The digital transformation of banking began with new ways of doing things — all those functions that go into online and mobile banking, says Bank of America’s David Tyrie.

He calls that the “I.Q.” stage of banking’s metamorphosis.

“What we have today is much more of a balance of I.Q. and ‘E.Q.’ — meaning ’emotional quotient,'” says Tyrie, BofA’s chief digital officer and chief marketing officer. “Customers put a much greater premium on how your bank, as an organization, makes them feel. It’s almost like how a doctor with a good bedside manner makes a difference.”

Not many banks and credit unions have reached this stage in their digital evolution, in his view. But Tyrie considers Bank of America to be at a level of digital banking maturity that enables it to focus not only on I.Q. but also increasingly on E.Q.

“I spend most of my time now on ‘how do they feel?'” says Tyrie, who is roughly a year into running his expanded team. (BofA merged the marketing group with Tyrie’s digital banking group in late 2021, when its chief marketing officer, Meredith Verdone, retired.)

Tyrie says he isn’t sure how focused other banking institutions are on this aspect of digital. “I don’t think you can overindex on how customers are feeling. Clients know what they want and that’s way more important than what technologies you are using to bring something to life.”

In an interview with The Financial Brand Tyrie spoke about his top concerns and the changing role of banking in consumers’ lives. He also discussed how BofA has moved far beyond “personas” in figuring out how to service people better, and why he’ll be content to be a “fast follower” with ChatGPT, even though Erica, the bank’s digital assistant, is built on artificial intelligence.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Bank of America’s ‘Flywheel of the Future’

The two jobs Tyrie holds might seem like an awful lot for one person to oversee. Some also might have reservations about melding separate marketing and digital banking units into one.

But Tyrie, turning around the signature line of the movie “Field of Dreams,” says that in digital banking, “If you build it, they will not come — you’d better market it.”

He also notes that the reconfigured team actually blends three functions: data analytics, digital banking and marketing. He calls this combo the “flywheel of the future.”

Data analytics is the key to understanding who the bank is serving and what they need to make their digital banking interactions more relevant and timely. This personalization is where marketing comes in.

“Marketing becomes much more targeted marketing,” Tyrie says. “Gone are the days of marketing saying, ‘Let’s look at a client segment and put a value proposition or a product out there. It means leveraging marketing as a real-time tool to allow us to serve customers better.”

Importantly, he says, change cannot be managed with coercion. Instead, the digital experience itself must be so persuasive that people have no interest in an alternative.

To explain the “flywheel” effect, Tyrie gives this example: Convincing more people to adopt, say, mobile check deposit reduces processing costs for the bank. The money saved there can be invested in improvements in technology and marketing capabilities. And the cycle repeats.

“So we are really kind of self-funding our efforts here,” says Tyrie.

Read More:

- Why Bank of America Believes Financial Health is the Future of Banking

- How Bank of America’s Social Media Chief Drives the Brand Online

- How BofA Grapples With The Increasingly Digital Small Business Market

Morning Coffee and Customer Satisfaction Readings

Tyrie gets a daily live view on how customers are rating their interactions with Bank of America.

“My first morning coffee goes with looking at what’s happening,” he says. “Are people happy with the experience they’ve had over the last 24 hours? What things are customers saying need to be improved? What things are missing that they wish they had from us?”

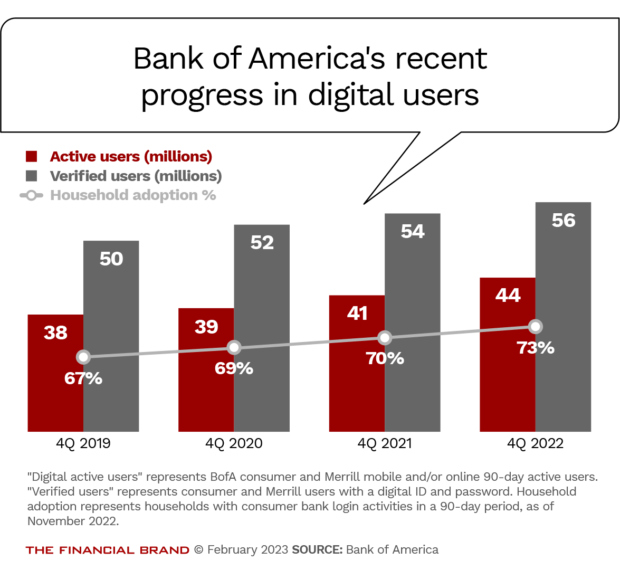

BofA’s consumer bank has roughly 67 million customers. They walk into a branch — BofA calls them “financial centers” — 250 million times a year. Another 250 million times a year they call the bank.

