More than 1,500 FinTech enthusiasts and 70 companies wanting to showcase their newest innovations converged on New York City during fashion week for Finovate Fall 2015, the premier FinTech event of the year. In a series of short, 7-minute demonstrations, the newest products were presented during the two-day event, encompassing solutions from payments to security, and from artificial intelligence to improved analytics and blockchain technology.

Each year, certain technologies or themes come to the forefront at Finovate, addressing a previously under met need in the industry. This year, innovations in the categories of digital account opening and multichannel onboarding were front and center, demonstrating how removing friction and building engagement from the initiation of a banking relationship can improve revenues, reduce costs and improve security.

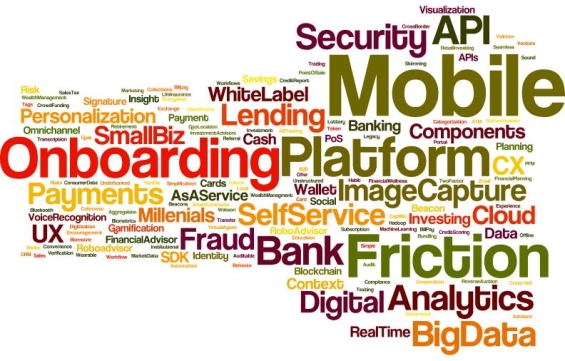

Dan Latimore from Celent agreed that removing friction from both the onboarding and mobile account opening process dominated the event, as he assigned two to eight words describing each presentation to develop a word cloud. His recap of the event can be found here.

In an effort to improve the customer acquisition process, reduce checkout abandonment, and provide an omnichannel banking experience that would continue after the digital ink is dry on the opening documents, new and existing competitors in the FinTech space demonstrated how much better new account opening and onboarding can get in banking. As has been covered in the Digital Banking Reports entitled Guide to Multichannel Onboarding and Digital Account Opening, most banks fall short in creating a positive customer experience during either of these stages of the customer journey.

Below are short recaps of the presentations done by firms hoping to improve new account opening and onboarding in banking. They are presented in the order in which they demonstrated their innovations at Finovate. A special thanks to William Mills, CEO of William Mills Agency, Steven Ramirez, CEO of Beyond the Arc, and Julie Schicktanz from Finovate for assisting with the recap of the demos and events.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Fractional Marketing for Financial Brands

Services that scale with you.

GRO Solutions

Gro Solutions is an online, mobile web and native mobile app account opening solution for use by both the financial institutions’ customers as well as their employees. Similar to other digital account opening solutions presented at Finovate, Gro Solutions limits manual text input, thereby reducing common high abandonment rates. According to Gro, “Whether online, on the go, or at the branch, financial institutions can open and fund new accounts in less than four minutes.”

Gro Solutions is an online, mobile web and native mobile app account opening solution for use by both the financial institutions’ customers as well as their employees. Similar to other digital account opening solutions presented at Finovate, Gro Solutions limits manual text input, thereby reducing common high abandonment rates. According to Gro, “Whether online, on the go, or at the branch, financial institutions can open and fund new accounts in less than four minutes.”

One of the unique features of the Gro Solution technology is that it can tell whether the users phone is from Verizon or other carrier and pre-populates the basic customer data. Leveraging the OCR capability of a mobile phone, not only can data be collected from a driver’s license, but image capture technology can be used to take a picture of a credit card to fund the deposit account seamlessly.

IDmission

![]() IDmissionis entering an increasingly crowded marketplace, providing a simplified new account opening process using digital technology to replace traditional paper-based documentation.

IDmissionis entering an increasingly crowded marketplace, providing a simplified new account opening process using digital technology to replace traditional paper-based documentation.

Their new product, INFORM, is a fully configurable enterprise product that enables building sophisticated user experiences without any programming. This includes document management, image processing, biometrics, online calls, rules configuration, workflows, and payments integrated into a cloud platform infrastructure. They claim that banks and credit unions can use INFORM to leapfrog the market in 3 dimensions – KYC, onboarding and payments.

ID Analytics

![]() ID Analytics wants to make it easier to open and use accounts in a secure digital environment. Instead of lengthy new account opening forms and cumbersome authentication processes, the ID Analytics real-time solution uses sophisticated matching analytics to fill in the required data fields instantly, verify the consumer’s identity, and score the applicant for identity fraud.

ID Analytics wants to make it easier to open and use accounts in a secure digital environment. Instead of lengthy new account opening forms and cumbersome authentication processes, the ID Analytics real-time solution uses sophisticated matching analytics to fill in the required data fields instantly, verify the consumer’s identity, and score the applicant for identity fraud.

