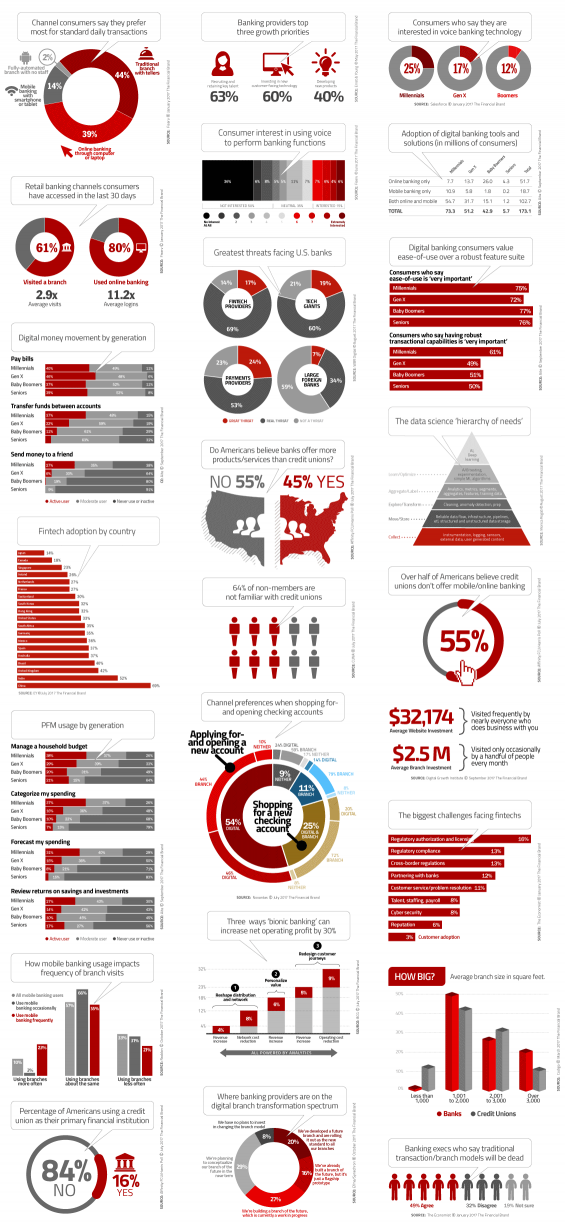

Every year, The Financial Brand creates hundreds of charts and graphs for inclusion in articles we publish. Over 175+ of the best from the last 12 months have been packed into this collection of PDFs that you can download for free.

Below is a list with all the different charts and graphs you’ll get in this year’s collection, followed by a visual preview that will give you an idea of what they look like. You can also download previous years’ collections.

These infographics make it convenient and easier for you to build powerful financial marketing presentations using any popular program — Microsoft PowerPoint, Microsoft Word, Macintosh Keynote, Adobe InDesign, etc.

2018 Charts & Graphs Master Pack

178 files | 6.7 MB zipped | 14.0 MB extracted

2017 Charts & Graphs Master Pack (256 files | 9.1 MB zipped | 18.9 MB extracted)

2016 Charts & Graphs Master Pack (130 files | 4.8 MB zipped | 10.4 MB extracted)

2015 Charts & Graphs Master Pack (210 files | 7.3 MB zipped | 7.5 MB extracted)

2014 Charts & Graphs Master Pack (107 files | 8.1 MB zipped | 9.4 MB extracted)

2013 Charts & Graphs Master Pack (120+ files | 6.6 MB zipped | 7.5 MB extracted)

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fractional Marketing for Financial Brands

Services that scale with you.

Digital Banking and Data Analytics (36 files)

