Last week, The Financial Brand wrote about how the FDIC and the NCUA are cracking down on financial institutions that attack the safety or soundness of any financial institution (or category of financial institutions). Their fear is that such ads might trigger an unwarranted run on deposits.

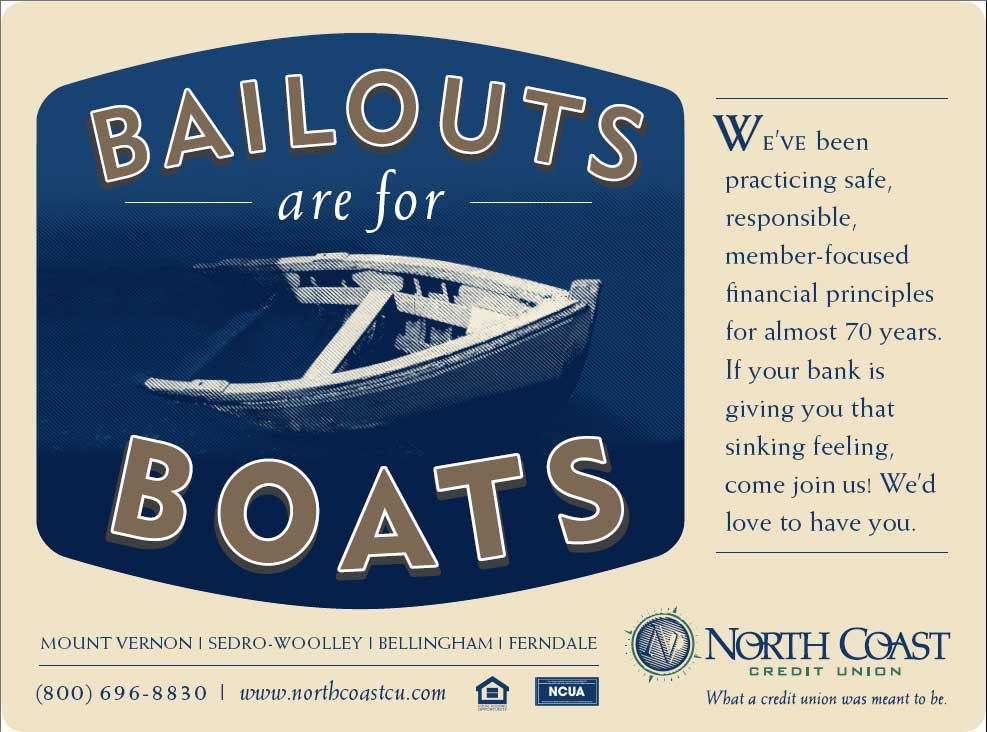

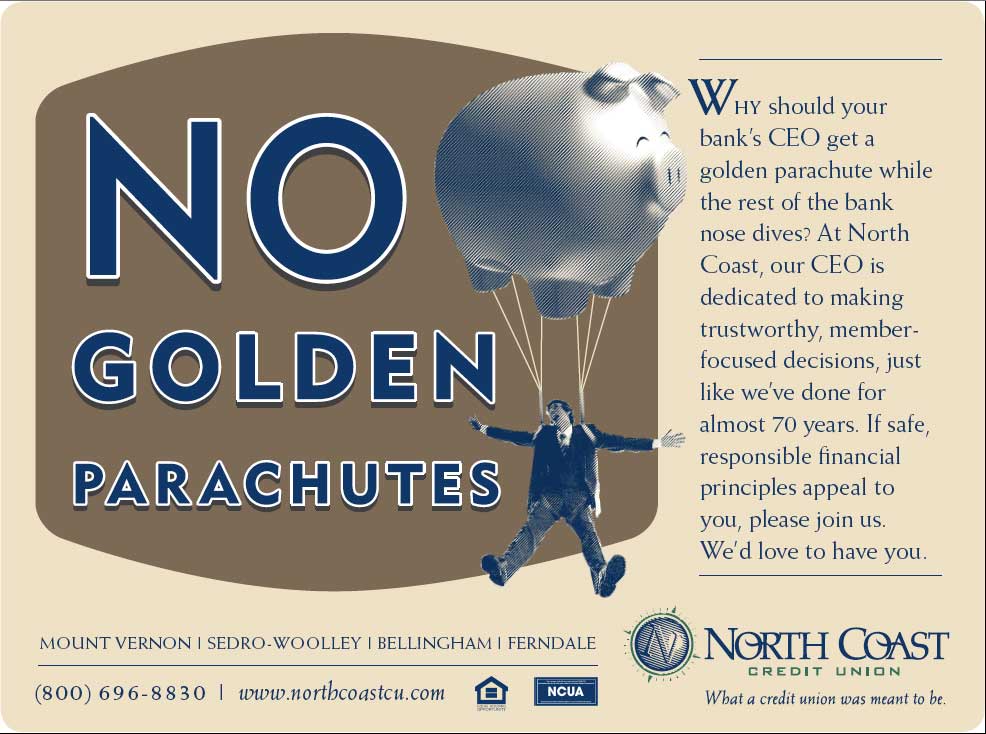

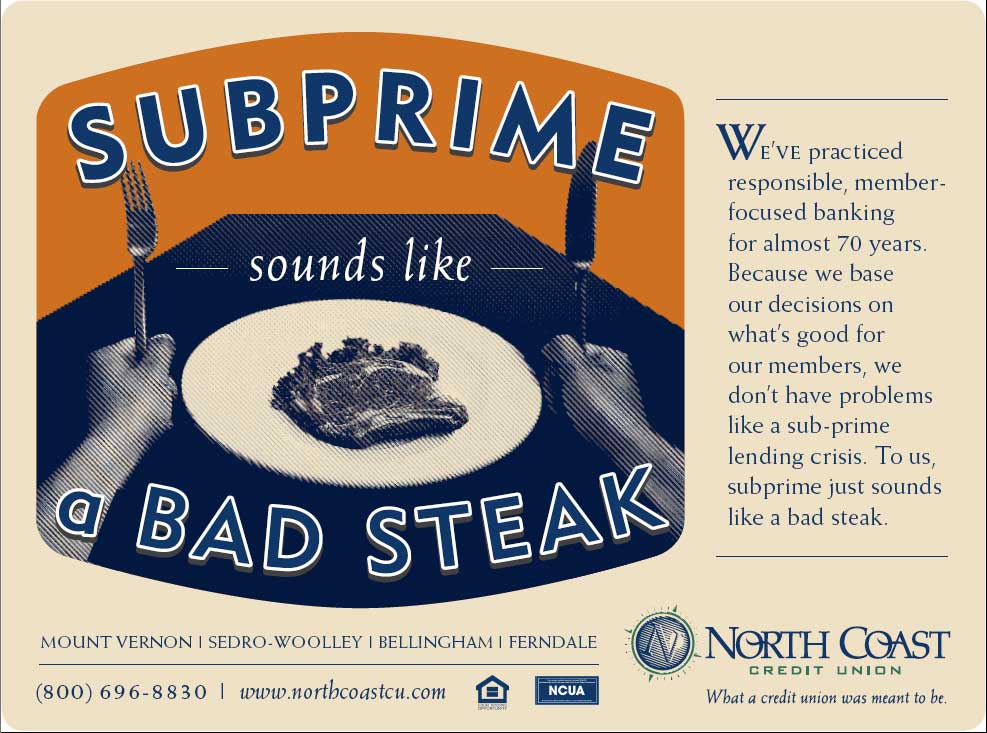

So how will federal regulators feel about these clever and attractive ads from Barron & Company for North Coast Credit Union?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Fractional Marketing for Financial Brands

Services that scale with you.

These ads clearly ride the line of what federal regulators are labeling “acceptable.” There could be trouble, specifically with copy suggesting that North Coast is “safe” while “your bank is giving you that sinking feeling.” Or that any bank might be taking a “nose dive.”

Key Question: If the NCUA censors these ads, do you think they’ve gone too far?

Bottom Line: North Coast Credit Union is going to get mileage out of these ads one way or another. These days, you almost hope that the FDIC or NCUA tells you to pull your ads because you can milk it for a mountain of PR. Local news outlets will be happy to report about a financial institution that’s “so safe and sound, the Feds are telling them to be careful with their marketing.” And the best part is that neither the NCUA nor FDIC can tell a publication (including this one) that it can’t reprint the ads as part of the story.