Powered by the ID Network®, the solution automatically and accurately confirms valid identities in real time with the input on only a few pieces of information. For example, all a customer may need is a name and last 4 digits of a social security number. The backend database verifies identity and provides a risk assessment to identify fraudsters.

ebankIT

ebankIT offers financial organizations the opportunity to deliver a truly integrated multichannel banking solution through online banking, mobile banking, branches, social media banking, account managers, TV banking, call centers, kiosks and even through wearables.

ebankIT offers financial organizations the opportunity to deliver a truly integrated multichannel banking solution through online banking, mobile banking, branches, social media banking, account managers, TV banking, call centers, kiosks and even through wearables.

The ebankIT solution allows consumers to choose what channel they want to use depending on location and preference. Some of the applications discussed at Finovate included the integration of beacon technology to drive offers to mobile devices, digital account opening, smart watch integration and voice banking.

One of the benefits of the ebankIT solution is that a consumer can begin an interaction using one channel (mobile while at home) and end it in another (SmartTV or Internet Banking). According to the presenters, “this brings the financial institution closer to the promise of true contextual banking in which financial services become seamlessly embedded into the lives of individual and business customers.”

Adobe

While somewhat of a surprise presenter at Finovate, Adobe demonstrated how financial institutions could create digital content, deploy it across media and devices, measure and optimize it over time and achieve greater business success. They also demonstrated how financial institutions can transform current complex paper forms and document transactions into much more engaging digital experiences, on any device which can improve both the new account opening and onboarding processes.

While somewhat of a surprise presenter at Finovate, Adobe demonstrated how financial institutions could create digital content, deploy it across media and devices, measure and optimize it over time and achieve greater business success. They also demonstrated how financial institutions can transform current complex paper forms and document transactions into much more engaging digital experiences, on any device which can improve both the new account opening and onboarding processes.

By leveraging the Adobe Marketing Cloud, financial institutions can personalize digital content (that was previously paper-based) and even automatically insert targeted offers into forms to increase cross-sell rates, while personalizing communications through preferred channels.

Using technology from Adobe, it was clear that even those organizations not ready to completely transform back office operations or customer-facing technology can improve the customer experience through the elimination of paper.

Avoka

Avoka demonstrated a code-free way of delivering an experience that allows a customer to apply for one product and seamlessly onboard into additional products such as deposit, loan, or card offerings, simplifying the delivery of digital products and services. With Avoka Transact Bundles, a financial institution can design an onboarding experience independent of the limitations of an existing core system, improving cross-sell rates.

Avoka demonstrated a code-free way of delivering an experience that allows a customer to apply for one product and seamlessly onboard into additional products such as deposit, loan, or card offerings, simplifying the delivery of digital products and services. With Avoka Transact Bundles, a financial institution can design an onboarding experience independent of the limitations of an existing core system, improving cross-sell rates.

By not requiring additional data input or leaving one product platform for another, banks, credit unions, and wealth managers, Avoka’s digital commerce platform improves customer acquisition and reduces abandonment.

In the demo, the user signed up for a checking account and filled out some demographic information that took about 90 seconds. Without having to repeat processes, three product applications were completed in 3 minutes including adding checking account, credit card and retirement account, thereby improving the overall customer journey.

Lexmark

Lexmark demonstrated a significant customer enhancement to its Mobile Onboarding Platform – a frictionless mobile onboarding process driven by interactive and instructive natural voice recognition along with a virtual collaboration session to e-sign the application in real time.

demonstrated a significant customer enhancement to its Mobile Onboarding Platform – a frictionless mobile onboarding process driven by interactive and instructive natural voice recognition along with a virtual collaboration session to e-sign the application in real time.

The demonstration illustrated multichannel onboarding where the customer is guided along the new account application process with instructions and guidance in natural language trained for this specific purpose. The applicant can interact with the platform in plain English to correct data extracted from their driver license, advance to the next step, initiate a same session video chat to collaboratively e-sign the new account application in real time, and finally to submit the completed application.

In the demo, the presenters browsed CNN, where an advertisement for home equity credit appeared. The applicant can drive the application process with voice, using a driver’s license to extracts critical data. Voice recognition was then used to fill out the form with simple questions, finishing within 60 seconds. The applicant can then connect to a live agent, walking the user through the process, which includes e-signature. After completion, an email welcome pack can be sent to the user immediately.

Learn More About Digital Account Opening and Multichannel Onboarding

The Digital Banking Report provides in-depth insight into how today’s financial institutions are reaching the digital consumer. Two publications available for purchase include the 66-page “Digital Account Opening” report and the 59-page “Guide to Multichannel Onboarding” report.

Both are available for purchase individually, or as part of an annual subscription. Both reports go into significant detail on the best-in-class processes being used by organizations globally, and provide case studies and links to additional research on these important topics.