Personalization comes in multiple forms, ranging from highly focused marketing efforts to keenly specific delivery of services to consumers. Personalization is one of the key goals financial marketers seek when piling up their martech stack. In some ways it is a new, elusive goal, and in others a technological attempt to replicate what community banks used to be able to do with veteran tellers and platform officers who truly knew their customers.

Yet personalization can also be oversimplified. It can be applied with too broad a brush by marketers eager to get on board, with the result potentially being a personalization flop.

Sometimes, in spite of the perception that personalized marketing and delivery are what consumers want, they may find it inaccurate, inadequate, intrusive or even creepy. Beyond this, the ideal of personalization can be undermined by deliberate gaming of the technology for a range of motives, in a practice called “algorithmic hacking.”

In spite of its being an ongoing hot trend in marketing, Gartner is predicting that by 2025 80% of marketers who have invested in personalization will abandon their effort. Lack of a trackable return on investment is one reason. Some aspects of personalization may be very broad and difficult to quantify, the firm states. The other reason is the difficulty in managing consumer data. In some organizations, according to Gartner, both reasons will shut down personalization.

“Personal data has long been the fuel that fires marketing at every stage of the customer journey, and the drive to find new forms of fuel and devise new ways to leverage them seems to be boundless,” says Charles Golvin, Senior Director Analyst in the Gartner for Marketers practice. “However, this quest has failed to meet marketers’ ambitions and, in some cases, has backfired, as consumers both directly and indirectly reject brands’ overtures.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Personalization Hasn’t Always Caught On

Part of the problem may be that some marketers hoped to buy their way into personalization and found it didn’t work. Citing Gartner’s Marketing Organizational Survey, a 2020 outlook report by the firm states that “Marketers may have overinvested in technology, underestimating talent requirements, and now see an opportunity to retrench. Marketing leaders may recognize they lack strategy, and pause to reassess and refine their approach. They may also realize further investment in tools, without upskilling their teams to connect usage to financial metrics, will lead to underutilization of that technology and fuzzy ROI.”

“Marketers may have overinvested in technology, underestimating talent requirements, and now see an opportunity to retrench.”

Personalization has become something of a religion or movement, complete with its own recruiters who often have a dog in the fight. Sometimes movements acquire momentum that outstrips strategy. Samuel Scott, who writes “The Promotion Fix” blog on The Drum, wrote a critique of enthusiastic endorsements and predictions about personalization. In every case, the booster had something relevant to sell, and the supportive data cited, he writes, often relied on thin research. For contrast, he quoted members-only research by the Advertising Research Foundation as follows: “People seem to understand the benefits of personalized advertising but do not value personalization highly and do not understand the technical approaches through which it is accomplished.”

In fact, sometimes marketers aim for personalization when a shotgun approach might work better, Scott suggests. Why laser-focus marketing for things with broad appeal? he argues.

It’s not that personalization doesn’t work, but that it can be misapplied and commenced without a clear plan.

“Personalization is not a goal in itself, but marketers have shown it can help attain performance goals like improved marketing effectiveness, revenue growth, and customer satisfaction and experience,” according to a Gartner presentation, “Maximize the Impact of Personalization.”

Read More:

- 94% of Banking Firms Can’t Deliver on ‘Personalization Promise’

- Personalization in Banking Can’t Be Disguised as Cross-Selling

- 5 Ways Banks & Credit Unions Can Personalize Better Than Fintechs

Consumers Aren’t Always Impressed with Personalization’s Results

Research by eMarketer indicates that personalization isn’t always the wow that enthusiastic marketers hope for.

“Marketers, especially digital marketers, love data and the promise of optimization it holds,” says Nicole Perrin, Principal Analyst at the firm. “And many report a lift in engagement, conversions or other behaviors they’re trying to drive, based on tailoring relevant messages. But while a 1-point lift for a marketer may be a result worth celebrating, it doesn’t necessarily mean consumers are perceiving those messages as personalized and highly relevant.”

“Consumers have developed an increasingly jaundiced eye toward marketers’ efforts to embrace them.”

— Gartner

A study by McKinsey cited by eMarketer indicates that no form of personalized content appealed to more than 50% of consumers — and many were much lower. While 50% favored product recommendations related to their interests, only one in three consumers liked receiving marketing messages based on their physical location. And only 17% put any weight on a message including their names.

A Cognizant white paper, “Algorithms Over Brands,” reports that while nearly seven out of ten consumers prioritize personalization, almost half of those surveyed are dissatisfied with the way brands deliver personalization.

Personalization can actually be a factor that gets between a brand and its consumers. Cognizant’s research indicates that as consumers accept the recommendations of algorithms for who to do business with, they lose the connection with brands. The algorithmic touchpoints include search engines, mobile apps, voice assistants and ecommerce sites. The researchers found that consumer faith in those sources of recommendations out-pulled brands’ own websites.

So there is a risk that money invested in personalization may be fighting other marketing efforts that a financial brand pursues.

The sheer volume of marketing most Americans are exposed to, in ways unheard of not so long ago, may also play a role.

“Consumers have developed an increasingly jaundiced eye toward marketers’ efforts to embrace them,” Gartner states.

Why Are You Trying Out Personalized Marketing?

Gartner researchers break up personalized marketing into two major streams, with very different goals. It’s possible that marketers don’t always appreciate the distinction.

On the one hand are personalized marketing message intended to make the consumer feel the brand is talking right to them. At the simplest level are messages that address the consumer by name. More advanced communications recognize something about the person, such as their having recently opened a retirement account.

On the other hand there are marketing messages used to help the consumer through the buying journey — essentially marketing that does some individualized hand-holding. Such messages, according to Gartner, can reassure consumers, teach them new things, guide them to helpful services, and even reward them with special benefits.

