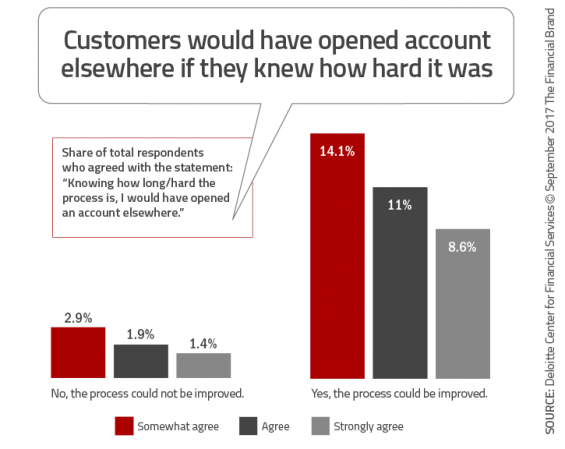

Not surprisingly, those customers and members who believed the acount opening process was in need of improvement also would have considered an alternative organization in hindsight if they knew how long the process took.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

3. Clarity of Communication

According to the Deloitte study, digital consumers wanting an improved account opening process believed their institution did not provide clear documentation or direction. These consumers considered themselves more financially astute, indicating a higher level of expectations up front.

4. Better Integration of Cross-Selling

Consumers who thought the account opening process could be improved were more critical of the way cross-selling is currently done. Most of these consumers did not think the sales recommendations were insight-based, again supporting the reality that digital consumers are more aware of what organizations can/should do with insight collected.

5. Post Account-Opening Follow-Up

Surprisingly, most of those who sought an improve account opening process were frustrated by the lack of post-opening follow-up by their bank. In fact, many customers did their own post-opening follow-up, requesting clarity about their account(s) not provided initially.

Preparing for the Future

More and more consumers are looking to use their mobile device to research, purchase, transact and engage. To meet the expectations of this growing population of digital-first consumers, banks and credit unions must provide the opportunity to open new accounts easily on a smartphone.

Beyond supporting a mobile account opening process, organizations must provide the technology and insight for front line staff (and digital applications) to engage easily and advise accurately. Engagements must be personalized for each customer, with cross-selling to be intelligent and contextual.

Finally, organizations need to remember that the new account process doesn’t end with the account opening itself. The process needs to include ongoing communication to satisfy an increasingly demanding consumer.