Based in Portland, Oregon, the team at Simple have swelled over 70. More importantly, the bank announced that the erstwhile BankSimple is now processing more than $1 billion in transactions a year, and has over 40,000 customers across the U.S. And they still have a line of potential customers — some 200,000 strong — waiting outside their virtual doors to open a new account.

Partnering with Bancorp, the same bank that supports Moven, Simple sets out to make banking as easy as possible (as you might expect from the name) by providing a streamlined online banking interface, intuitive technology and painless transactions — all for free, but with no branches.

“We were kind of nervous when we launched last year that people wouldn’t get it,” said Joshua Reich, founder and chief executive of Simple, in an interview with VentureBeat. “The real hope with these features is that we could do something that people have been trying to do, but that’s been difficult to do.”

Interestingly, Reich thinks his company over-compensated for its lack of branches in one area. “We went to a lot of effort to build the largest fee-free ATM network in America, but our customers aren’t really using it,” Reich admits.

This lower ATM utilization is likely to be seen as a good sign by financial industry observers. So virtual customers comfortable with an all-online/tech experience don’t need ATMs? Who cares?

Read More: Easy Banking: The Simple Strategy

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

Startups Challenge The Status Quo, Redefine Consumer Expectations

While the size of the bank may not be keeping traditional bankers up at night, the way Simple (and other new entrants like Moven, GoBank and Bluebird) leverage a branchless strategy with data-rich applications and a streamlined user experience can’t be ignored.

Over the past year, Simple has continued to innovate, providing features like reports and goals which offer immediate insight into one’s account. Leveraging smartphone capabilities, Simple also was one of the first banks that allowed you to block and unblock your card, reset your PIN and deposit a check using your phone. And just last month, Simple introduced new features like Goals for iPhone and fee-free External Account Linking that allows for transfers between accounts.

In the future, Simple hopes to continue to simplify the mobile and card-based banking experience, providing the best service without fees. Innovation will continue expanding the capabilities of the bank while not losing site of the underlying vision.

Attention to Little Details

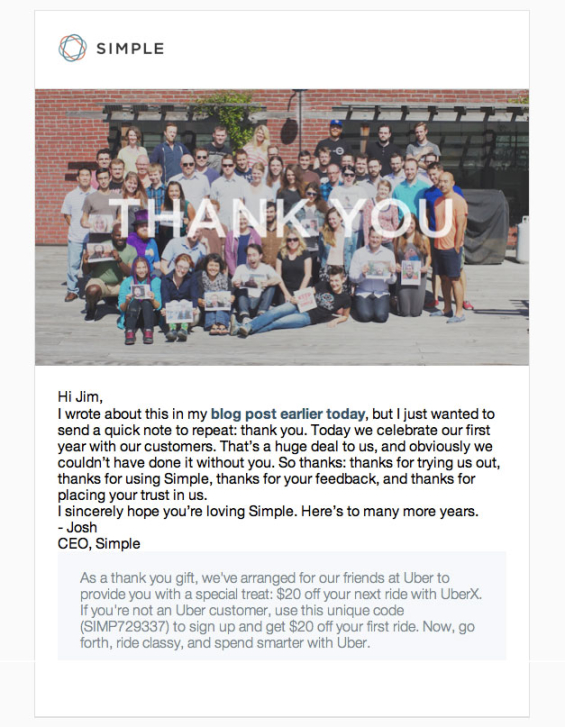

Probably most importantly, Simple continues to do the little things right. While the majority of my ‘traditional’ bank relationships continue to serve me as they have for years, Simple continues to provide surprise and delight experiences like today’s thank you email that included a gift…

EDITORIAL UPDATE: Simple has since been shut down, as of May 9, 2021, and absorbed into BBVA.