How many years does it take for financial institutions to fully understand and meet the needs of women customers? Quite a few, apparently, as the industry still needs to create greater financial inclusion and literacy for women. Banks and credit unions have touchpoints with consumers every day with payments, savings, borrowing, retirement planning and more. Given the breadth of these relationships, and the opportunity they present, providers should work to consistently support the needs of women.

It doesn’t take a savant to see the potential of this market. The evidence has been there for years. Some industry experts estimate there is at least a $700 billion revenue opportunity globally from better serving women across all areas of financial services. And this opportunity will only grow as women increase their control of more wealth, buying power and financial decisions.

Financial institutions today are investing in new products and technologies that deliver improved connections and customer experiences. The potential connection points with women should not be overlooked.

Some Progress, But Far from Complete

Women have been locked out of financial discussions for many years across many cultures. Part of the gap is related to cultural differences, but a country’s economic health also plays a part. In some countries, notably in Sub-Saharan Africa and Asia, women are not involved in household decisions about spending their personal income.

While conditions for women are much better in Western Europe and North America, it was only 50 years ago in the U.K. that married women were not allowed to have a bank account without their husband’s permission. Today in the U.S. more than half of married Millennial women leave all financial decisions to their husbands.

We are making progress and mindsets are shifting, but we still have a long way to go. Even in this modern age, women often do not feel comfortable talking about or dealing with money.

It is time to create more discussion, debate, and work to ultimately change the relationship between women and financial institutions. There should be impatience and pressure to drive better returns through diversity and inclusion. Banks’ and credit unions’ business strategies should embed more financial inclusion for women in actionable plans.

When we look at women as a segment, its size and importance become clear. Women now:

- Control two-thirds of consumer spending.

- Hold 40% of total global wealth.

- Account for 40% of entrepreneurial activity worldwide.

- Are the main breadwinner in 49% of U.S. households.

Furthermore, over the next decade we will see the greatest wealth transfer in history with more than $30 trillion in wealth passing from Baby Boomers to their children and their heirs. Women’s share of private wealth is expected to grow dramatically.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Women Are Not One Segment

So, what should be done? To dig deeper into this opportunity, we recently commissioned a research report with Cornerstone Advisors to better understand differences in how men and women manage their finances and to identify their perceptions, attitudes and beliefs about this topic. We also asked how they view their financial services providers.

Along with a survey of U.S. consumers, we interviewed financial services executives (mostly women) to gain their perspectives. Our research considered that the experience and beliefs of one woman are not the same as those of another woman.

“We cannot treat women as a single customer segment — that approach will fail.”

— Scott Woepke, Acxiom

We cannot treat women as a single customer segment — that approach will fail. There are important factors that must be considered including age, race, ethnicity, educational levels, marital status, profession and income.

Bank and credit union marketers need to be thoughtful how they interpret the data and create value propositions to meet the needs of women. In fact, some industry experts feel that developing services and solutions for women will not only benefit women, but will benefit all customers. Improving “marketing to women” is not the answer; nor is hiring more female sales personnel or financial advisors to support women. The challenge is more complex.

Financial Wellness Points to a Solution

Banking has been gravitating to the topic of financial wellness recently. Providing actionable advice and intelligently engaging with consumers about their finances has gained increased importance.

Several newer companies such as Ellevest and SmartPurse have built services and tools to support women that take into account the differences in women’s lives, such as average lifespans, pay gaps, career breaks, salary curves and other factors. These companies are embracing the mission of improving financial wellness for women.

Recent events, driven by COVID-19, have demonstrated how vulnerable consumers are with respect to their financial wellness. Unfortunately, this situation is exacerbated for women as it deepens pre-existing inequalities. Some of the industries hit hardest by job cuts and layoffs (retail, hospitality, tourism) are industries where women are over-represented in terms of employment.

Delivering convenient services plays an important role in addressing this, and integration into the “real lives” of women is important. Banks and credit unions should adapt and find ways to help women save time and put them in more control of their finances.

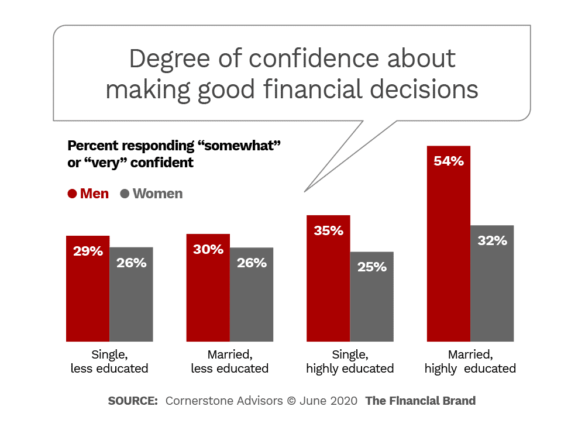

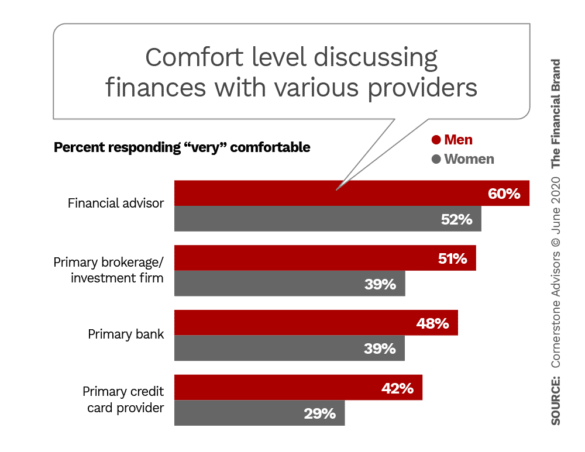

There has been much discussion about providing services that recognize consumer life stages and life events, and there is also a need to understand the realities of women’s lifestyles. Generally speaking, most women are not very comfortable talking with their financial providers about their finances. Nor are they as confident as men on average about their ability to make good financial decisions.

Read More: How Bank Marketers Can Forge Human Connections in a Digital World

Key Differences in How Financial Decisions Are Made

Discussions about finances are very personal and need to be tailored to each individual. While men and women primarily learn about financial matters through general discussions with various people, from family members to professionals, women still find family conversations to be a key source of learning. Only one category of financial service provider (financial advisors) made more than half of the women surveyed “very comfortable” discussing their financial lives. Banks did not fare nearly as well.

Collaboration as a pathway for building financial knowledge is typically very different for women and men. Women will often lean toward consultation, while men tend to prefer autonomy. Developing tools that enable better collaboration (i.e. account aggregation, spending analysis, budgeting and investing) can improve the situation.

While improvements have been made to balance approaches to customers by gender, there needs to be a new wave of progress to reach the ultimate destination. Financial institutions play a unique role in society and must strive for greater financial inclusion and literacy for women. By doing so, the new propositions and services will be better for all customers.