In the 2014 Bank Financial Education Survey, a study from TD Bank focusing on Gen-Y banking habits, 69% of respondents confessed they have never received any formal financial education at all. Nevertheless, three out of every five millennials think they are “extremely” or “very” knowledgeable about day-to-day banking products.

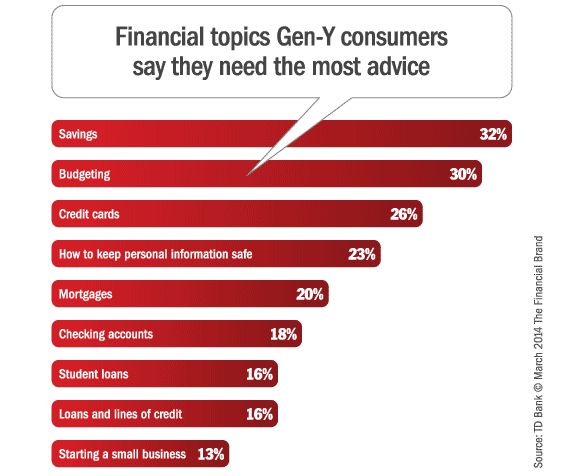

That doesn’t mean they don’t want advice on certain personal finance topics. Roughly a third say they need help and guidance creating a budget (30%) and getting a savings plan underway (32%). More than one in four say they need advice about how to choose and manage their credit cards.

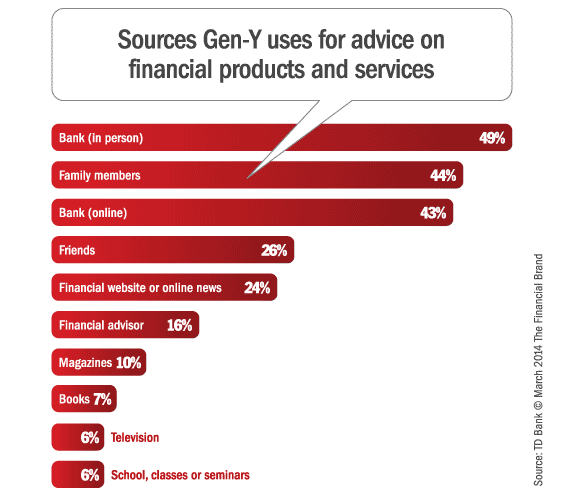

So where do they turn for answers? When it comes to Gen-Y and money, it seems the apple doesn’t fall far from the tree. According to the survey, millennials rely mostly on their families for financial advice. 49% of see their parents as primary influencers in shaping their banking and financial views, and 40% still say they turn to parents and family as a source of information. 62% go online looking for answers, but 54% also say they find what they’re looking for in their local bank branch.

Read More: Millennials Desperate for a Better Banking Experience

Fractional Marketing for Financial Brands

Services that scale with you.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Changing Behaviors

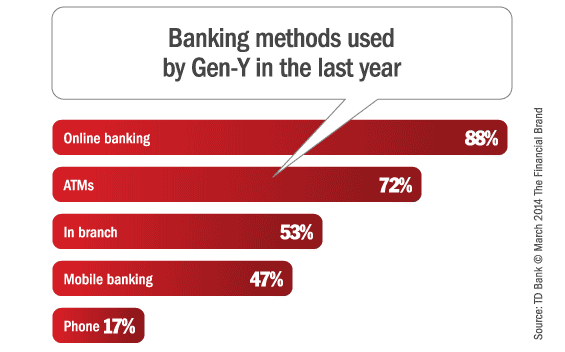

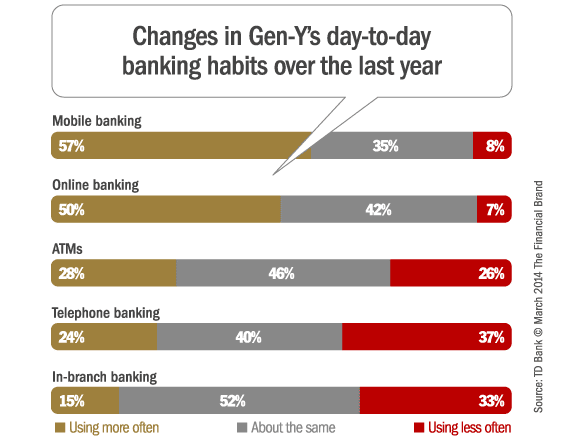

According to the TD Bank survey, millennials are banking online and on their mobile devices more frequently than in a branch. In fact, 90% of survey respondents said they use online or mobile tools for their everyday banking activities, such as checking balances or paying bills, and 57% said they are using mobile banking more frequently than they were last year.