- Adoption of Data Analytics Strategies By Size of Institution

- Adoption of Digital Banking Tools and Solutions

- Advanced Digital Banking Features That Interest Consumers Most

- Biggest Data Challenges Facing Traditional Financial Institutions

- Breakdown of Digital Banking Consumers By Channel Usage

- Consumer Interest in Applying for Loans Online

- Consumer Interest In Virtual or Branchless Banking

- Consumer Interest in Voice Banking Technology

- Consumer Interest in Voice Banking

- Consumer Satisfaction With Mobile Banking

- Consumer Satisfaction With Online Banking

- Consumer Sentiment About Digital Banking Features

- Consumer Utilization of Mobile Photo Check Deposit

- Consumers Using Digital-Only Banking Providers

- Consumers Who Have Installed Their Bank’s Mobile App

- Consumers Who Trust AI Powered Robots

- Digital Money Movement By Generation

- Financial Institutions Capable of Opening Accounts on Mobile Devices

- Financial Institutions Leveraging Artificial Intelligence

- Financial Institutions’ Attitudes Towards Artificial Intelligence

- Fintech Adoption By Age

- Fintech Adoption Rates By Country

- How Consumers Feel About Automation and AI

- Millennials Conducting Mobile Transactions in the Past 30 Days

- Mobile Banking Features Consumers Have Used in the Past Six Months

- PFM Usage By Generation

- Problems Facing Financial Institutions Trying to Leverage Big Data

- Reasons Consumers Prefer Fintech Providers Over Banks

- Reasons Why Consumers Don’t Use Mobile Banking

- The Data Science Hierarchy of Needs

- Trust in Traditional Banking Providers vs. Fintech Alternatives

- Types of Accounts Financial Institutions Allow Consumers to Open Digitally

- Usage of Mobile Banking Features By Generation

- Use of Voice Data Assistants By Age

- What Consumers Store in Mobile Wallets

- Why Consumers Use Fintech Providers Instead of Traditional Institutions

Retail Banking Strategy and CX (30 files)

- Average Investment Into New Branches vs. New Websites

- Banking Providers Top Three Growth Priorities

- Banking Providers Top Three Retail Delivery Priorities

- Banking Providers Top Three Risk Management Priorities

- Channel Consumers Prefer Most When Interacting With Their Primary Institution

- Channels Consumers Prefer for Daily Transactions

- Consumers Top Banking Service Concerns

- Consumers Who Regret Trying to Open an Account Online

- Consumers Who Say Branch Access is Very Important

- Consumers Who Say Their Bank Helps Them Reach Their Financial Goals

- Consumers Who Understand What Their Bank Offers

- CX Projects Financial Institutions Find Most Challenging

- Digital Banking Consumers Who Have Attempted to Open an Account Online

- Financial Institutions With a Formal CX Program

- Financial Institutions’ Top Priorities for CX Improvements

- Greatest Threats to the US Banking Industry

- How Consumers Feel Their Banks’ CX Has Changed in the Last Year

- How Mobile Banking Usage Impacts Branch Visits

- How Often Consumers Interact With Their Banking Provider

- Impact of Financial Institutions CX Initiatives

- Most Important Trends in the Retail Banking Industry

- Preferred Retail Banking Channel By Age

- Reasons Why Consumers Did Not Complete an Online Application

- Retail Banking Channels Consumers Accessed in Last 30 Days

- Retail Banking Providers Strategic Investment Priorities

- Time Required to Open an Account Online

- Top Problems Consumers Experience When Calling Their Banking Provider

- Top Strategic Priorities for Retail Banking Providers in 2018

- What Consumers Want From Banking Providers vs. What They Get

- Where Personalization in Banking is Most Important

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Digital Transformation (16 files)

- Attitudes of Banking Executives About Digital Transformation

- Banking Executives Who Say Traditional Branch Models Will Be Dead

- Banking Providers Most Significant Digital Challenges

- Barriers to Digital Transformation in Banking

- Biggest Challenges Facing Fintechs

- Biggest Competitive Threats Facing the Banking Industry

- CEOs Who Say Their Financial Institution is Digitally Ready

- Drivers of Traditional Financial Institutions’ Digital Investments

- Financial Institutions Digital Readiness

- Financial Institutions That Have Partnered With a Fintech Firm

- Financial Institutions’ Digital Transformation Priorities

- How Digital Banking Can Increase Net Operating Profit

- How Financial Institutions Define Digital

- How Financial Services Are Being Unbundled

- Impact of Digital Disruption in Banking By Line of Business

- Top Obstacles to Digital Transformation

Marketing Strategy (24 files)

- Average Cost Per Lead By Type of Company

- Average Number of Email Campaigns Sent Per Month

- Average Read Rate For Email Marketing Messages

- Biggest Digital Marketing Opportunity in the Coming Year

- Critical Factors Shaping Digital Marketing Strategy

- Digital Marketing Drivers of Acquisition for Financial Brands

- Email Elements Marketers Test

- Financial Service Emails Opened By Device

- Financial Services Emails Opened By Day of The Week

- How Digital Marketing Budgets Will Change in the Coming Year

- How Financial Marketers Plan to Achieve Differentiation in the Next Five Years

- How Marketers Rate The ROI of Various Channels

- How Marketing Works With Other Teams and Departments

- Marketers Aligning Marketing Roles to a Customer Journey Strategy

- Martech Tools That Marketers Use or Plan to Use

- Media Channels Still Around 10 Years From Now

- Number of Brand Consumers Receive Email From

- Number of Martech Tools Used Regularly

- Number of Social Media Posts Published Per Bank Per Quarter

- Number of Social Media Videos Published Per Bank

- Percentage of Banks Paying to Promote Content on Facebook

- Time Spent Reading Financial Services Emails By Device

- Top Three Digital Marketing Priorities in the Coming Year

- What Marketers Need to Leverage Their Martech Stack

Branches (23 files)

