Over the past decade, the marketing profession has moved from art to science, with a foundation of new technologies powered by artificial intelligence (AI) and internet of things (IoT), and with a level of personalization and real-time communication only dreamed of in the past. Consumers are continuously connected through mobile devices and have complete control over the organizations they interact with and purchase from. Their expectations are elevated — and the opportunity for banks and credit unions that master the new technology has never been greater.

Management’s expectations are elevating as well. Rather than asking to see the newest TV commercial or hear the next radio commercial, financial institution leaders will increasingly say, “Show me the money” as it relates to the impact of marketing initiatives. They see that momentum is building across all industries for using technology to build engagement, in real-time, with connected consumers. The return on these personalized interactions can’t be matched by traditional marketing.

While marketing strategies and tactics are far more complex due to the mix of channels available and the multitude of consumer journeys taken, the upside from combining data, analytics and digital channels is a powerful formula for success.

According to Salesforce, “79% of consumers say the experience a company provides is as important as its products and services. Today’s most successful marketers are using AI-powered automation through a myriad of channels to reach consumers with relevant, personalized content in real time, at all stages of the customer journey.”

Authentic personalization is now more essential to marketers than ever, as 84% of customers say treating them as a unique individual is key to winning their business. “Innovations in real-time two-way communication, from AI-supported live chat to dynamic chatbots, are transforming consumers’ brand interactions for the better,” states Salesforce. “Brands now have all the tools they need to deliver truly personalized customer experiences at every touchpoint.”

Read More:

- 15 Applications for AI and Machine Learning in Financial Marketing

- Artificial Intelligence: The Financial Marketer’s Secret Weapon

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Focusing on the ROI of Digital Marketing

The marketing function across industries is moving from an emphasis on the customer experience to being held accountable for a tangible return on marketing investment (ROMI). These should not be conflicting objectives. In fact, it has been found that building a better customer experience through effective, personalized and contextual engagement positively impacts revenues and customer lifetime value.

Research from Salesforce found that nearly eight in ten (79%) customers are willing to share relevant information about themselves in exchange for contextualized engagement, and 88% are willing to share for personalized offers. When marketers invest in personalizing customer experiences, they see clear benefits.

- 92% of marketers say personalization majorly (54%) or moderately (38%) improves brand building.

- 86% of marketers credit personalization with a major (44%) or moderate (43%) boost in lead generation.

- 84% of marketing leaders say personalization majorly (45%) or moderately (39%) improves customer acquisition.

As could be expected, developing highly personalized communication also has a positive impact on customer retention (85%), customer advocacy (82%) and up-selling (79%), Each of these has a major financial impact for an organization.

Thanks to their experiences with Google, Amazon and other big tech companies, 62% of consumers now expect companies in general to “anticipate their needs.” And that number is only going to increase in 2020 and beyond. The financial institutions that improve contextualized communication and engagement will be the most successful.

Shifting from Product to Customer Centricity

In 2020, successful marketers will not be at the mercy of product managers who want to ‘push product’ based on season or broad consumer segmentation. Micromarketing using digital channels and highly personalized content will be the norm, with results measurable by the hour as opposed to by the quarter. Product and financial goals will be met incrementally in real-time as opposed to being based on product promotions.

Each communication going forward will be customized based on the behavior of the customer and the stage of the buying journey, as well as the time of day, location of the customer, recent social engagement, etc. More importantly than ever, seamless multichannel communication will become paramount,

Across every stage of the customer journey, social marketing will become increasingly important. According to Salesforce Research’s fifth “State of Marketing” report, once a customer relationship has been established, tried-and-true email marketing remains a keystone in effective direct engagement. In addition to a company’s website:

- The marketing channels with the highest ROI for lead generation include social marketing, customer social communities, and paid search or search engine marketing.

- Marketing channels with the highest ROI for up-selling include email marketing, partner affiliate marketing and social marketing.

- Marketing channels with the highest ROI for customer retention include customer social communities, email marketing, and social marketing.

Moving Marketing Measurement out of the Dark Ages

While the channels and technologies of marketing have evolved, the Digital Banking Report has found that marketing measurement of results has not kept pace. With customer journeys involving more channels and stages than ever before, single touch attribution no longer works. Not only can it over or under-represent the importance of any channel or message, it will completely invalidate any marketing ROI measurement.

