Despite many advancements in the use of data that help banks and credit unions target the most appropriate consumers, marketers face many challenges measuring marketing performance. The fact is, the level of investment in marketing has never been higher. Yet, many financial institution marketing leaders are still asking themselves:

- Am I spending my marketing dollars efficiently?

- How should I plan for next year?

- How am I performing compared to my peers?

The need for improved marketing measurement has become a higher priority because of the shift of spend into more advanced digital channels. For a long time, digital measurement was somewhat straightforward. But mobile changed that. Measurement today is more complicated, more nuanced, and more important than ever. What’s needed is the ability to deliver accurate marketing measurement to maximize media spend, creative rotation, brand impact, account openings and, ultimately, marketing ROI. Yet, effective measurement often lags behind customer acquisition marketing strategies and capabilities.

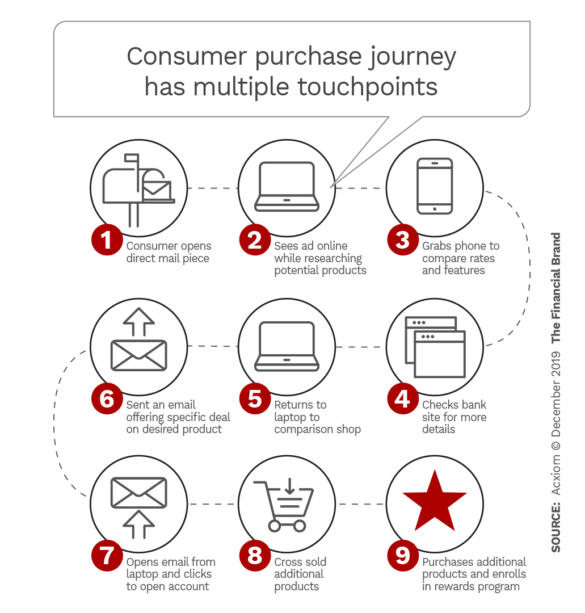

As marketers spend more of their budget in digital, they come under increasing pressure to justify the spending and quantify its impact. More than ever, they need to take into consideration other touch points beyond the one that immediately preceded the conversion.

Challenges to Accurate Measurement

Because digital media generates a lot of data, it is assumed to be highly measurable — and it is, when taken one medium at a time. However, due to the fragmentation of technologies and platforms, digital introduces complexities that marketers must understand to achieve accurate results. In contrast, offline channels may provide less user engagement data, but in many cases personally identifiable information (PII) enhances targeting precision due to a clearer understanding of the consumer identity.

From a campaign measurement perspective, the points below summarize some of the challenges marketers must address with digital channels.

Digital Channels and Some of Their Measurement Challenges

Display ads (cookie or mobile ID based, anonymous user)

- Cookies expire and consumers may delete them; mobile IDs can also be reset by the consumer.

- Most consumers have multiple cookies, because they use multiple devices and browsers. Shared device usage can associate multiple consumers with a single cookie.

- Anonymous identifiers used for targeting may have resolution issues for achieving closed-loop campaign measurement.

- For mobile devices using Apple iOS, third party advertising cookies are blocked by the Safari browser.

Display ads (people-based, known user, e.g. social display, authenticated video)

- Some people-based ad networks do not support third-party measurement tags to enable verification of what is reported to marketers.

- For most PII-based publishers, you can only look at aggregated campaign data side by side.

Search advertising

- Marketers do not receive consumer-level ad “exposure” data to understand reach as search engines don’t use pixels for impression tracking and report on clicks.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

5 Steps to Setting the Right Marketing Metrics

A key component in marketing success has become the ability to demonstrate the impact of marketing initiatives on key business outcomes, yet many financial marketers struggle to determine which metrics are the right ones to deploy.

Some marketing executives focus only on their efficiency of spend (e.g. cost per thousand, cost per click) rather than on more important business metrics (e.g. cost per new-to-bank accounts). Each bank or credit union has a different starting position and may even need to measure performance differently at a market level. Factors such as branch share, competitive intensity, pricing strategies, and overall awareness can become important in understanding true marketing performance.

