The biggest institutions have their names all over baseball, soccer, golf, football, and many other sports. Bank of America and Citi are among the largest bank sponsors of sporting events, each spending between $80 million and $85 million per year, according to ESP Properties.

According to sports fan website The Comeback, 30 out of 123 major sports teams in the U.S. play in venues named after banks. Here are a few:

- Bank of America Stadium (Carolina Panthers, NFL)

- Citi Field (New York Mets, MLB)

- Rocket Mortgage Fieldhouse (Cleveland Cavaliers, NBA)

- Capital One Arena (Washington Capitals, NHL)

- U.S. Bank Stadium (Minnesota Vikings, NFL)

But that’s just the big guys. Banc of California, a new brand, in 2013 hooked up with The Los Angeles Football Club in 2016 for the rights to name the team’s new home field the Banc of California stadium. It cost the bank $100 million over 15 years, Bloomberg reported. That’s for a soccer team!

And TDECU, a credit union with $3 billion-assets is five years into a ten-year, $15 million deal for the naming rights on a college football stadium. An institution that size could do a lot of things with $15 million, even spread over ten years.

Worldwide, the sponsorship market — all events, not just sports — is pegged at $60 billion, and growing at 4% a year, according to BrandWatch. In North America, 70% of all corporate sponsorship money goes to sports.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Word Comes Down From The Head Office … Uh Oh

Sports sponsorships clearly suck up a huge chunk of money. But are these deals — the larger ones, versus local Little League commitments — worth it? Or would a bank or credit union do better to put sponsorship dollars into building a better martech stack, hiring a digital marketing expert, or increasing its Facebook ad budget?

McKinsey researchers found that U.S. corporate spending on sports sponsorships equalled one-third of U.S. television advertising. But a key point of the research is that one-third to one-half of U.S. companies don’t have a system in place to measure sponsorship ROI comprehensively. Further, McKinsey states that companies that do use a comprehensive approach have increased sponsorship impact by 30%.

Determining the effectiveness of sports sponsorships — particularly logos emblazoned on a jersey or the side of a stadium — is difficult. It often comes down to brand awareness or recognition.

On top of everything else, sports sponsorships typically are initiated at the highest level within a company. “Whereas ad campaigns are managed by professional marketing and communication teams in a company, the decision to sponsor … a cycling team in the Tour de France, will very much depend on the predilections of the chairman or the CEO of a company,” notes B2B International, adding: “This is a potential nightmare for the marketing and communications teams.”

But it doesn’t have to be. B2B points out that if the goal of the sponsorship is to entertain strategically important clients, then the sponsorship may be more than justified if one or two of these convert to significant new business.

Read More: How Experiential Marketing Made Citi an Entertainment Giant

Social Helps Give Sponsorship Wide Visibility

Although sports sponsorship comes with caveats, it definitely has its place in the financial marketer’s playbook.

“For financial brands looking to communicate new products or benefits to the masses, league or sporting event sponsorship can be an effective way to quickly generate wide reach,” maintains Nick Batt, senior research analyst, Mintel Comperemedia. Live sports is one of the last content genres with large, real-time viewership — eight of the ten largest TV broadcasts in 2018 were sporting events, Batt points out. “Brands are wise to use the exclusive advertising rights that occasionally come with sponsorship to communicate new features or show their brand in a new light.”

“For banks and credit unions that are in the top three in their market, sports sponsorships could make sense as a way to deepen the emotional bond with consumers.”

— John Mathes, Strum

“For banks and credit unions that are in the top three in their market, and have allocated funds to other objectives, sports sponsorships could make sense as a way to deepen the emotional bond with consumers,” states John Mathes, Director of Brand Strategy for Strum. He adds that it also makes sense for challenger brands that want to standout and create awareness.

Fintech lender and neobank SoFi, is an example of this. Following the success of its 2016 Super Bowl ad, the personal finance brand became a sponsor of the Big Ten men’s college basketball championship finals at Madison Square Garden in 2018. As Tearsheet notes, sponsoring a prominent sporting presents the company as a “well-resourced entity capable of standing on its own alongside other larger consumer brands.” At the Big Ten Finals, SoFi was in the company of Gatorade, Shell, State Farm and T-Mobile.

While TV is still the prime medium for sports audiences, social media has become popular for streaming sports events in short clips. A blog from LogoGrab, a provider of logo detection software, says 80% of fans use social media during live sporting events — “second screening” at the actual event and elsewhere, giving financial brands a wider range of platforms on which to appear.

