As the main frontrunner to the online personal financial management movement, Mint.com has had a lot of time to grow. The company was founded in 2006, acquired by Intuit in 2009, and has recently undergone a fresh redesign. In addition, they acquired Check last year and have expanded their services to help consumers effortlessly see their credit score.

All of this growth is good for Mint users and potentially bad for financial institutions. And yet many financial institutions still don’t see Mint as a threat. In fact, some banks and credit unions even encourage their account holders to sign up for Mint.com to track their finances — a suggestion that could easily backfire on financial institutions.

Below are five ways that Mint.com can threaten banks and credit unions. In this list, I walk through a fictional scenario where an account holder at ACME Bank has signed up with Mint at the suggestion of ACME.

1. Mint Shows All Accounts in One Place

1. Mint Shows All Accounts in One Place

In this scenario, let’s say the fictional customer’s name is Scott.

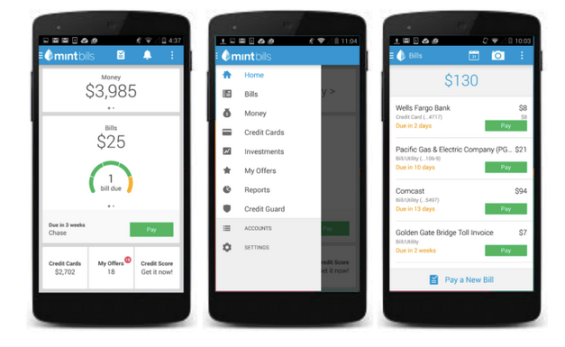

When Scott signs up for Mint, the first thing he does is add all of his accounts — including those he has with ACME — to Mint.com. He sees his mortgage, his car loan, his checking account and more in Mint’s hub. In addition, he interacts with spending charts and budgets based on his aggregated data. The Mint experience is more engaging and insightful than the experience Scott gets through ACME’s banking portal (where he typically just looks at his balance and then signs out).

At this point, Scott sees less of an incentive to sign into ACME to check his balances and transactions. He can see all of that in Mint. This change alone is potentially damaging for ACME, because Scott no longer sees ACME’s offers when he does his digital banking. Instead, he sees ads for banking products from other institutions, including third-party competitors on his Mint site.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

2. Mint Is a Digital Financial Advisor

2. Mint Is a Digital Financial Advisor

When Scott sets up a goal in Mint.com for a mortgage, he notices that Mint encourages him to read relevant posts on Mint’s blog, MintLife. After reading a few posts and realizing that MintLife has the answers to a lot of his mortgage-related questions, Scott starts to look to Mint, not ACME, for financial guidance. He doesn’t call or visit a loan officer at ACME when he wants to figure out how to get the best deal on a loan. Instead, he looks up the answer directly on Mint’s impressive blog, and ACME loses its position as Scott’s primary financial advisor.

3. Mint Helps Simplify Bill Payments

After creating a goal, Scott sees that he can set up bill payment directly through Mint’s portal with Mint Bills. He likes that he can view his bills in context of his full financial picture, and so he signs up. Now he pays for his utilities and rent from the same place he checks his financial health.

What this means is that ACME no longer gets Scott’s bill pay data and can no longer use that data to produce intelligent marketing. Even worse, Scott’s bank or credit union will likely never get that data stream back again. It’s gone for good. This is damaging because, in the future, the best customer experience will likely belong to whoever can leverage their account level and purchase data most effectively to cater to the financial needs of the consumer.

4. Mint Markets Competitive Credit Cards

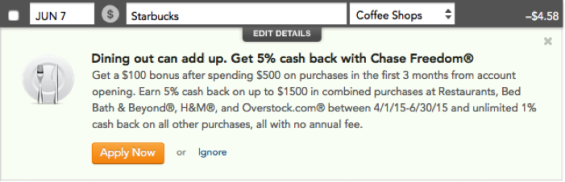

As Scott switches his bill payment from ACME to Mint he notices an offer on Mint for a Chase Freedom credit card. He’s been satisfied with his ACME debit card for years, but the rewards that Chase offers him are pretty tempting.