Here are five specific measurement recommendations:

1. Use closed-loop measurement to understand the impact of a specific marketing campaign in driving consumer response and conversion.

The ability to connect digital and offline transactional data underpins closed-loop measurement of marketing impact. We live in a world where many consumers may initially engage with a brand via digital channels; however, they may then open their account in a branch or via a call center. This can make it challenging to connect an offline transaction to related digital touch points. Further complicating the situation, there can be siloed agency or platform (social, direct mail, mass media) reports that do not generate a central source of truth.

Closed-loop measurement requires access to a wide range of data and accurate identity resolution with the use of common identifiers for consumers as they interact through digital and offline channels. Once marketers set the foundation for effective closed-loop measurement they can shift from only measuring past performance to providing a quantitative basis needed for future planning and investment decisions.

Read More:

- 6 Marketing Myths That Can Trap Banks & Credit Unions

- How Financial Marketers Should Calculate The Real ROI of Branding

- Why Banks and Credit Unions Keep Blowing It Using Net Promoter Scores

2. Set-up test-and-control experiments to assess whether marketing truly drove the decision to purchase.

Experimental design is a proven methodology that helps financial institutions answer questions like “Did my marketing campaign drive new account openings, or would consumers have opened the accounts anyway?” Financial marketers should use test-and-control experiments for digital and offline marketing campaigns to objectively measure the lift in new business associated with their marketing programs.

This methodology requires a defined test group of campaign-exposed individuals and a control group of non-exposed individuals. The selection needs to ensure an apples-to-apples comparison between the two groups so they are statistically identical and isolates the effect of campaign exposure on conversion. Furthermore, marketers should ensure these groups are large enough to provide statistical significance.

It is our observation that in many cases, experimental design is not in place and there is no clean control. Without this type of testing, banks and credit unions are not able to truly understand the performance of their marketing and unable to optimize their marketing effectiveness.

3. Minimize audience drop-off by working with demand-side platforms (DSPs) and ad networks with higher match rates.

As marketers enter a more advanced world of digital marketing, they depend more on new platforms and partners where data flows and are utilized by DSPs and ad networks. Understanding the nuances of data and matching technologies is very important, as it has an impact on match rates.

Financial marketers should review match rates from ad networks or platforms prior to starting a campaign and request their definitions to evaluate each network properly. By doing so, marketers can plan for and neutralize exposure bias, which helps them reach their target audience and mitigates the biases generated by audience drop-off due to match-rate variations.

4. Audit your data and analytics to ensure the accuracy of your analysis.

More data is not always the answer. The lack of good input data will lead to poor conclusions. Also, data is available at different levels of granularity (i.e. individual vs. household), which can impact a true comparative analysis. As a result, it is important to collect and audit all data across touch points so you have the necessary information to answer measurement and attribution questions.

For many financial institutions, this can be a complex process as data can exist across multiple lines of business, reports from agencies, social media platforms, and other sources. Lack of comprehensive data makes it difficult to answer performance questions. Additionally, the lack of readily accessible data inhibits the development of timely marketing execution and planning. Creating an asset mindset regarding data makes it easier to care for over the long haul.

The increasing use of machine learning and artificial intelligence in marketing creates efficiency and opens up new opportunities with prediction and optimization. While there are many advancements, marketing analytics should employ transparency to support auditors and internal compliance.

5. Sharpen marketing performance with attribution analysis.

Attribution focuses on understanding the impact of omnichannel campaigns over a longer period of time and on assigning credit to the channels or campaigns that touched consumers along their journey, resulting in conversion events. (See journey chart, above.) But not all attribution approaches deliver the same results. Here are four attribution models to consider:

- First touch attribution. Credit goes to the first channel a consumer engages.

- Last touch attribution. Credits the last campaign a lead engaged with prior to converting.

- Multi-touch attribution (rules based). Shares credit across all of the touches of the buyer’s journey, based on a set of predefined rules. This approach often is not robust enough, because rules can be modified to give more credit to channels that marketing decision-makers favor.

- Multi-touch attribution (algorithmic). Splits credit among all the touches along the buyer’s journey, using an algorithmic approach that is based on a statistical model. Using optimization routines this approach can assess the true contribution of each channel’s impact in driving conversions.