While certain categories of consumer goods naturally lend themselves to messages or sales points very directly aimed at mothers, it’s curious that financial services advertising doesn’t focus more on this segment.

“There’s a Mother’s Day push every year and maybe we’re seeing mothers portrayed a bit more creatively,” says Jeannette Ornelas, Senior Digital Marketing Analyst at Comperemedia, a Mintel company. “But in terms of messaging that is very explicitly or directly talking to moms, it’s more few and far between than other industries.”

For decades financial marketers have known that in many traditional households wives and mothers typically handle banking and make many financial decisions. And in single-parent households run by mothers the moms are, of course, nearly everything.

In addition, mothers are the primary source of income in 40% of U.S. households and 67% of those mothers are single, according to marketing figures curated by M2Moms.com. Despite that, only 9% of American mothers surveyed by Mintel say that moms portrayed in advertising bear much resemblance to the real-world.

While financial marketers understand that the days of “Donna Reed” and “Father Knows Best” are long past, when they do target mothers in ads or social media posts, they tend to portray them visually in ways that don’t match modern realities, according to several pieces of research by Comperemedia and Mintel.

In addition, with some exceptions, their messaging exhibits a sameness.

“If you strip away the brand logos in the posts on social media, it’s often hard to say who the institutions are addressing and how what they are saying relates to their brands,” says Ornelas. “This is where I think the struggle is and why so many moms don’t feel represented in financial services advertising. When you’re talking to a specific audience, you have to truly understand that audience, what their pain points are, what their struggles are, what motivates them and what excites them.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

From ‘Having It All’ to ‘Doing It All’

Something that may be getting lost in the overall push to adapt bank and credit union service to consumers in general during the pandemic, for example, is that COVID-19 has made motherhood even more challenging than it was even just a year ago.

For example, where the media and advertising tended to portray modern motherhood as a time of “having it all” — family, career and more — the pandemic has changed the dynamic.

“COVID-19 has placed extra pressure on moms to ‘do it all,’ forcing moms to make peace with the chaos and find creative ways to adapt,” states Mintel’s report Marketing to Moms.

There’s a challenge here, but also an opportunity for financial brands that take a fresh look at the who, how and why of their outreach to mothers.

“Moms are surprisingly open to getting parenting advice from brands — 44% say they like it — which indicates that brands can play a role in moms’ support network as they handle new challenges,” states Mintel’s report.

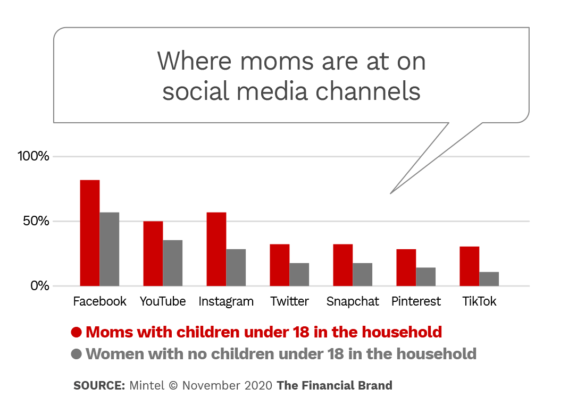

Mothers use social media platforms a good deal and they also follow “mommy-bloggers” and others online that write specifically to the needs and challenges of modern motherhood.

“73% of mothers we surveyed say that they follow people on social media who they don’t know in real life, and these tend to be influencers and celebrities,” says Ornelas. “47% say they like or love ‘mom influencers’ and 24% consider themselves to be a social media influencer themselves.”

Ornelas says that more generally mothers — 83% of new moms today are Millennials, according to M2Mom.com — use social media and the web to connect with other moms, to ask for advice, referrals and feedback. “Facebook remains the most popular social media platform among mothers and there are a lot of mom groups on Facebook,” she says.

Read More:

- Building Better Banking Services for Women

- 5 Things Financial Marketers Should Know about Love and Money

Moms Don’t Fit Into One Neat Category Today

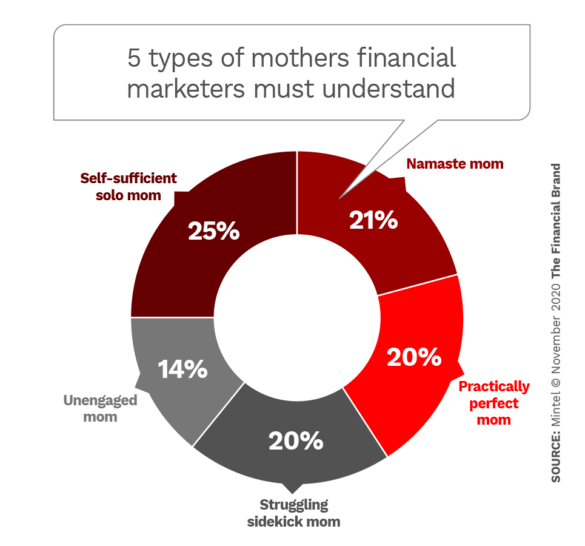

Mintel’s research gathered a broad sampling of self-described traits of mothers — including those whose children had left home. The firm used it to frame five personas of modern American mothers.

Overall, nine in ten respondents say they love being a parent and seven in ten believe that motherhood has made them a better person. In addition, the report notes that the average age of first-time mothers is now 27, up from 23 in 1980.

“Modern moms are starting families on their own terms. They are aware of how much it costs to raise a child and are choosing to wait until they are more financially stable to have kids,” according to Mintel. “Moms are also choosing to have fewer children. These trends will only be amplified by the effects of the COVID-19 pandemic, which is expected to drive down birth rates.”

Mintel’s questions in this part of the research probed four factors: struggles of motherhood, parenting devotion, traditional family structure, and parental comparison — that is, how moms compared their involvement with their kids with their own upbringing.

The firm created five personas from the data. The descriptions in the report are lengthy, but in summary:

- Self-sufficient solo mom. Most tend to be single or primary parents, struggle somewhat but are not overwhelmed, enjoy being a mom, and feel more involved than their parents were. Key pain point: Finding time for themselves. Opportunity: Provide them with convenient solutions to save them time.

- Namaste mom. Most likely to love being moms, tend not to have traditional households, aren’t as involved with their kids as their parents were. Key pain point: They don’t believe they are as good at mothering as their moms were. Opportunity: Play up products and services that will help them emulate their parents’ style. (“Namaste” is Sanskrit for “I bow to you,” and was considered an address of respect to elders.)

- Practically perfect mom. They love being moms and think they have it nailed. They have traditional family structures and struggle least of all among the mom types. They generally try to improve on their own parents’ efforts. Key pain point: Many are “seasoned” moms and will be empty nesters soon. Opportunity: Services that will help them refocus on themselves — perhaps retirement planning — can help.

- Struggling sidekick mom. Likes being a mother, but struggles with everything about it even though they typically live in traditional households. They are especially likely to be looking for advice, notably via social media. Key pain point: They tend to feel inferior to their own parents, particularly because many work. Opportunity: Services that help them connect with their children — kids savings programs would be a start.

- Unengaged mom. Does not like being a mom and finds the role tougher than expected. They tend to be older, in higher-paying jobs and are generally single. Key pain point: They dislike most parts of being moms. Opportunity: They put priority on “me time” and any service that helps them take care of themselves will have appeal.

Ornelas says that financial marketers may not want to adopt these five personas precisely, but that it is critical to take these kinds of differentiations into account when framing marketing messages to mothers. Aiming solely for a traditional viewpoint of motherhood and family will miss the mark with many mothers. A factor to account for, perhaps through local research, is the role of parents, spouses and significant others in child rearing.

A key point that comes through in the report is that many mothers are realists and that for many life is a series of “little wins.”

For most of the personas, life is about “getting your kids to eat dinner, to be ready for school on time, to clean up their rooms,” says Ornelas. Understanding this can help a financial institution’s messaging to ring true with more mothers’ lives.

In addition, “there’s something to be said for remembering that moms aren’t just moms. They’re still women at the end of the day and they still have their own well-being to think about,” says Ornelas. “It’s okay to think about Mom as a woman first. You don’t have to talk about her just in the context of her kids.”

This would be a shift, she continues, because typically when financial marketers think of mothers, the reflex is to think of them solely as caretakers.

“What we don’t see much of is the thought of ‘Who’s taking care of Mom? And how does she take care of herself?”

A brand worth looking at for ideas, she says, is Ellevest.

“They entered the space to talk specifically to women and empower them to feel confident in investing and with their finances overall,” says Ornelas.

Read More:

- Google Throws Digital Advertising Curveball at Financial Marketers

- Financial Marketers Can’t ‘Personalize’ Anything with Junky Data

- Fintechs Draw Increasing Attention in Social Media Banking Chats

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Don’t Paint Motherhood and Family with a Broad Brush

While some of the personas summarized above feel they don’t measure up to their own upbringing, the quest for “put-together” motherhood perfection isn’t as broad as it once had been.

