Note: If you’d like your bank or credit union marketing project featured on The Financial Brand, please complete this questionnaire here.

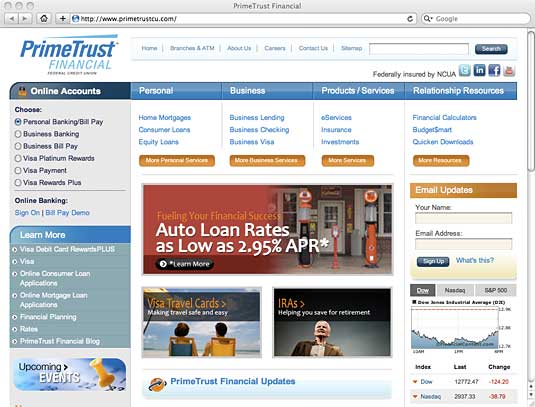

Name of financial institution: PrimeTrust Financial (Federal Credit Union)

Project description: Rebranding and rebuilding marketing structure

Budget: $500,000 to $560,000 annually

Geographic area served: Community charter serving East Central Indiana

Website: www.primetustcu.com

Assets: $144.5 million

# of branches: 3

# of members: 17,650

Facebook: PrimeTrust-Financial

Twitter: PrimeTrustFCU

LinkedIn: PrimeTrust

Blog: PrimeTrust

Objectives: To move the credit union from a limited product and service line/line of business units, and customer base to a modern financial institution to meet the following goals: new community charter, new brand, production, support commercial lending and wealth management areas, new product and service development, and infrastructure investment in MIS and MCIF/CRM/database-target marketing areas.

Target audience: Expand consumer base to access more financial/credit users that maintain higher balances.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

Background/Overview: (All answers provided by David Parmerlee, VP of Marketing and Sales.) The situation I inherited three years ago was really not a marketing driven organization. I have tried with limited resources to build the kind of marketing that a small credit union or community needs to be competitive. Branding can be a huge drain on your budget, and has a two to three year investment (minimum) before you can see the beginning of new consumers making moves to move accounts from the competition. With a small little $500,000 annual budget and one other person in the marketing department, a new brand change was a difficult goal to obtain.

I also had to invest in pricing models (software) we did not have to calculate rates. This includes price point/schedule profitability, cost to income allocating (converting to an ABC shop), and building customer profitability capabilities to identify our customer base by profit levels (product relationships to balances – weighted towards credit/loan products). In addition, we have no IT department. We outsource the management of our file server and any and all enhancements to a company four hours away, so any changes to the system for a current or new product or service (not to mention compliance) spells doom. This also means we had no MIS. So I had to spend money to build an MCIF/CRM/Database Marketing data manager resource that again is outsourced to a company another four hours away. This includes MIS tracking of lead generation performance, all new this month after three years of effort.

We also had to change our charter to a community based credit union and we had all types of new products — commercial lending, wealth management, investments, insurance, expanded mortgage products, etc.) to support — doing all this; while pushing a target market/market segmentation data analysis and new creative upgrades for a direct mail effort to support and reach production goals of new originations in the loan departments, added for fun to our new branding actions. We had no rewards products for debit card or Visa; we do now. We had no pricing strategies related to relationship pricing; we will soon. We had no competitive intelligence; we do now, but continue to upgrade. I’ve had to build a new credit union from a marketing data, branding, business, finance/accounting, and sales point of view – driven by marketing.

Therefore, in elevating and transforming a marketing department from a small communication and event planning focused department, has been a real challenge in building a new brand internally and externally. Creating a culture of selling compared to servicing has been a hurdle. Building a brand as you know is more than changing a logo…in this case, it is about repositioning a 75 year old credit union’s identity and value proposition. Building a brand that motivates people and businesses takes more than a new creative appearance. At PrimeTrust Financial, we are trying to generate growth while building the infrastructure to support it all.

What was the basic strategy and solution behind this project?

Position the credit union with a brand ID that says “we offer a plan,” that we can provide the resources to make the right decisions regarding managing customer’s financial needs and therefore select the best mix of products/services. One of the biggest component of the credit union’s rebranding strategy involved changing the name from WGE to PrimeTrust.

The old, clunky, dated name and logo are shown left, next to the newer, more modernized brand identity.

Were outside vendors needed, and what did they do?

Working with a small budget and internal IT limitations, outsourcing was the key approach we employed. They provided selective creative, market research, MIS/MCIF, and IT support.

How did this project integrate branches and front line staff?

We worked with staff to make sure they were trained on all new aspects of the changes to credit union. This included new processes and procedures related to marketing, customer service, operations, etc.

What was the most difficult part of the project?

Having a small staff and budget, being resourceful was the key, but still it is an almost impossible job to be able to function as a credit union and make the changes required on a timely basis.

What were the results?

Marketing is an investment over the long term. Therefore our results are on-going… with a large future benefit. We did experience initial positive results in the form of new production activity with mortgages, and doing so by seeing results in the form of new money (75% of all mortgages originated were either new loans or loan balances transferred from another bank). Most early metrics were more driven by seeing positive changes in loan balances. As our infrastructure improves, ROI on selected marketing mediums will be obtainable. New name awareness studies will be updated to reflect the current and long term impact from current marketing actions.