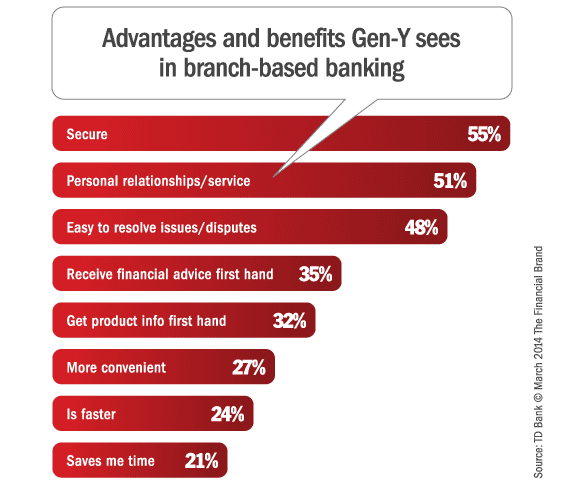

Millennials are still visiting bank branches as frequently as they did last year, saying it is more secure and they enjoy in-person service.

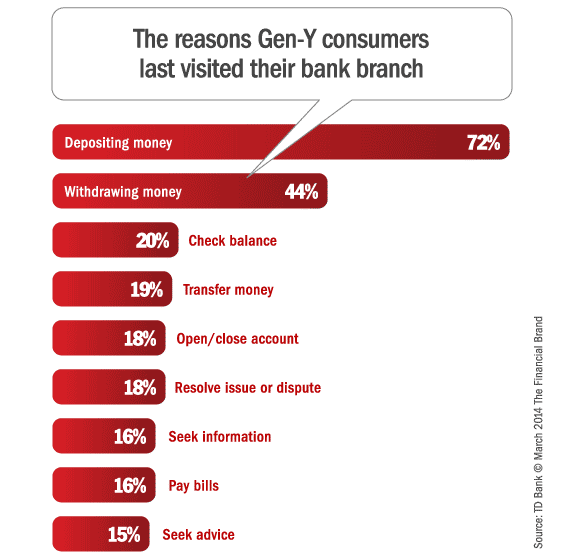

35% of millennials said they check their balance daily; 53% check it at least once a week. While checking their balance is the most popular activity online, millennials reported that they are still visiting bank branches as frequently as they did last year, mostly to deposit or withdraw money. Those who do their banking in a branch feel it is more secure and enjoy the in-person service.

“While millennials are banking more online and on their mobile device, 52% are still visiting a branch as frequently as they did last year,” said Nandita Bakhshi, EVP/Retail Distribution at TD Bank.

The study also found that young adults take few risks when it comes to managing their money. In fact, 47% of millennials describe themselves as “cautious” when it comes to their overall approach to personal finance.

Read More: Why Gen-Y Opens Accounts In Branches And Not Online

Regional Banking Behaviors

The study revealed some weird and surprising differences in the ways Gen-Y handle money in various parts of the country:

- 23% of Boston respondents feel extremely knowledgeable about banking products vs. 13% of Philadelphians who feels extremely knowledgeable.

- 40% of New York City respondents check their account balance daily vs. 21% of Philadelphia respondents who check their balance daily.

- 54% of Floridians prefer going in to a bank branch to receive banking advice vs. 53% of Philadelphians who prefer asking their family for advice.

- 46% of New York City respondents want advice on saving vs. 28% of Boston respondents who want advice on saving.

The 2014 Bank Financial Education Survey was conducted among a nationally representative group of consumers from January 28 through February 10, 2014. The total sample size was 2,031 millennials (ages 18-34).