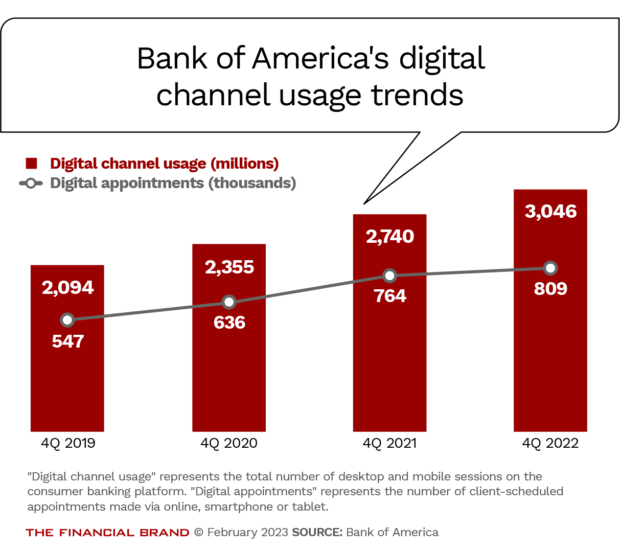

“Over 9 billion times a year, they interact with us through digital channels,” says Tyrie.

BofA has a team that operates a highly interactive tool called the Client Imperative Dashboard. The team pulls together every measurement the bank has on customer activities, plus other inputs like complaints.

Besides his daily E.Q. check, Tyrie looks for trends. “How many people in the last month sent money out of their Bank of America account to, let’s say, a fintech?” says Tyrie. “Is the volume something I should be worrying about or not? Why did they do it? I can see all of this.”

Tyrie can go from the general trend to ultra-specifics with a few clicks. “For example, if I want to see how they liked our separating Zelle transactions on the web from internal transfers, I can click right in,” he says. “The answer’s probably three levels down from my report.”

A live dashboard allows for addressing issues as they arise, rather than having to wait until quarterly reports get compiled.

Read More: 9 Digital Banking Stats from Bank of America To Worry Legacy Banks

BofA’s Goal: Let Customers Tailor Services to Their Own Liking

It’s become a mantra of digital transformation that “bank” will no longer be someplace you go, but something you do. To a degree that implies reaching out to your bank when you have a need. But Tyrie likes the idea — “it’s kind of a passion of mine” — of your bank being more or less ever-present.

He cites customer alerts as an example of this. Some “core” alerts, such as warnings about low balances, are always sent. For some others — like those dealing with credit card charges — consumers can opt out or make changes to the settings for sending one.

“And then there are those that are client opt-ins, which are very specific to the client,” says Tyrie. “It could be something like, ‘Hey, every Friday night I want you to tell me what my balance is looking like so I can figure out how much I’m going to take out for the weekend.'”

In January 2023, Bank of America sent nearly 900 million alerts to the 67 million consumers who bank there.

“Let me be a data geek for a second,” says Tyrie. Weigh that 900 million against another number: In the same time period, consumers logged into BofA digital services a billion times.

“So, in a couple of months, I expect that we’ll cross the number of alerts for the number of log-ins,” says Tyrie, “and I predict that alerts will continue to drive on from there.”

What this tells Tyrie is that many consumers don’t find the alerts annoying, but a key part of their BofA relationship.

“People don’t really want to think of banking as separate from their lives,” he insists. “They want to think of banking as an integral part of their lives.”

Read More: Shakeup in Retail Banking Strategy Spurs Product and Branch Innovation

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Alerts Become Marketing Outreach Tools

Tyrie predicts this will yield benefits with other interactions beyond simple alerts, when layered with other technology such as mobile-phone based geolocation.

Consumers could opt into a feature like receiving an alert if they are near a retail location that is featuring a special discount for Bank of America card holders, through its BankAmeriDeals program.

