The combination of rising interest rates, high inflation and a gradual slide into recession is shaking things up for credit union marketers, from what they promote to how they promote it.

Case in point is a return to actively marketing for deposits. It’s something many credit unions haven’t had to do for so long that younger employees are experiencing it for the first time in their careers.

Senior marketers say they need to educate their colleagues about the importance of deposits as fuel for lending, in addition to explaining how to go about bringing in more of them.

“They’re freaking out, marketing deposits is so foreign to them,” says Pam Hatt of Pen Air Credit Union. “And you’re like, ‘Been there, done that.'” Hatt was speaking with two other veteran credit union marketers, Kerry Graham of AFFCU and Lee Wojnar of O Bee Federal Credit Union, as part of a roundtable discussion during The Financial Brand Forum 2022.

People are borrowing more now and money in savings accounts is dwindling amid increased spending, some of which can be attributed to inflation, the marketers agree.

That makes for a completely different environment than in the past decade, and one that is entirely new to younger credit union employees and members, says Hatt, vice president of marketing at the $2.3 billion-asset Pen Air, based in Pensacola, Fla.

Explaining the dynamics behind the need for deposits is important, she adds. “Marketers like to live in the marketing zone. They don’t necessarily like to live in the banking world. But they have to understand the ‘why’ of what’s going on.”

The three marketers who took part in the roundtable have been navigating the flip-flop in priorities. At the same time, they have been relying on some traditional credit union tactics to help meet consumers’ changing needs as inflation squeezes household budgets and pandemic-era savings dwindle away.

They stress the importance of maintaining a steady presence in communities, through branches, volunteer projects and financial literacy initiatives. All three also argue for keeping marketing budgets intact through the tough times.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

A Shift to Marketing for ‘Deposits, Deposits, Deposits’

The mix of loan activity and deposit growth has tilted, according to the roundtable participants. Loans are continuing to grow, but deposits have not kept pace.

“We’ve got good rates out there and we’re getting deposits from all over the country. But the situation is almost the inverse of what it used to be,” says Graham, vice president of marketing at AFFCU in San Antonio. “We used to be trying to get loans, but now it’s deposits, deposits, deposits. That’s all we can think about right now.”

This need comes at the same time that Graham’s credit union, historically serving San Antonio neighborhoods near Lackland Air Force Base, has been reaching out digitally and through new branches to gain more members. A new management team speaks of the credit union as a startup and wants to market the brand more broadly.

In early December the credit union’s homepage promoted a 24-month certificate of deposit paying an annual percentage yield of 4%.

Some perspective on credit union deposits: In the 12 months ending June 2022, the latest figures available, loans outstanding among federal credit unions increased by 16.2%, based on data from the National Credit Union Administration. That is the largest such increase in two decades, according to the NCUA. By contrast, in the same period, federal credit union deposits rose by only half that rate, 8.1%. Higher-rate money market accounts rose by 13.9%.

At Pen Air, deposit growth is a hope, but the immediate battle is simply to retain what the credit union has. It, too, has hiked rates, in its case largely for the sake of retention, Hatt says.

Its homepage broadcast the message in early December with a massive header in big type: “Our Certificate Rates Are Rising.” A special 15-month CD promises a 4% APY.

There are strategies at play beyond competing on rate, however. O Bee is deploying several alternative options in its quest for deposits.

An Alternative to Just Paying Up on Deposit Rates

During the height of the Covid-19 pandemic, “we saw a huge amount of money coming in and we turned on a dime, lending it out,” says O Bee’s Wojnar. “But now we’re struggling to get funds. Our loan-to-share ratio is already over 105%.” (Credit unions often refer to deposits as shares.)

Wojnar, senior vice president of marketing at the $546 million-asset institution in Lacy, Wash., says O Bee tends to run a high ratio because “we’re a lending machine.” But now, with the ratio indicating that loans exceed deposits, the credit union is taking steps to increase deposit production.

Part of O Bee’s strategy is to seek funding via grants and investments available to community development financial institutions, as the credit union is part of that program. (If this idea appeals, be advised that April 2023 is when the federal CDFI Fund intends to end its pause on accepting applications from financial institutions seeking to join the program.)

In addition, Wojnar says O Bee has a “low-income designation” from the National Credit Union Administration. This status allows a credit union to accept nonmember deposits from any source and to participate in NCUA’s Community Development Revolving Loan Program, among other benefits. Qualification includes having at least 50.01% of the credit union’s membership meet certain low-income criteria.