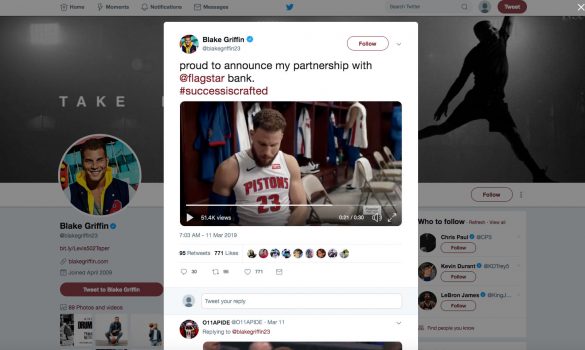

Social can also be powerful if a bank or credit union decides to sponsor a team or athlete. Michigan’s Flagstar Bank, for example, inked an agreement with basketball superstar Blake Griffin to appear in a TV ad campaign along with the bank’s CEO, Alessandro DiNello. The 2019 deal helps anchor the bank’s overall sponsorship of the Detroit Pistons, where Griffin plays, and the athlete has actively mentioned the partnership to his 4.43 million Twitter followers.

Texas Credit Union’s Big Stadium Deal, 5 Years In

According to Ad Age, JPMorgan Chase is ponying up $10 million a year for 20 years for the naming rights to San Francisco’s Chase Center, where the NBA’s Golden State Warriors play. $200 million is a drop in the bucket for a $2.74 trillion enterprise. For a $3.4 billion credit union, a similar $15 million deal, is much bigger proportionately. That’s the amount TDECU is paying over ten years for the naming rights to the University of Houston’s 40,000 seat football stadium.

The Financial Brand caught up with Alex de la Cruz, Chief Growth and Strategy Officer to ask about the ROI of the deal.

The arrangement involves naming rights to the stadium, related signage, a 50-yard-line suite, ticket discounts for the credit union’s members and the ability to market the credit union through activation events.

There are several indirect benefits from the deal, de la Cruz states. Among them is the ability to work with undergraduate and graduate student teams to help assess product and channel strategies. In addition, the partnership has led to the opening of a full-service branch on campus and an ongoing relationship with the UH alumni association. These benefits were not all anticipated at the outset, but have proven to be significant.

The goals for the deal were straightforward: build brand awareness, add members and sell more products. De la Cruz declined to share product or member numbers, but did say that brand awareness — aided and unaided — had almost tripled within the Houston MSA since the start of the deal. He did point out that TDECU’s awareness numbers were “pretty low” five years ago. Traditional marketing approaches were, and still are, being used to improve the numbers, but de la Cruz says management was looking for a “heavy hitter” option, and the stadium naming opportunity fit the bill.

As good as the improved brand awareness numbers are, de la Cruz says the other benefits the institution has received from the overall relationship “are almost priceless.” He cites input from the student teams about products — including how to improve credit card performance — delivery channels and even operational efficiency.

Read More: It Doesn’t Take a Sports Celebrity to Inspire Greatness in Banking

5 Tips If You’re Contemplating Sports Sponsorships

Sports sponsorships, though obviously popular, are not a “slam dunk” for everyone. Alex de la Cruz and other marketing professionals offer suggestions for bank and credit union marketers.

1. Have the right expectations. “If you’re looking for immediate lift, or increased traffic to your branches, or website, sponsorships might not be the best avenue,” advises Strum’s John Mathes. He rarely recommends sponsorships as an acquisition tool. But for financial institutions “looking to foster loyalty, build awareness, connect to a particular target market that follows the sporting activity, then it could be a great opportunity.”

2. Be sure the sport is a good fit. Sports fans range from loyal to fanatic, so it’s crucially important that the sponsor be a good fit with that fan base. One example of where it wasn’t was with Wisconsin’s Incredible Bank, which sponsored NASCAR driver Kyle Busch for several years as a way to build awareness of its online motor home lending business. It didn’t pan out, says President Ellie Reineck, because the NASCAR celebrity angle didn’t fit with the market the bank knew well — self-made business people.

3. Don’t forget activation. McKinsey finds that companies often spend a lot of money acquiring sponsorship rights, but not on activation — marketing activities such as merchandise and booths to promote the sponsorship. Adds Mathes: “If you decide that a sports sponsorship would help you achieve your objectives, then go all-in. Utilize every opportunity provided to you by the team. You want to own it.”

4. Integrate traditional and digital channels. “Second screen” use is growing rapidly among live sports viewers, notes Mintel Comperemedia’s Nick Batt. He says one in three adults now check social media or email while watching sports. This is an opportunity for financial brands to promote specific offerings to get consumers to take action, in contrast to a brand message.

5. Picking a winner is important. Financial marketers can’t predict a season’s results — much less a multi-year record — but they definitely should consider a team’s prospects before committing big bucks to a sponsorship. Alex de la Cruz acknowledges that performance of the University of Houston football team was a consideration for TDECU in inking its stadium deal and will continue to be. And if you’re a big enough sponsor, like Anheuser-Busch InBev, you can now scale the deal based on teams reaching the playoffs, or other goals.