In addition, the importance of measuring social media, mobile interactions, video engagement and referrals will increase in the future. Most importantly, not being able to measure results in real-time will no longer be tolerated by most progressive organizations.

Some trends from 2019 that will increase in importance in 2020 and beyond include:

- High-performing marketers are 1.4x more likely than underperformers to say traditional approaches to marketing measurement are no longer effective.

- 43% of marketers are now tracking customers’ overall lifetime value, while 49% track mobile analytics.

- 52% of marketers track how many and how often they receive referrals from customers, and 51% track how much it costs to acquire a given customer.

Read More:

- AI Could Destroy Traditional Banking As We Know It

- 94% of Banking Firms Can’t Deliver on ‘Personalization Promise’

New Ways to Connect

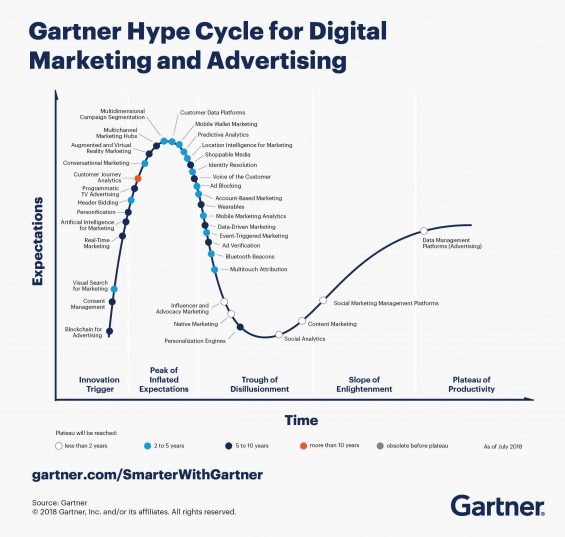

The Gartner Hype Cycles illustrate that there is a sequence of stages when we look at the maturity and adoption of marketing technologies and applications. From the ‘innovation trigger’ to the ‘peak of inflated expectations’ and ‘trough of disillusionment’, it is sometimes difficult to sort out the real from the hype.

As we move quickly to 2020, we are beginning to see the trends that will stand the test of time in financial marketing. Not all will be embraced by all organizations, either because of budget limitations and or lack of skillsets or the culture required to move forward. That said, each of these relatively new trends should be considered as a way to improve marketing ROI in banking.

Voice-first engagement: Voice devices are one of the most rapidly adopted technologies in recent history and is changing the way consumers interact with the world around them. Beyond standalone devices in the kitchen or bedroom, voice engagement is possible on a mobile device, in a car or virtually anywhere a consumer wants to engage,

The biggest change in the future will be the transition from the use of voice devices to answer questions to the ability to use voice devices to provide personalized advice and recommendations.

Video marketing: The growth of using videos to connect has expanded well beyond YouTube marketing. In fact, 72% of consumers would rather use a video to learn about a product or service than any other channel. The impact on financial marketing will be significant as we look for new ways to deliver personalized financial education and content marketing. According to some experts, 80% of what we consume online may soon be video content.

Social media ‘conversations’: In the past, financial institutions used social media to ‘talk’ to customers and prospects or used social channels for referral purposes. Today, we are beginning to see a lot more organizations use social listening (monitoring) strategies to find mentions of brands, products or keywords that can drive outbound engagement across all social channels.

Content marketing: By 2020, we expect to see more use of content marketing, from financial education to product demonstrations and advisory messaging. Banks and credit unions will continue to test the viability of long vs. short-form content to determine the best way to engage. The biggest trend in banking regarding content will most likely be the ability to personalize, by name, each message.

Outsourcing: With so many changes to the marketing landscape, more and more organizations will seek outside partners to help them move forward and generate positive financial results quickly. With talent in the marketplace limited, and an increased focus on generating a positive financial impact, the movement to solution providers who have a proven record of success will be part of every financial institution’s strategy in the future.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Road to 2020

As we look to 2020, marketing will double down on the importance of improved customer experiences, but will increasingly focus on measuring the financial impact of these experiences. With ROI driving the mission, there will be an increasing adoption of artificial intelligence, a premium placed on mastering data management and advanced analytics, a heightened focus on real-time customer engagement and a need to deliver detailed measurement of results.

It’s time for marketing departments in banks and credit unions to move from being viewed as a cost center to being a revenue center.