Ever since Covid-19 hit the world economy, experts have been casting sweeping pronouncements in concrete. Reality wields a cruel sledgehammer sometimes. A few examples:

• “Covid killed in-store shopping.” Been in a store lately?

• “The office is dead and everyone will work from home, forever.” Not quite. There’s definitely a hybrid pattern settling in.

• “Digitization is everything, especially in marketing.” Look around you — in airports, at ballgames and sponsored events, offline marketing abounds.

The pandemic period encouraged such sweeping predictions and there’s a risk that ongoing rising inflation is going to create its own new set. For example, research by Gartner found that as inflation began settling into the world economy, many marketers in banking and other fields have tended to see it as a positive.

Politely calling this view “marketing’s cognitive dissonance,” Ewan McIntyre, VP/Analyst and Chief of Research for the Gartner for Marketers Practice, appeared to be warming up his sledgehammer muscles. In a Gartner webinar concerning its annual marketing spending and strategy survey, he made it clear that marketers must be careful not to take any factor — not even their marketing budgets for the year — as a given, as significant inflation rolls through business for the first time in four decades.

“We live in an incredibly volatile environment now,” said McIntyre.

The analyst said that many marketers may have been optimistic about inflation because they hit many of their goals in 2021 and into 2022. In fact, almost nine out of ten said they exceeded their targets in 2021.

Such optimism, based on past performance, may blind marketers from seeing the potential risks that like ahead, McIntyre suggested.

“Marketers need to be under no illusions,” said McIntyre. “Uncertainty lies ahead. And companies can’t use the playbook from 2008 to deal with 2022’s problems.” He said that marketers face a heavy-duty mix of challenges and that they must respond by devising robust scenarios to plan for — and being ready to revisit those plans frequently.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Marketing Budgets Have Grown … for Now

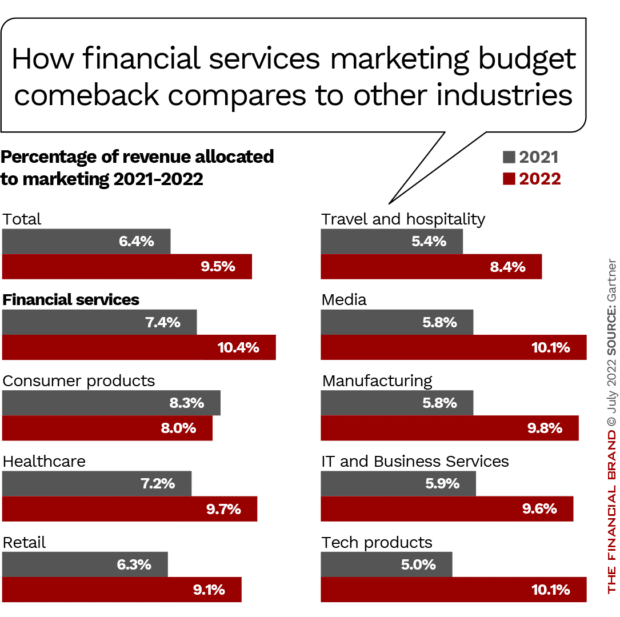

Across the entire Gartner sample, seven out of ten marketers indicated that their budgets had increased in 2022 over 2021. However, the study found that the rebound, on average, has not risen as high as it might have. Overall, budgets represented 10.5% of total revenue in 2019, and fell to 6.4% in 2021. In 2022, they have risen to 9.5%, still short of pre-2020 levels.

Financial services companies have seen the strongest rebound in terms of total 2022 budgets, also measured as a percentage of revenue, as shown in the chart below. Other industries saw higher year over year increases. While financial services budgets rose by 40%, tech company marketing budgets doubled, on average.

The Gartner CMO Spend and Strategy Survey found that marketing budgets have evolved as the remnants of lockdowns in most of the world went away.

“CMOs have adapted to the post-lockdown hybrid channel environment,” said McIntyre. While 56% of spending goes to digital channels, 44% goes to offline channels.

McIntyre said that while many speak of the emphasis on digital channels, marketers increasingly recognize that people come to their companies through a mix of exposures on multiple channels.

In addition, “moving out of lockdown thinking has led to a recalibration of marketing budgets,” said McIntyre. He said that marketers realize that “betting just on digital” is not enough.