He sees this as a vast improvement over manually checking to see if the bank has arranged a deal with, say, Starbucks, and then having to figure out where the nearest Starbucks is.

“So my prediction is that you’re going to have this kind of capability of full-blown advice on your desktop as well as your mobile device,” says Tyrie. “Such alerts and notifications are going to make your life easier and it will make banking more relevant. It will become part of what you’re doing, rather than you thinking, ‘Oh, I’ve got to go log into Bank of America.’”

This is part of why the bank has gone beyond the fixed personas that other institutions have in place for understanding different groups of consumers. BofA’s data analytics capabilities allow for drilling down far beyond that level.

“We’re not going to be pushing out something on our digital properties and randomly saying, ‘Hey, preparing for a wedding?'” says Tyrie. “It’s going to be very targeted to you.”

Calls to action will be based on filters that include the consumer’s generation, their wealth level, and relevant “opportunity points” based on analysis of past consumer behavior. The latter consists of experiences where the bank won a new client or lost an existing one, Tyrie says.

Read More: The Right Way to Balance Digital and Branch Banking

Will BofA Add ChatGPT to its Erica Chatbot?

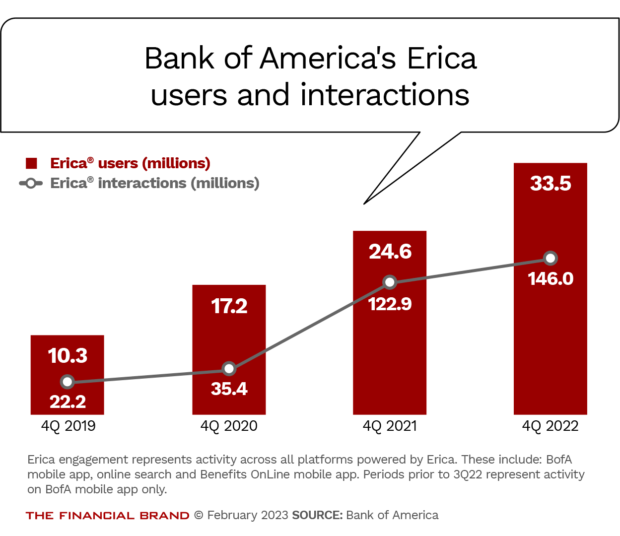

Erica, the pioneering chatbot Bank of America introduced in 2018, is built on artificial intelligence. In the first two months of 2023, the bank was on pace for 55 million Erica interactions per month, ahead of the pace of the fourth quarter of 2022.

“That’s about five interactions per user per month, which is pretty good,” Tyrie says.

Perhaps one of Erica’s greatest strengths, he says, is that it serves as a navigator throughout the BofA digital presence. Simply asking a question sends Erica on a quest to find the answer, whether it is general or specific to the consumer’s own relationship with the bank.

Erica’s flexibility is key to its success, says Tyrie. He describes the three ways consumers can use Erica now. At the simple end, the chatbot answers straightforward queries, such as balances. The next level is to deliver insights, such as a caution that the consumer is spending more than they usually do. Finally, the third level is true interactivity, where the consumer and Erica engage in back and forth dialogue regarding the next best step for the consumer in a given situation.

This saves the consumer time and aggravation and cuts the cost of human interactions for BofA.

“Erica is a massive opportunity for us to have great client interactions that are not phone based nor are they physical. We’re keeping people contained within the digital environment.”

— David Tyrie, Bank of America

Tyrie says of all the safety protocols a bank can build into its AI approach, an essential one is this: “The client has the ability to say, ‘I don’t like what I’m seeing, so turn it off.'”

So, would ChatGPT make Erica even better?

BofA’s digital team will leverage “anything and everything,” Tyrie says. But “you’ll never know what’s behind Erica. We don’t want you to know. What we want is to make sure that whatever tools that are behind there are industrial strength.”

For all the fuss about ChatGPT, it is still in the “super early” stage, he adds. “I hope it works. I hope that the lessons learned from many years of everything that’s happened on the internet can help.” He feels there is a lot to learn from the internet’s evolution.

“I have more than enough” to work on, says Tyrie. “So I can be a fast follower with ChatGPT.”

In retail banking, working with AI is critical, he adds. “Anybody who is not embracing everything around AI is not going to be in the lead three years from now.”