“Most women are embracing the imperfections about motherhood,” says Ornelas. “People are more open in general about their struggles and moms are no exception. Mom doesn’t have to have all the answers. Mom doesn’t have to be perfect.”

Ornelas thinks brands can reflect this in their marketing. “Embracing those imperfections can come across as more authentic,” she says, “and will resonate more with what it truly is like to be a mom — because it’s not easy, and it’s not perfect.”

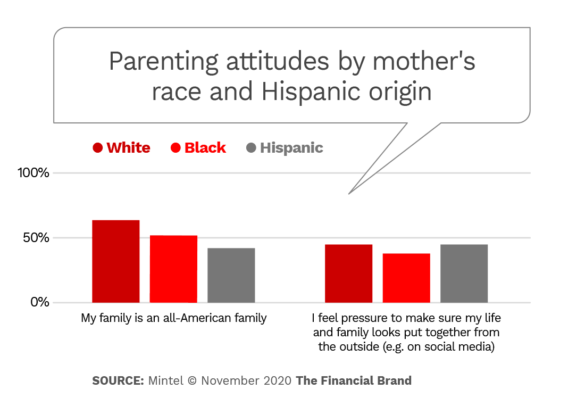

Beyond understanding the different types of mothers financial marketers need to understand the state of the American household. Beyond no longer feeling the urge to look perfect, even on social media, the concept of the “perfectly packaged ‘All-American’ family” has been questioned.

2018 research by HP cited by Mintel found that three out of four people interpret that phrase to mean a white heterosexual couple with children. Yet not only does Mintel’s research indicate that this is no longer the dominant norm, but that fewer people feel the need to fit any such mold.

“This is something to consider when a financial institution is starting to segment its own customers and its own prospective audience,” says Ornelas. This potentially affects artwork choices in advertising and social media posts and could affect the subjects, approaches and terminology used in content marketing efforts.

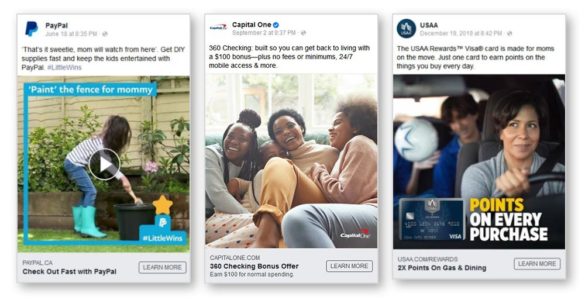

Looking at Examples of Mom-Oriented Paid Social Posts

In a blog and report by Ornelas, examples of current paid posts on Facebook were used to see examples of various approaches to messages designed to attract mothers’ attention. (As paid placements, these posts tend to promote specific services, while organic posts usually avoid specific product promotion.)

The posts featured in the two groups below address specific pain points for mothers relating to their children at various ages.

In the first group, brands are addressing mothers’ efforts to teach their kids about money and personal financial management.

In the second group, the appeal is more about help meeting the challenges of everyday life.

Ornelas considers the PayPal post a strong example of meeting a pain point. During COVID-19 parents with kids at home have sought ways to keep them busy.

“The message was, ‘We know your kids keep you busy. Here’s how we can help you manage your time’,” says Ornelas. “It wasn’t patronizing or stereotypical. It was just trying to appeal to their daily lives.”

Steps Financial Marketers Can Take to Better Reach Mothers

Ornelas suggests that because moms today tend to be networkers, financial marketers should monitor how their brand is discussed on social channels. In addition, podcasts of interest to mothers are another place where referrals and word of mouth can help connect the brand with potential customers.

Ultimately what will mean the most to mothers, she emphasizes, is solutions.

A blog on Social Toaster adds these tips:

- Remember that mothering is a 24/7 job, so providing help that can be accessed on that schedule is critical.

- Hard sells don’t work with mothers, but they will respond to authenticity.

- Moms tend to live on roller skates, so think mobile first when trying to reach and serve them.

- Moms like to research household products and services, but they have limited time for it. Streamlining content marketing with features like comparative tables helps cut to the chase.

- Don’t be afraid to add a touch of humor to your marketing.

“Not only can this provide your moms with a much-needed break in their day-to-day, but it also has the added benefit of making your brand feel more authentic and ‘real’,” according to the blog.