Read More: Marketing Smarter on a Community Bank Budget

Where Digital Marketing Budgets Go

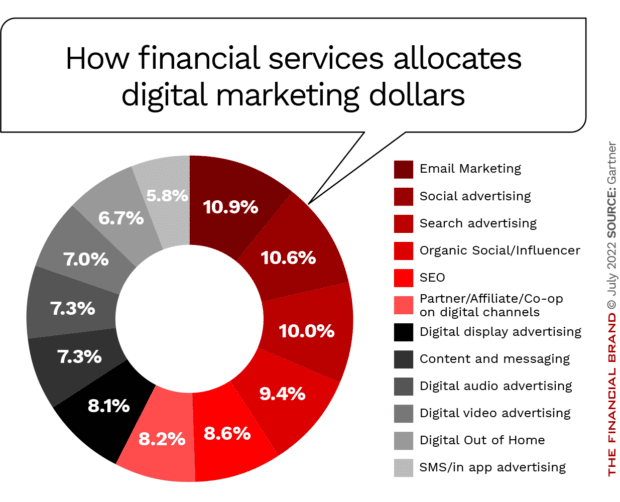

Looking at digital spending, more than half of the average budget — over 60% — goes to paid channels, such as social media advertising (10.1%), search advertising (9.8%), digital display advertising (9.3%) and digital video advertising (8.8%).

However, McIntyre said it was important to consider other distinctions beyond paid and non-paid channels. Paid search advertising (9.8%) and search engine optimization (8.5%) together represent 18.3% of marketing budgets, a significant amount.

“As a channel, these are the glue that holds the customer journey together,” said McIntyre.

The leading digital marketing budget item for financial services firms is email marketing, favored less by other industries. 10.9% of the financial firm’s digital marketing dollar goes toward email, with only travel and hospitality, at 8.3%, and some others at 8%, coming near that. On the other hand, the total of search advertising and SEO spending comes to 18.6%, which is just slightly beyond the budgeted level for the entire sample.

Marketing Change is Constant:

Marketers shifted priorities from 2021 to 2022. 77% changed up digital channel spending, while 73% adjusted priorities for offline channels.

Read More:

- What to Cut, What to Keep as Bank Marketing Budgets Get Squeezed

- Why Are So Many Banks Killing the CMO Role?

- Digital Marketers in Banking Facing Their Greatest Hurdles Internally

- Metaverse in Banking: Not Just a Playground for Big Banks Anymore

Where Offline Marketing Budgets Go

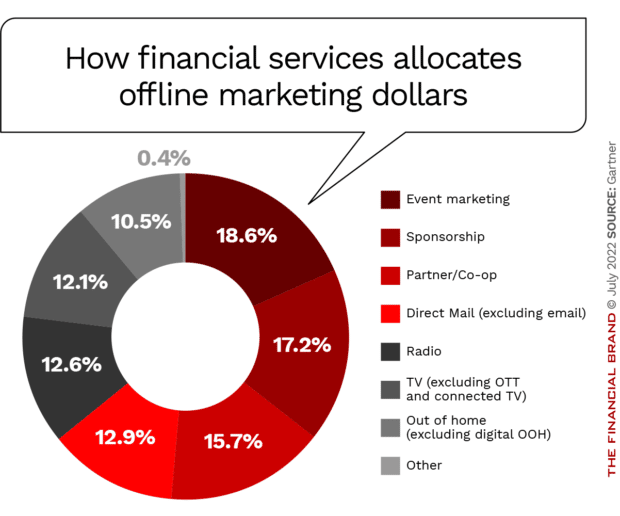

The offline marketing channel category represents an eclectic collection of methods.

“People who talked about the death of these channels were clearly wrong,” said McIntyre.

By way of illustration, the leading channel for 2022 is event marketing, accounting for 18.8% of the nondigital marketing dollar over the entire sample. Sponsorships came in second at 15.3%.

On the other hand, non-digital out of home advertising came in at 12.3% — still a bit more than a “dime” out of every offline marketing dollar.

Event marketing topped the financial services category specifically, as shown in the pie chart below, at 18.6%, matching total spending on search marketing and SEO. Clearly, offline channels continue to matter to banking.

Managing the two broad categories of spending — digital and non-digital — calls for a concept that Gartner refers to as “orchestration.”

“In simple terms,” states a Gartner report, “brands need to meet the customer where they are, not where brands wish them to be.” This is part of handling the hybrid customer journey.

“Orchestration implies that you have to be listening and adapting in real time,” said McIntyre. “A ‘set it and forget it’ approach really isn’t appropriate anymore in marketing. Carefully listening to the channels that are working and adapting plans accordingly is the right thing to do.”

And that underscores the reason for relying on such analysis, and not falling for marketing memes of the moment.