- Average Branch Size in Square Feet

- Average Number of Branches Per Bank (1976 Through 2016)

- Average Number of Employees Per New Branch

- Average Size of Branches By Region

- Bank and Credit Union Branch Distribution Plans

- Bank Branches Per 100,000 Adults in the United States

- Branch Appointments By Product or Service Need

- Deposit Volume Relative to Branch Density

- How Many Branches Banking Providers Are Adding

- How Many Institutions Are Adding More Branches

- How Many Institutions Are Remodeling Branches

- Last Time Consumers Said They Visited a Branch

- Most Popular Self–Service Technologies For Branches

- Technologies Banking Providers Would Like to Put in Branches

- Technologies Offered in Branches Today

- Total Visits to Branches By Day

- Total Visits to Branches By Hour

- Type of New Branches Banking Providers Are Adding

- Value of Branches to Banks and Credit Unions

- What Financial Institutions Want Their Branch Design to Communicate

- Where Banking Providers Are On The Digital Branch Transformation Spectrum

- Who Is Responsible For Decisions About Branch Projects

- Why Branches Are Important

Checking Accounts and Switching (15 files)

- Consumers Most Likely to Continue Banking With Their Primary Institution

- Consumers Who Have Switched Banking Providers in the Last Five Years

- Consumers Who Have Switched For a Higher Rate

- Consumers Who Would Switch Banking Providers Over a Bad Service Experience

- Consumers’ Channel Preferences When Shopping For and Opening Checking Accounts

- Factors Important to Consumers When Choosing a New Checking Provider

- Factors Most Likely to Prompt People to Switch Banking Providers

- Features Most Important When Consumers Choose a New Checking Account

- Generational Distribution Among Banking Providers

- Millennial Familiarity With Megabanks and Community Banks

- Millennials Who Would Switch for Better Rewards

- Number of Different Financial Institutions Consumers Currently Use

- Reasons Why Consumers Chose Their Most Recent Banking Provider

- Total Deposits of All Commercial Banking in the United States

- Type of Banking Provider Consumers Most Recently Switched To

Payments (14 files)

- Best Features Consumers Say a Card Can Offer

- Card Features Consumers Find Most Attractive

- Consumer Interest in Consolidating All Payment Cards

- Consumers Who Made P2P Payments in the Last 30 Days

- Consumers Who Say They Will Never Go Completely Cashless

- Consumers Who Say They Would Go Completely Cashless

- Digital Wallet Features Consumers Want Most

- Drivers of Structural Change in the Payments Space

- Payment Methods Consumers Prefer Most

- Reasons Why Consumers Didn’t Apply for Credit Cards After Shopping Online

- Share of Transaction Volume By Type of Payment

- Types of Voice Payments Consumers Make

- Where Consumers Like Using Mobile Payments

- Why Consumer Don’t Use P2P Payments

Business Banking and Business Lending (8 files)

- Distribution of Small Business Banking Relationships Among Large Institutions

- Distribution of Small Business Banking Relationships By Type of Institution

- Factors Critical to Small Businesses Banking Relationships

- Reasons Why Business Loans Where Denied

- Reasons Why Business Won’t Use Community Banks or Credit Unions

- Small Business Satisfaction Levels With Lenders

- Types of Financial Challenges Facing Small Businesses

- Usage of Online Banking Among Small Businesses

Credit Unions (12 files)

- Consumers Using Credit Unions as Their PFI

- Consumers Who Don’t Think Credit Unions Offer Mobile or Online Banking

- Consumers Who Don’t Think Credit Unions Offer Mortgages

- Consumers Who Say It Is Difficult to Join a Credit Union

- Do Banks Offer More Products and Services Than Credit Unions

- Do Credit Unions Care More About People Than Banks

- Do People Know Credit Unions Are Not–for–Profit

- How Often Credit Union Members Visit a Branch

- How Often Credit Union Members Visit Branches

- Non–Members Who Are Unfamiliar With Credit Unions

- Obstacles to Joining a Credit Union

- People Who Think They Can’t Join a Credit Union

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment