Note: This data is compiled using Google’s free Trends service. Each chart represents the relative increase (or decrease) in the number of searches Google’s users performed for each term over time.

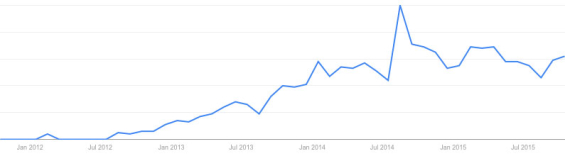

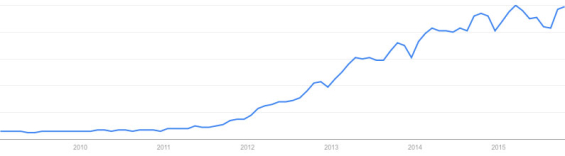

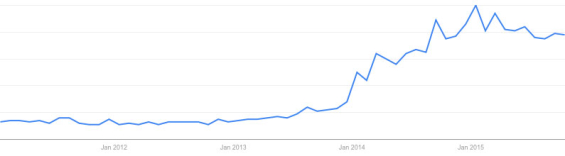

Native Advertising

Native advertising refers to a new form of online marketing where paid content is positioned next to editorial content. (In the old days, this used to be called “advertorial” content.) It’s become quite common — so much so that mainstream media outlets like CNN have a huge section of paid material on their homepage, positioned as content “From Our Partners.” If you haven’t heard of native advertising yet, it’s time to put it on your radar. Native ads are a growing trend, and could be very effective for banks and credit unions alike.

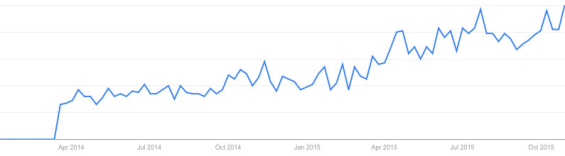

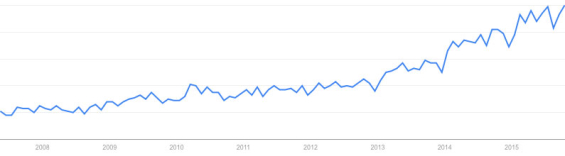

Programmatic Advertising

The term “programmatic advertising” is little more than a fancy expression for “automated ad buying.” If you’ve ever bought Google AdWords or AdSense advertising, you’ve used a programmatic service; you specify your criteria and budget, and the system handles the rest automatically. This model is intended to replace the cumbersome approach of yesteryear, where RFPs and insertion orders required a ton of hands-on human intervention. Programmatic advertising is one of the hottest trends in the marketing world, and most experts believe it will be the primary method for buying ads in the future.

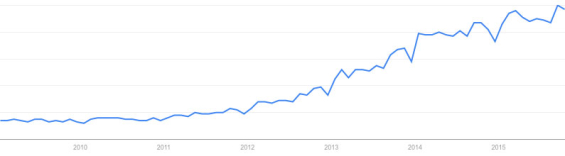

Retargeting

Not long ago, this was considered a new revolutionary and radical idea. But today, retargeting has gone mainstream. If your financial institution hasn’t implemented retargeting as one of the main cornerstones of your marketing strategy, you are leaving money on the table.

Read More: A Comprehensive Guide to Retargeting for Banks & Credit Unions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

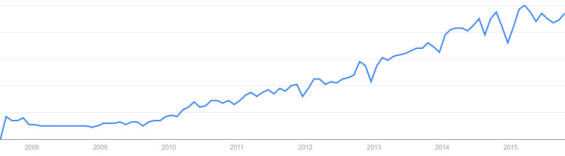

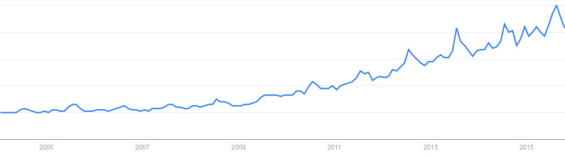

Data Analytics

The maturation of the internet has lead to an explosion of digital data. Marketers are awash in more data than they know what to do with. They can track nearly everything consumers do online, and they are increasingly able to link that data with offline behaviors. This has fueled a huge uptick in the subject of “data analytics.” If you work in any kind of marketing capacity today, you had better be able to capture and crunch numbers.

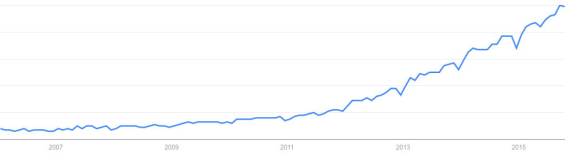

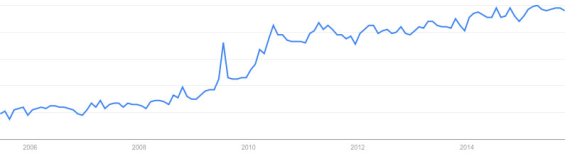

Big Data

Unless you are an über nerd, you probably hadn’t heard the term “big data” prior to 2012. Initially regarded with the same kind of skepticism reserved for things like alchemy and voodoo magic, big data has evolved into a tool that can help financial institutions mitigate risk, reduce fraud and improve their marketing strategies. However, big data remains largely beyond the reach of most modest-sized banks and credit unions.

Marketing Automation

With the increasing complexity of marketing in the Digital Age, it’s no wonder attention is focused on automation. The abundance of data available today allows financial institutions to slice their target audience into new segments and personalize marketing messages to new levels. But these new capabilities also require new tools, which helps explain the exponential growth of companies specializing in marketing automation such as Salesforce, Hubspot and Marketo.

Content Marketing

Back in 2007, we weren’t sure what to call it, so we used the term “Web 2.0.” From 2009 to 2013, it was called “social media.” These days, the “content marketing” is the vogue term to use when referencing online channels like blogs, social media platforms and social sharing tools. The nomenclature we use isn’t irrelevant. It’s a reflection of how the online space has grown and matured. At first, we didn’t know what it was good for — it was just new and exciting. Now we have a much clearer idea of why and how to leverage online channels; today, it’s all about content.

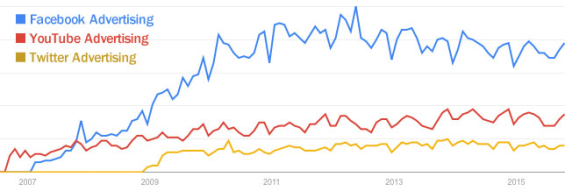

Facebook, YouTube, Twitter Advertising

Many financial marketers obsess over their social media strategy — What should we tweet next? How many Facebook ‘Likes’ do we have today? But few think about social media channels as an advertising outlet. Considering Facebook’s organic reach is now Ø and most financial institutions have less than 500 followers on Twitter, more bank and credit union marketing execs will have to look at leveraging ads on these channels to generate any real traction. You can use the chart below to gauge your relative investment in each channel.

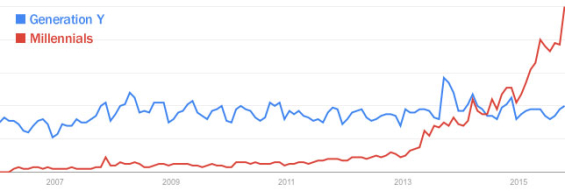

Millennials vs. Generation Y

It’s no longer cool to use the term “Gen Y,” which was never intended to be anything more than a placeholder. These consumers are now referred to as “Millennials.” Whatever you choose to call them, financial institutions have struggled — and continue to struggle — connecting with these consumers. But make no mistake: these aren’t “kids” anymore; most are adults. The oldest members of this generation are in their mid-30s — old enough to have been married, divorced, served in the military, bought a house, had kids and changed jobs multiple times.

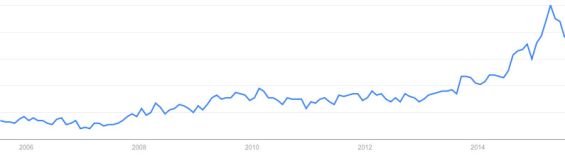

Generation Z

Generation Z refers to those born after the Millennial Generation. There is consensus on the exact range of birth dates, although many generational academics start this generation in the mid- or late 1990s. Considering how long it took for banks and credit unions to wrap their heads around Millennials, financial marketers should start work on their Gen Z strategy now.

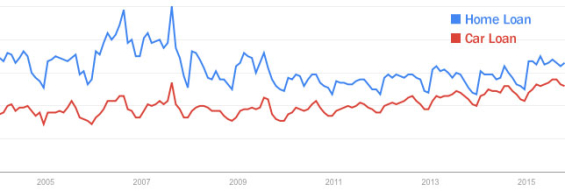

Home and Auto Lending

In the wake of the financial crisis that lead to the Great Recession, consumer lending ground to a halt. But starting in 2012, you can see search volumes in Google for terms like “home loan” and “car loan” starting to rebound, with steady improvements every year since. Will a rate increase from the Federal Reserve put the brakes on this recovery?

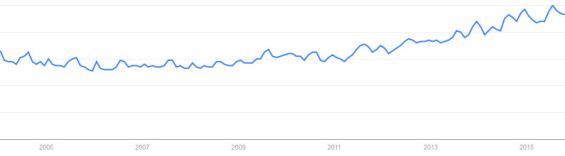

Credit Cards

Consumer interest in credit cards hit a low point in 2007, the bowels of Great Recession. However, searches for “credit card” have been on the rise since, and suggest that the market for revolving credit is stronger than mortgage or auto lending.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Mobile Banking

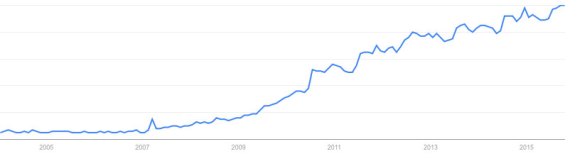

Prior to the introduction of Apple’s iPhone, the concept of “mobile banking” was virtually non-existent. But on June 29, 2007, everything changed. It took a couple years for the financial institutions to catch up and roll out new tools and solutions for smartphones. Today, banks and credit unions — and the consumers they serve — all realize the potential mobile devices have in the banking industry. And there is no indication that the rapid growth of this new delivery channel will slow down anytime soon.

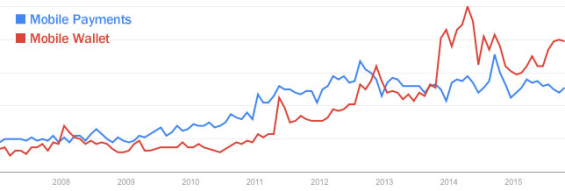

Mobile Payments and Mobile Wallets

Once retail financial institutions worked out their initial challenges with smartphone solutions, everyone’s attention quickly shifted to the payments space. Mobile devices first killed digital cameras and watches — no need to lug that extra baggage around anymore. As consumer acceptance of mobile payment tools grows, physical wallets will be the next thing people ditch.

Bank Branches

Despite those who decry the bank branch as “dead,” study after study shows that consumers still consistently use branch proximity as the number one factor driving their decision when choosing a new banking provider. Google search volumes seem to support this premise, with a four-fold rise in searches for “bank branch” over the last six years. If branches are dead, why are consumers still searching for them?

Geolocation

Thanks to the GPS systems in today’s mobile devices, it’s now as easy for consumers to find what they are looking for — in real life — as it is to type a search term into Google. Financial marketers — particularly those working at community-based institutions — need to be sure they stay on top of the geotargeting trend. You can deliver your marketing messages with pinpoint precision, at the right time and right place.

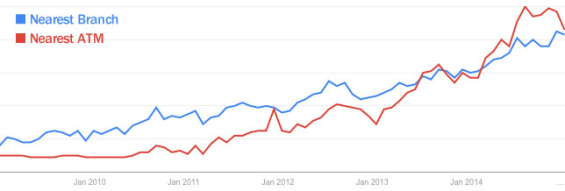

Nearest Branch and ATM

Consumers may not be going to branches and ATMs as frequently as they used to, but they are searching for them with increased regularity. Presumably, the majority of these searches are performed on smartphones.

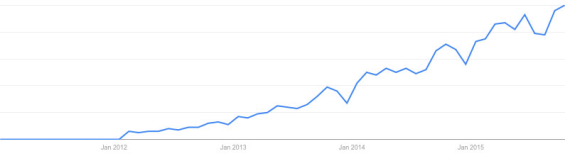

Omnichannel

Most experts agree that it’s become increasingly important to deliver a seamless, consistent, integrated experience across all channels and touchpoints — a concept captured with the single word “omnichannel.”

Crowdfunding

The notion of “crowdfunding” was initially dismissed by the mainstream banking sector as a quaint concept. Consumers however see it as an increasingly viable alternative to traditional lending options. Online providers like Kickstarter, IndieGoGo and Kabbage represent a real threat in the business lending category, with some crowdfunding campaigns raising as much as $93.8 million in capital for a single business venture. It’s time banks and credit unions look at how they can tap into this popular trend.

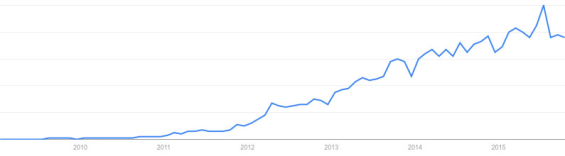

Fintech

The fintech sector has erupted in recent years. For every challenge facing the financial industry, there seems to be a technological solution. Fintech has captured the attention of the banking industry and venture capitalists alike. Between all the new players disrupting the status quo, and thousands of financial institutions scrambling to keep up, everyone is fixated on “digital innovation.”

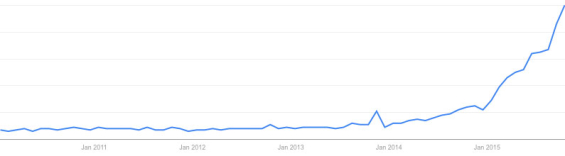

Wearables

While the mainstream media has celebrated the arrival of wearable technology, the future for wearables — particularly in the financial industry — remains unclear. There was some hullabaloo about the potential Google Glass, but that initiative was aborted. Some financial pundits predict that Apple’s new Watch will play a significant role in the industry, but what does a watch offer that a smartphone doesn’t (especially when carrying a phone is a necessity these days, whereas a watch is optional)? Whatever the ultimate outcome, interest in wearables will continue to grow. Get ready… the Oculus Rift is coming next.