Read More: How Two Banks Are Chasing The AI Dream

Is It Lying If You’re Tricking Artificial Intelligence and Not A Human?

One of the oldest memes about cyberspace is this one: “On the internet, no one knows you’re a dog.” The thing of it is, you may not be a dog, but you may not be what you claim to be. Welcome to the age of “algorithm hacking” — the gaming of the algorithm’s math to fool it.

Personalization frequently relies on forms of artificial intelligence to work in high-volume areas like retail banking and that represents an exposure for institutions using it.

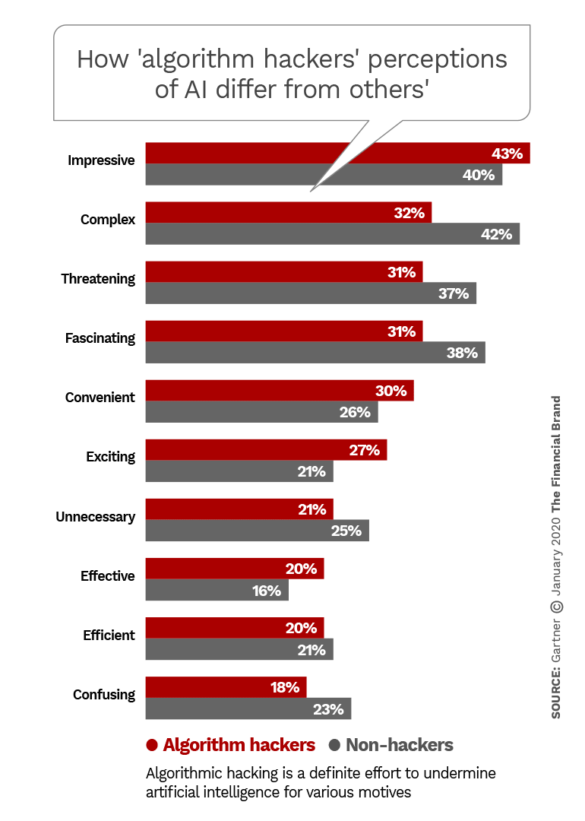

A Gartner report by Analyst Kate Muhl, “Algorithm Hacking Puts Marketers’ Data and Personalization Efforts at Risk,” traces how this can run from the relatively innocent effort to change social media profiles in order to change one’s news feed to much darker designs.

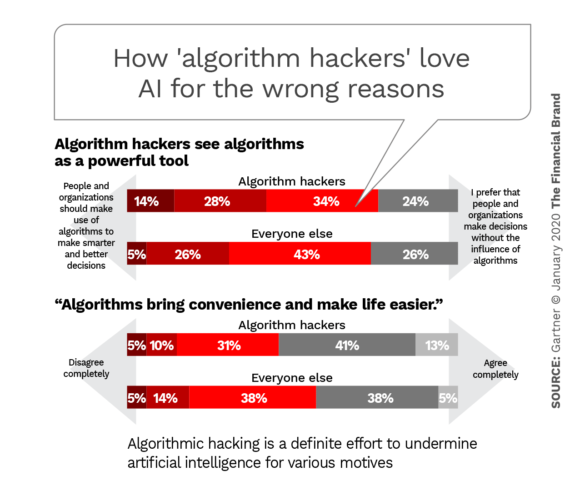

“Sounds like dystopic sci-fi, right?” says Muhl. “But it turns out, the key driver behind all these behaviors isn’t fear of algorithms and suspicion about their role in society. Rather, these consumers are confident that algorithms will be a net good for society, that they understand how the technology works, and that they can use that understanding to bend the technology to their own ends.”

Gartner’s research found that not only were there people willing to admit to some algorithm hacking, but others who said they would have indulged if they’d known it was a possibility.

Motives for the more innocent side of algorithm hacking often concern taking back perceived control of one’s life from artificial intelligence. Quotes from consumers responding to Gartner’s survey give an anecdotal taste of the reasoning.

“Karen” told Gartner that on social media “If I can, I use a false name and gender, and try to be illiterate, old and unemployed so that they don’t bother me or think that they can sell me anything.”

“Sheryl” told the firm that she was frustrated by Amazon’s algorithm, which can change pricing even within a single day. “I would like a way to hack their algorithm so that I don’t get cheated when ordering something from there and then finding out in the next day or two that the price has significantly decreased.”

On some levels messing with algorithms is just another form of trying to beat the system, and practitioners might consider what they’re doing to be harmless. But there are already efforts to fool AI designed to recognize faces. It’s not too hard to begin to see other AI targeted for fun, philosophy, or profit.

“It may be hard for marketers to see the urgency around consumers who actually feel confident in their knowledge about algorithms and good about the technology’s potential,” writes Muhl. “Yet algorithm hackers create risks that marketers must get ahead of while the threat is still manageable. Consumers who engaged in algorithm hacking, even just at the everyday hacking level, put data quality at risk, which in turn threatens marketers’ algorithmic initiatives.”

Muhl notes that marketers have concentrated on building consumer trust in algorithms, and she suggests messages stressing that humans remain in ultimate control. Longer term, however, “since consumers who mess with algorithms are driven by a desire for control and personal benefits, smart marketers will offer ways to honor and engage these consumers’ confidence and tendency toward action.”

Marketers must also recognize that much worse behavior is out there. There are YouTube postings and more, for example, on how to hack various social media algorithms and more. One fraudulent practice is called “adversarial machine learning.”

Ultimately, it will be critical for marketers to play fair. Writes Muhl: “People who seek to hack algorithms are questioning the idea that marketers will use these systems to generate experiences, product suggestions, pricing, etc., in the interest of the consumer, or the consumer and the marketer equally.”