On the tenth time he sees the offer from Chase, Scott decides to act. He signs up for the Chase card, and over time, Chase becomes his primary spending account. At this point, ACME loses access to all of the daily transaction data that could be helpful in future marketing or account servicing efforts by his bank. Eventually, Scott no longer views ACME as his primary financial institution.

5. Mint Markets Third-Party Loans

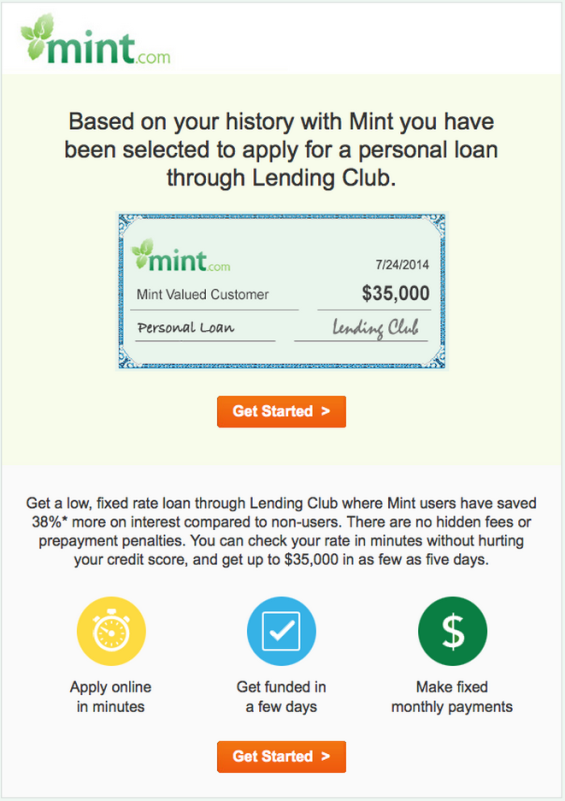

After Scott has been using Mint.com for a few months, he gets an email from Mint inviting him to apply for a $35,000 personal loan with Lending Club. He had been thinking about jumpstarting a new business, and this opportunity seems promising. As he researches the advantages of Lending Club — their speedy lending process, simple user experience, and better rates — he decides to sign up for a loan with them.

Before joining Mint.com, his primary financial institution (ACME) would have been the first place Scott turned when looking for a loan like this. But at this point, Scott’s not considering ACME at all. He hasn’t even visited ACME’s branch, online site or mobile banking app before deciding to get a loan with Lending Club, and as a result ACME has lost out on all that potential revenue.

At this point, it might only be a matter of time before Scott moves his primary checking and savings account from ACME to one of the many big-name financial organizations that Mint sponsors in their portal. ACME will then no longer be a player at all in Scott’s financial life at. Mint will have stolen one of ACME’s customers.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What Should Financial Institutions Do?

Fortunately for financial institutions, there are ways to stop account holders from joining Mint and drifting away. The first step is to not suggest Mint.com as a solution for account holders. The second step is to offer a better digital banking experience — one that might include a digital money management (PFM) component. Such a component can hopefully incentivize your account holders to not start using Mint at all.

From MX to NCR, from Yodlee and Meniga to Geezeo, and from Strands Finance to Finance Works, there are a range of products that can meet this need. Critically, the product must aggregate internal and external accounts, automatically categorize transactions, and engage users with a simple and visually rich interface.

In the past, PFM has been maligned for poor user adoption, and those complaints were often justified. But bankers who haven’t seen the latest improvements and updates in digital money management products might not be aware of how much has changed.

Aggregation and categorization services are far more powerful than they use to be, and the latest user interfaces are stunning. As a result, user adoption has started to rise. One notable example recently came from an MX webinar where clients reported reaching adoption rates ranging from 43% to over 50% leveraging top-down organizational advocacy. It’s clear that today’s digital money management products drive better results than they have in the past.

It’s likely that you have account holders who are looking for a place to manage their money. If you can provide an easy, overarching solution, they’ll be far less likely to sign up for Mint.com. And, that’s a good thing for you — especially when they start signing into your portal to see all their finances in one place.

When they come to your online or mobile site daily to manage their finances, you are more likely to retain your position as their primary financial institution.