These steps will have to be balanced against the increasing likelihood of a recession, which Wojnar expects to be “slightly tougher” than recent ones. Low-income designation permits exceptions to business lending limits, for example, but with a slump on the horizon, care and attention to reserves are critical.

Read More:

- Deposit Strategies Must Be Revised Before Funds Exit for Higher Rates

- Bankrate, Step Aside. Seattle Bank’s Unbiased CD Site Has National Plans

Avoid Cuts to Marketing

Many banks and credit unions are considering cutting back on their marketing budgets; others already have. But this trio of marketers say that’s a mistake, in spite of the traditional pressures among financial institutions to do so.

For credit unions, community service is a form of marketing that ranks high, and Hatt says consistency is going to be essential in the period ahead.

Pen Air spends about $500,000 annually on sponsorships and other community programs. In the wake of Hurricane Ian in fall 2022, the credit union held a fundraiser that generated more than $50,000 of aid for Fort Myers, Fla.

“You want to show up when times are hard and you want to show up when times are good,” says Hatt. “When times are good, everybody’s there. But when times are hard, not everybody’s there. You need to show up and be present in your community.”

Consistency in marketing, she continues, helps demonstrate “that you’re always there having people’s back.”

AFFCU’s Graham echoes that sentiment, adding that his credit union increased its marketing budget in 2022 to generate growth.

“You can’t stop marketing when times are bad. It’s not a time to hunker down and just protect what you have. It’s an opportunity to grow, to get your name out there and to show up when people need you.”

— Kerry Graham, AFFCU

Wojnar says O Bee has been a steady marketer for all of his 16 years there, through thick and thin. While marketers (and their superiors) may gripe at the expense, the end result is that it generates income, he says. Plus, as a recession grinds on, digital media and other advertising options have lower prices.

Read More: Why Banks Shouldn’t Slash Their 2023 Marketing Budgets

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Fractional Marketing for Financial Brands

Services that scale with you.

Pen Air’s Financial Literacy Push

One of Pen Air’s marketing promotions — which is entirely fitting for the economic environment — is for its NOW program. NOW makes certified financial counselors available at every Pen Air location to help people budget and work their way toward financial freedom. (The name is not an acronym, but instead aims to emphasize urgency.)

How people are reacting to inflation underscores a pet peeve for Hatt: how unprepared many people are to make smart decisions about money.

“It’s terrible how many people graduate high school who are financially illiterate,” and the rate of financial literacy is hardly any better for college graduates, she says. “They just don’t know what they are doing because they don’t have the tools.”

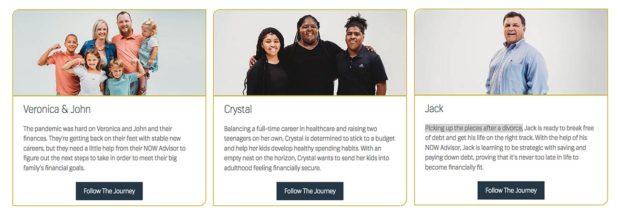

To help make its credit union members aware of the help available in its branches, Pen Air has a contest going on. Three counselors are teamed with a family or individual needing help to reduce their debt and increase their savings. They include Veronica and John and their four children; Crystal, a single mother with two older children; and Jack, who is “picking up the pieces after a divorce.”

The progress of each team is being published via video blogs on Pen Air’s website. Points awarded for hitting financial milestones will be added up at the end of the competition. Whoever has the most points will receive $5,000.

The marketing roundtable participants emphasized that continuing to volunteer in the community is a key part of credit union outreach. To help that happen, both O Bee and Pen Air give employees paid time off to use for service. Graham says one of his priorities is setting up this type of program for AFFCU staff.

Read More: Should Banks Add ‘Financial Therapists’ to Their Wellness Programs?

Branches Make a Statement: ‘We’re Here for You’

All three marketers believe that branches are important, not just for promoting their brands, but also providing a steady presence amid economic turmoil.

“When you have a physical presence in a community, that’s an anchor,” says O Bee’s Wojnar. “That’s your own sign saying that ‘we’re here for you.'”

Hatt says that consumers love digital services, but in times of financial difficulty or crisis they want to meet with someone in person and talk through their troubles. “Divorce, death, marriage, a new baby,” says Hatt. “These are all big, big life-changing things.”