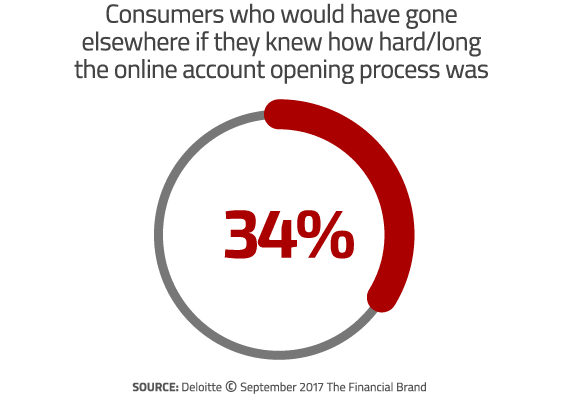

High abandonment rates continue to plague banks and credit unions that offer online account opening. Ironically, an industry that’s so singularly focused on providing a positive and engaging digital banking experience continues to fall short of consumers’ expectations when it comes to opening accounts digitally.

Today’s online account opening enrollment process must change. Abandonment rates are ridiculous — 40% or more, according to reports. Opening an account through the digital channel can often take more than 15 minutes, which simply doesn’t cut it for today’s consumer who won’t settle for anything other than a simple, streamlined digital experience.

The online account opening process at most banks and credit unions struggles with redundant and repetitive steps that often require applicants to navigate an irritating series of screens. Consumers can also be required to enroll for online banking separately, meaning more forms. Disjointed experiences break the seamless digital banking process, requiring applicants to supply duplicate information.

If you’re going to offer online account opening, it should be fast and easy, because first impressions count, and it only takes one lousy experience to tarnish your financial institution’s reputation. The issues must be addressed.

Those financial institutions that can build and deploy the right online account opening solution with a laser focus on experience design will enjoy a clear advantage with respect to attracting and retaining customers.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Here are six quick tips to help improve the online account opening enrollment process. These tips will help form a well-defined foundation to provide quick, secure mobile account opening.

1. Create a highly intuitive, mobile-optimized applicant experience that addresses current and future device usage trends. Effective online account opening designers understand their audience.

2. Provide direct integration into a digital banking platform. The more seamless the enrollment process with a banking platform, the better the overall experience will be for the user. Quite often, using third-party account opening solutions result in slower enrollment times, and the possibility that the third-party approach is using legacy desktop workflows that hinder speed and may result in errors that lead to increased abandonment.

3. Find innovative, easy ways to automate information collection that don’t rely on manual input. For example, consider using mobile capture to pull customers’ information from their driver’s licenses. Doing so allows for pre-population based on current account details, and reduces manual input errors while expediting the enrollment process.

4. Consider automated regulatory compliance with the Customer Identification Program (Know Your Customer), the Office of Foreign Assets Control and Bank Secrecy Act. Today, this automated approach can be achieved with a number of software-as-a-service companies providing fast and thorough monitoring and risk management.

5. Automate decisioning and approval. A configurable, automated process that will decision application approvals based on an institution’s risk tolerance is a must. A configurable process will ensure low-risk applicants can begin banking almost immediately.

6. Engage in real-time monitoring and reporting to identify application trends. Financial institution staff should be able to view real-time application information with the ability to customize products and disclosures. In addition, there will be occasions when they will need to manually review applications, as with a higher-risk applicant.

Read More:

- What The Heck Is Wrong With Online Account Opening?

- Is Your Online Account Opening Process Driving People Crazy?

- Measuring and Reducing Friction in Account Opening

Good UX Makes The Right Impression and Grows Relationships

Forward-thinking financial institutions would benefit greatly from extensive design research that keeps pace with market trends, so they can quickly translate insights into iterative prototype testing and bring improvements to market more quickly. In the end, the best online account onboarding process will be one that identifies and addresses usability issues before the solution is deployed.

According to data from Mitek, the quality of the customer experience has an extremely high degree of correlation to acquisition and adoption of new products and services. Online account opening enrollment is often the first touch point a new customer has with a financial institution, and the importance of making a great first impression can’t be underestimated. An investment in usability research and design will ultimately result in account holder growth and profitability.